I. MARKET ANALYSIS OF SECURITIES ON AUGUST 21, 2025

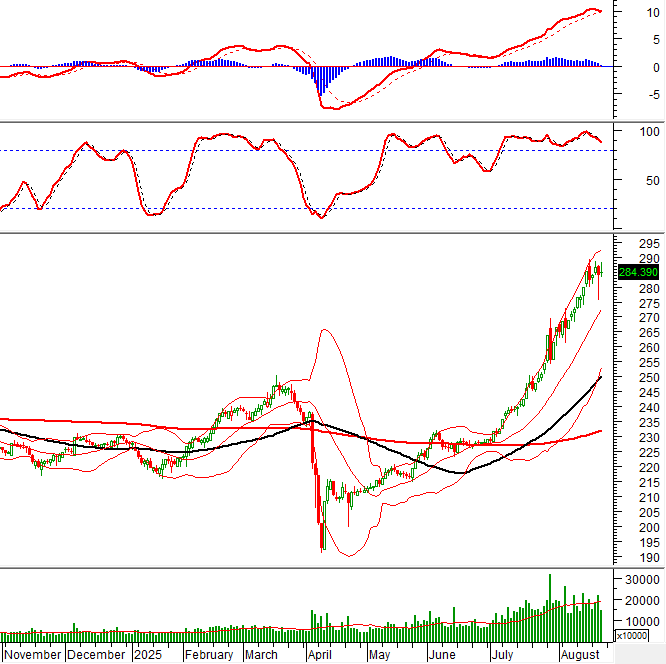

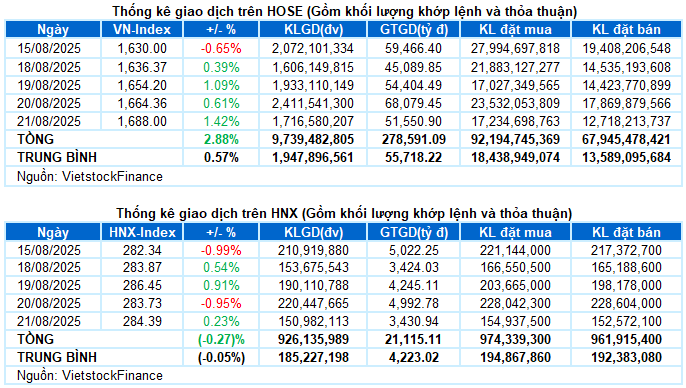

– The main indices surged strongly in the trading session on August 21. VN-Index continued to break through 1.42%, reaching 1,688 points; HNX-Index also increased by 0.23% compared to the previous session, reaching 284.39 points.

– Market liquidity decreased significantly. The trading volume on the HOSE floor decreased by 28.3%, reaching more than 1.6 billion units. The HNX floor recorded nearly 147 million units, a decrease of 33% compared to the previous session.

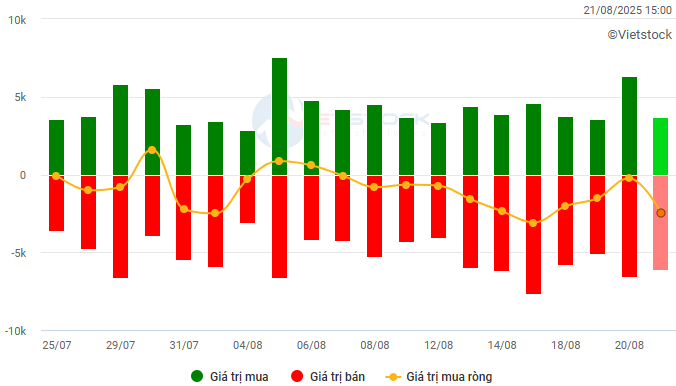

– Foreign investors net sold heavily with a value of nearly VND 2.4 trillion on the HOSE floor, but still net bought slightly more than VND 3 billion on the HNX floor.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

