|

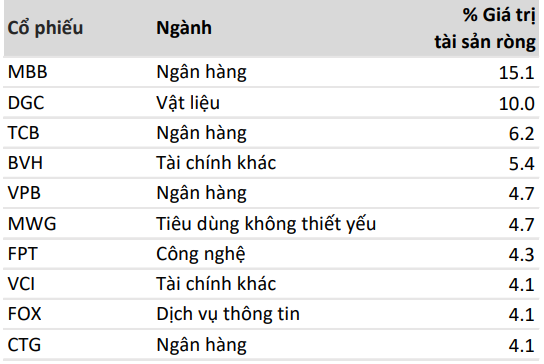

VESAF’s Largest Investments as of Late July 2025

Source: VinaCapital-VESAF

|

Commenting on the market situation, VESAF stated that the average trading value on the three exchanges HOSE, HNX, and UPCoM reached a record high of VND 39.5 trillion in July, up 68% from the previous month, reflecting a very positive investor sentiment.

Entering the first half of August (from the 1st to the 20th), liquidity was even higher, with the average trading value on the HOSE reaching over VND 51.3 trillion/day.

In terms of business results of listed companies, VESAF reported that net profit in Q2 2025 and the first half of the year increased by 31.5% and 21.2%, respectively, compared to the same period last year. The energy sector was an exception to the decline, due to the results of Binh Son Refining and Petrochemical (HOSE: BSR) and Petrolimex (HOSE: PLX), while most other sectors experienced positive growth.

Regarding the macroeconomic situation, the fund assessed that July’s data continued to show positive signals, with a highlight on the disbursement of public investment in the first seven months reaching 44% of the yearly plan, a significant increase compared to the same period last year.

The manufacturing production index increased by 9.3% in July and 10.3% in the first seven months – lower than the 11.1% recorded in the first half of the year. VESAF attributed this decline to expectations, as exports to the US slowed down (up 26% in July compared to 31% in June) after a rush in imports.

Meanwhile, domestic consumption remained stable, with total retail sales of goods and services after excluding price factors increasing by 7.1% in the first seven months. A bright spot was tourism, as the number of international visitors to Vietnam in the first seven months increased by 22.5% over the same period in 2024 and was higher than the pre-COVID-19 period.

Amid this favorable context, the VESAF fund achieved a profit rate of 4.6% in July 2025. This performance was mainly driven by the banking and securities stock groups, which directly benefited from the return of foreign capital inflows, along with heightened expectations of a potential market upgrade. For VESAF’s portfolio, the two largest contributors were VPBank (HOSE: VPB) and Viet Capital Securities (Vietcap, HOSE: VCI).

According to VESAF, VPBank witnessed a significant improvement in asset quality, with a decrease in new bad debts and Group 2 debts – in line with the overall trend in the industry. More importantly, the bank’s net interest income grew exceptionally compared to the industry average. On the other hand, VESAF expects Vietcap to boost brokerage revenue from 2025, while investment banking activities are anticipated to contribute more from 2026 onwards.

|

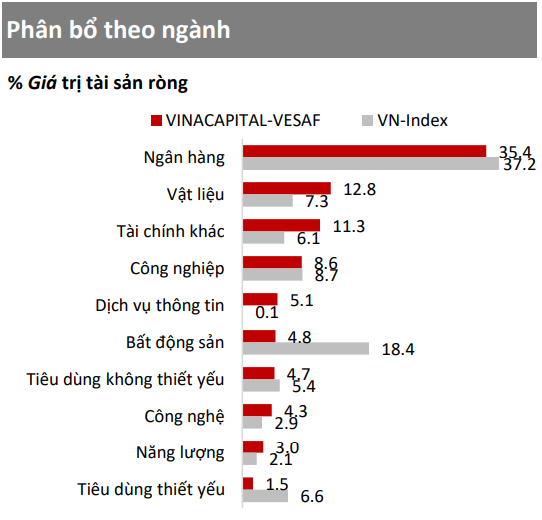

VESAF Portfolio Weighting

Source: VinaCapital-VESAF

|

Notably, VESAF revealed plans to invest in a number of medium and small-cap stocks with enterprise values trading below their estimated liquidation value, thanks to their ownership of valuable assets with high entry barriers and potential for re-rating when the southern real estate market recovers.

As of August 19, VESAF’s cumulative yield in 2025 was 16.8%, significantly lower than the VN-Index’s rise of up to 30.6%.

– 11:05 21/08/2025

The New Industrial Revolution: Unveiling the Northwest Hoa Xa Industrial Park – The Epicenter of Investment in North Central Vietnam

On August 19, 2025, the groundbreaking ceremony for the Tay Bac Ho Xa Industrial Park Infrastructure Investment and Business Project (Tay Bac Ho Xa Industrial Park) took place in Vinh Linh district, Quang Tri province. This event marked a significant turning point in the province’s journey towards sustainable industrial development post-merger.

A Vietnamese Stock Exchange-listed Company Bets Big on Digital Assets, Sending its Stock Price Soaring by Threefold Since the Start of the Year

In an increasingly digital world, investing in digital assets has become a global trend, and Vietnam is no exception. With the recent legalization of digital assets in the country, the popularity of this new investment avenue is only expected to grow.