On August 22, Vinahud Joint Stock Company for Housing and Urban Development (code: VHD) organized its 2025 Annual General Meeting of Shareholders. However, by 8 am, only 18 out of 209 invited shareholders were present, representing 31.52% of the total voting shares. As the quorum requirement was not met, the meeting could not proceed.

For 2025, Vinahud aims to achieve a total revenue of over VND 248 billion and a net profit of approximately VND 13 billion.

According to the proposed agenda for the shareholders, Vinahud will continue its investment restructuring plan by divesting its entire stake in Friends Investment and Construction JSC for a price of at least VND 1,200 billion. Simultaneously, the company plans to divest 99.99% of its capital in Xuan Phu Hai Construction Investment JSC for a minimum price of VND 286 billion.

Both of these enterprises are related to a tourism project in Dien Duong ward, Dien Ban town, Quang Nam province (now belonging to Dien Ban Dong ward, Da Nang city), commercially known as Grand Mercure Hoi An. The proceeds from these divestments will be utilized by Vinahud to settle loans at TPBank, thereby reducing financial pressure and restructuring the company’s capital sources.

Vinahud’s development strategy for the upcoming period is oriented towards a medium and long-term vision, requiring time to complete legal procedures, initiate construction, and organize sales according to the roadmap.

Currently, the Vien Nam Eco-Urban and Amusement Project in Quang Tien ward, Hoa Binh city (now Thinh Minh ward, Phu Tho province) has basically completed site clearance and is in the process of finalizing legal procedures related to land.

The Vien Nam project spans approximately 65 hectares. Vinahud is closely coordinating with a consortium of investors to jointly develop project components, aiming to generate cash flow during the 2025-2027 period.

“A Billion-Dollar Nest Egg”: A Generous Company Pays Out 35% Dividends in Cash, Sending Stocks Soaring to Historic Highs

With 67.1 million shares outstanding, the company will have to dish out a hefty 235 billion VND in dividend payments to its shareholders.

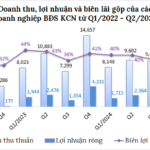

The Second Quarter Boom for Industrial Park Businesses

The industrial real estate sector has witnessed a significant surge in land and factory rentals during Q2, resulting in substantial profit growth for numerous businesses. While some companies struggle with declining core revenues, others are reaping the benefits of this increased demand. VCI attributes this positive outlook to the influx of FDI and the expansion of land banks, anticipating continued growth in the industry.