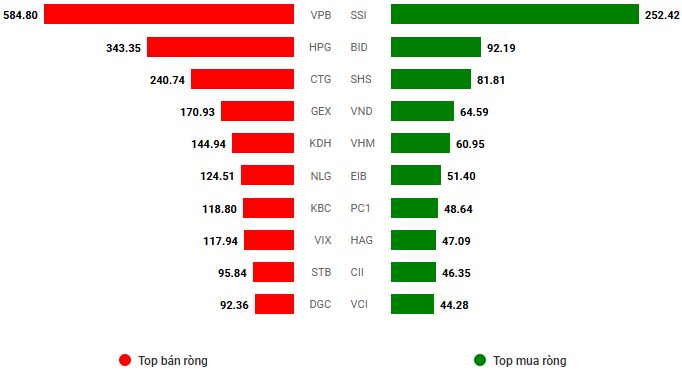

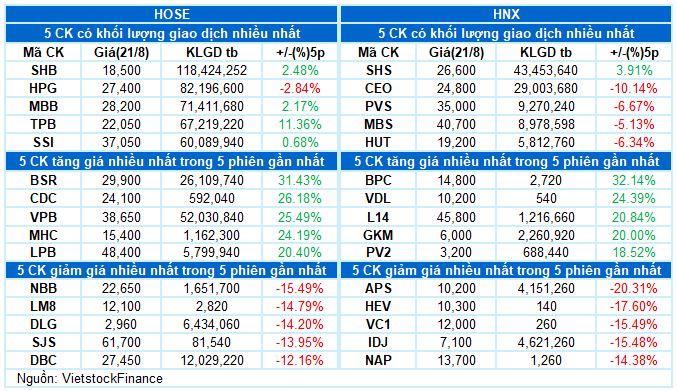

Net trading value by stock code. Unit: VND billion

– The securities market continued to break through to new highs in the trading session on August 21. VN-Index quickly surpassed the 1,680-point threshold after half an hour of trading thanks to the strong pull from the group of pillar stocks. However, the situation was quite similar to the previous session when the market breadth was not favorable, and the increase was mainly focused on large-cap stocks, especially financial stocks. This trend lasted until the end of the session, with the VN-Index closing at 1,688 points, up 1.42% from the previous session.

– In terms of impact, the 10 most positive contributing stocks brought a total of nearly 21 points to the VN-Index. Of which, 9/10 codes belong to the banking industry, and the remaining code is FPT. On the opposite side, the suppressing pressure was negligible as VIX and GVR were the two stocks that had the most negative impact, but they only caused the index to decrease by less than 1 point.

– VN30-Index extended its winning streak with 46.45 points, reaching 1,874.91 points. Buyers dominated with 24 rising codes, only 5 falling codes, and 1 code standing at the reference price. The most prominent were SSB, STB, TPB, and VIB, which all hit the ceiling price thanks to strong buying force. Meanwhile, LPB, VPB, ACB, and HDB also recorded an increase of more than 4%. On the opposite side, the red color only appeared in a few codes, of which DGC fell the most with 2.3% and GVR decreased significantly by 1.6%.

In terms of industry groups, information technology led the gain with the main driving force coming from the three largest stocks in the industry by market capitalization, FPT (+4.09%), CMG (+2.58%), and ELC (+2.76%).

The financial sector was not far behind, with purple and green colors spreading across banking stocks. However, securities and insurance stocks were somewhat polarized, mainly fluctuating slightly around the reference price, with only a few small securities companies hitting the daily limit, such as AAS, VUA, EVS, and TVS.

In contrast, the media & publishing group ranked last today with a decrease of more than 1%, as large-cap stocks in the industry such as VGI (-2.25%), VNZ (-2%), YEG (-2.3%), TTN (-1.18%), and MFS (-1.83%) faced significant adjustment pressure.

