Hung Thinh Land JSC has recently announced a delay in interest payments for its H79CH2124019 bonds.

According to the schedule, the company was due to pay over VND 49.9 billion in interest on these bonds by August 18, 2025. However, HTL has been unable to make the payment due to unfavorable conditions in the financial and real estate markets, resulting in a delay in securing the required funds.

The company is currently adjusting its payment plan to align with its financial situation and will be negotiating with bondholders to reach a mutually agreeable solution.

Hung Thinh Land is a subsidiary of Hung Thinh Group, specializing in real estate management.

The H79CH2124019 bond issue has a total value of VND 1,800 billion and was issued by Hung Thinh Land on August 18, 2021, with a maturity of 60 months, due for redemption on August 18, 2026.

In addition, Hung Thinh Land has another bond issue, H79CH2124018, with a total value of VND 1,500 billion, issued on July 7, 2021, and maturing on July 7, 2026. Both bond issues carry a fixed interest rate of 11% per annum.

Hung Thinh Land, as a subsidiary of Hung Thinh Group, manages the group’s real estate portfolio. The company currently owns and develops 59 projects across Vietnam, spanning over 3,300 ha of strategically located land.

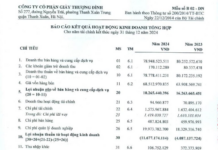

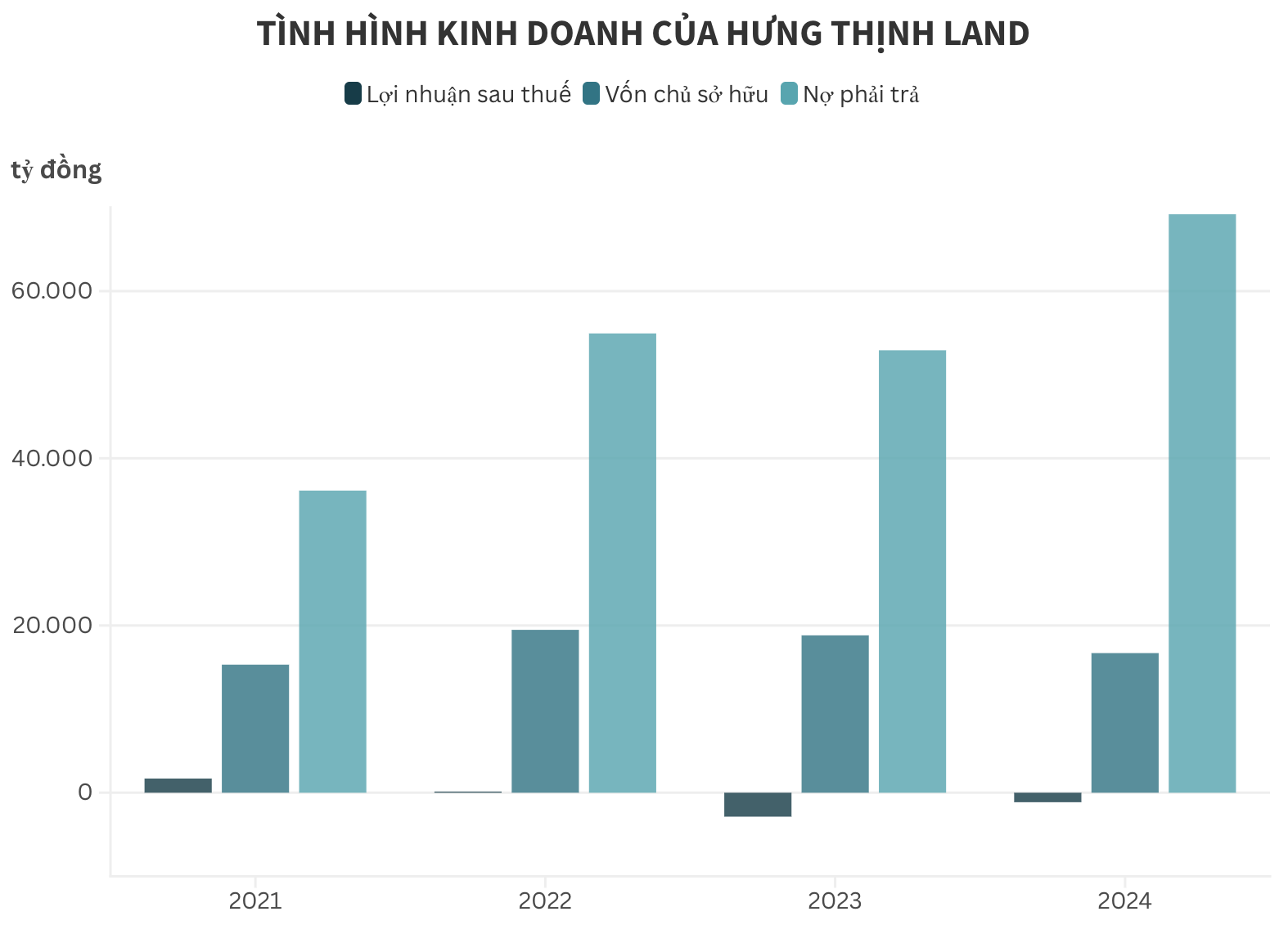

Hung Thinh Land’s business performance in recent years

In terms of financial performance, Hung Thinh Land reported a post-tax loss of VND 1,138.7 billion for the year 2024, an improvement from the VND 2,865.4 billion loss in 2023.

As of December 31, 2024, the company’s equity stood at VND 16,700.7 billion, a decrease of VND 2,121.9 billion compared to the previous year.

The debt-to-equity ratio reached 4.14 times, with the company’s total liabilities at the end of Q4 2024 amounting to nearly VND 69,195 billion, a significant increase of VND 16,279 billion from the previous year.

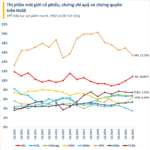

The Ultimate Stock Market Rally: VPS Securities Convenes Extraordinary Shareholder Meeting

VPS plans to hold an extraordinary General Meeting of Shareholders in October, with the record date for meeting participation set for September 8th.

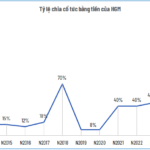

“HGM Shareholders to Receive Cash Dividend of VND 4,500 Per Share”

In just 6 months, Hanoi Mechanical and Mineral Joint Stock Company (HNX: HGM) has surpassed its annual profit plan, prompting the company to declare an interim cash dividend for 2025 at a remarkable 45% rate, equivalent to VND 4,500 per share. This payout ratio almost reaches the 50% minimum target set by the company for the entire year.

How is Vinh Xuan Real Estate Performing in the First Half of 2025?

As of June 30, 2025, Vinh Xuan Real Estate’s liabilities stood at over VND 1,106 billion, with a significant portion comprising bond debt.