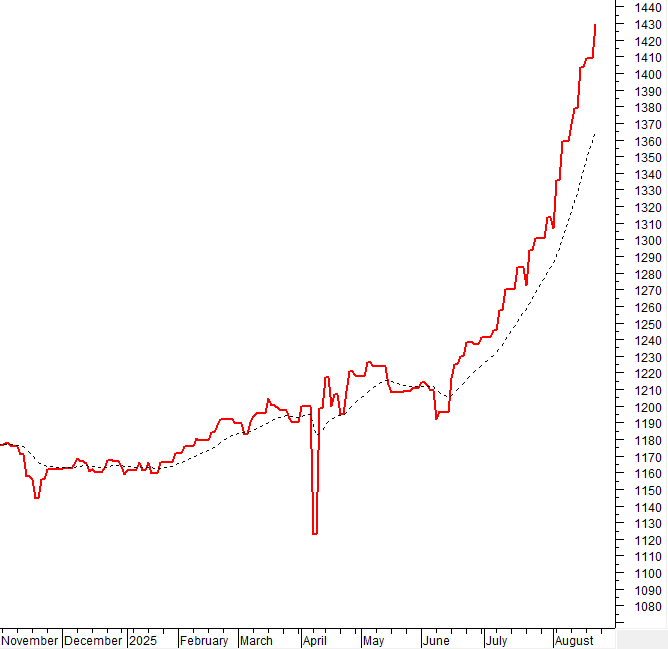

VN-Index increased for the 4th consecutive session and closely followed the Upper Band of the Bollinger Bands. However, trading volume has been fluctuating in recent sessions, indicating that investor sentiment is not truly stable in the context of the uptrend relying mainly on pillar stocks. Nevertheless, the MACD indicator continues to rise and shows no signs of weakening, thereby opening up the possibility for the VN-Index to soon conquer the 1,700-point threshold in the coming sessions.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Following the Upper Band of Bollinger Bands

VN-Index increased for the 4th consecutive session and closely followed the Upper Band of the Bollinger Bands. However, trading volume has been fluctuating in recent sessions, indicating that investor sentiment is not yet truly stable, as the uptrend relies mainly on pillar stocks.

Nevertheless, the MACD indicator continues to rise and shows no signs of weakening, indicating the possibility of the VN-Index soon reaching the 1,700-point threshold in the next sessions.

HNX-Index – Doji Candlestick Pattern

A Doji candlestick pattern appeared on the HNX-Index chart, and the trading volume decreased below the 20-session average, indicating investor indecision.

Currently, the Stochastic Oscillator indicator continues to weaken after giving a sell signal, while the MACD is narrowing the gap with the Signal line. Investors should note that the risk of a correction will increase if the MACD confirms a sell signal in the coming sessions.

Money Flow Analysis

Changes in Smart Money Flow: The Negative Volume Index indicator of the VN-Index is above the EMA 20-day line. If this state continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Changes in Foreign Capital Flow: Foreign investors continued to net sell in the trading session on August 21, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS ON AUGUST 21, 2025

Economic & Market Strategy Division, Vietstock Consulting

– 17:26 21/08/2025

“Vietstock Daily 20/08/2025: Sustaining the Uptrend”

The VN-Index reached new heights, with trading volume recovering above the 20-session average. The upward trend of the index remains robust as the MACD indicator continues to widen the gap with the signal line, providing a strong buy signal. However, investors should be cautious of potential short-term volatility if the Stochastic Oscillator indicator continues to weaken.

Market Pulse for August 22: Pessimism Prevails as Foreign Investors Heavily Sell Off HPG

The market closed with notable losses, as the VN-Index dipped by 42.53 points (-2.52%), settling at 1,645.47. Likewise, the HNX-Index witnessed a decline of 11.91 points (-4.19%), ending the day at 272.48. The overall market breadth was dominated by decliners, with 647 stocks trading lower against 180 gainers. This bearish sentiment was echoed in the VN30 basket, where 26 stocks closed in the red versus just 4 in the green.

Stock Market Wrap-up: A Peak Pause

The VN-Index struggled during the week’s final session as intense profit-taking pressure drowned the market. This development mirrors late July 2025, when the rally stalled after an extended uptrend. The upcoming trading sessions will be pivotal in determining whether the market is taking a breather before resuming its ascent or transitioning into a more distinct corrective phase.

The King of Stocks Reigns Supreme: What Do the Experts Say?

The surge in bank stock prices is not a fleeting phenomenon but a result of a confluence of factors: robust business fundamentals, conducive monetary and legal policies, market reforms, and a stable macroeconomic environment. However, the differentiation will become more pronounced, and only banks with strong governance, cheap capital advantages, a thriving digital ecosystem, and a robust asset structure will sustain their allure.