Vinahud JSC (Stock Code: VHD) recently announced its Board of Directors’ resolution to approve a loan agreement.

Specifically, Vinahud secured a loan of over VND 906.5 billion from Mr. Bui Thanh Cong with an interest rate of 4% per annum and a term of 6 months.

The Board authorized Mr. Truong Quang Minh, Chairman of the Board, to take full charge of negotiating, agreeing, and deciding on the terms and conditions, as well as signing all relevant documents, contracts, and related papers for the above transaction as per regulations.

In addition to the loan agreement, Vinahud also entered into a business cooperation agreement (with Vinahud as the capital recipient) with Friends Investment and Construction JSC and Me Linh Homes JSC, with respective cooperation amounts of VND 358 billion and VND 150 billion.

The scope of cooperation involves carrying out and developing activities that meet the legal requirements.

Notably, both Friends Investment and Construction JSC and Me Linh Homes JSC maintain close relationships with Vinahud.

Me Linh Homes JSC was established in July 2020, initially named R&H Contruction JSC, with its primary business being specialized construction.

The initial chartered capital of the company was VND 300 billion, with three founding shareholders: R&H Corporation (70%), Mr. Truong Quang Minh (20%), and Mrs. Pham Thi Hanh (10%). Mr. Truong Quang Minh served as the Chairman of the Board and legal representative of the company.

In December 2020, R&H Contruction increased its capital to VND 1,100 billion. According to a change registration in August 2022, Mr. Nguyen Minh Tuan (born in 1985) took on the role of General Director and legal representative, replacing Mr. Truong Quang Minh.

In February 2023, the company changed its name to VNC Contruction JSC, and in December 2024, it was renamed Me Linh Homes JSC as it is known today.

In the most recent change registration, Mrs. Pham Thi Hanh (born in 1977) is the Chairman of the Board and legal representative of Me Linh Homes JSC.

According to Vinahud’s semi-annual management report for the first half of 2025, Mr. Truong Quang Minh held the position of Member of the Board of Me Linh Homes JSC.

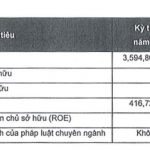

Additionally, according to the same report, Friends Investment and Construction JSC is a wholly-owned subsidiary of Vinahud, with an investment value of nearly VND 1,475 billion as of the end of the second quarter of 2025.

Mr. Phan Anh Tuan, Member of the Board and Vice General Director of Vinahud, serves as the Chairman of the Board of Friends Investment and Construction JSC. Meanwhile, the position of General Director is held by Mrs. Pham Thi Hanh, Chairman of the Board of Me Linh Homes JSC.

Regarding Mr. Truong Quang Minh, Chairman of Vinahud, his name is closely associated with the development of R&H Corporation (R&H Group).

R&H Group, established on August 7, 2019, operates in six main fields: M&A, investment and development of high-end real estate, civil and industrial construction and interior, investment in clean energy, investment in the development of organic agricultural farms, and management and operation of luxury residential areas/high-class ecological resorts.

The initial chartered capital was VND 999 billion, of which Mr. Truong Quang Minh held 70%; the remaining shareholders were Mrs. Pham Thi Hanh with 25% and Mrs. Pham Thi Hong with 5%.

In 2019, the chartered capital of R&H Group decreased to nearly VND 273 billion. It was not until 2020 that Mr. Truong Quang Minh’s enterprise increased its capital to VND 1,290 billion.

After several adjustments, by October 2021, the enterprise’s chartered capital reached VND 1,450 billion. At that time, Mr. Bui Minh Ket (born in 1977) was the General Director, and Mr. Truong Quang Minh was the Chairman of the Board.

According to the enterprise registration change announcement on August 14, 2025, Mr. Tran Hoang Quy (born in 1978) is currently the Chairman of the Board and General Director and is the legal representative of R&H Group.

Additionally, Mr. Tran Hoang Quy is also the legal representative of several other enterprises, including Son Long Investment and Development JSC and VNI Invest JSC, which are closely related to Chairman Truong Quang Minh.

In early 2023, both Vinahud and R&H Group underwent company transfers worth thousands of billions of VND, as mentioned in the article “Thousand-Billion-Dong ‘Selling Children’ Deals of R&H Group” by An Ninh Tien Te.

According to data obtained by our reporters, before the bond issuance in 2021, Chairman Truong Quang Minh had sold a 10.51% stake in R&H Group to Amber Fund Management JSC.

“VPBank Secures a Monumental $350 Million Agreement for Sustainable Growth.”

“VPBank joins forces with renowned global development institutions, SMBC, BII, EFA, FinDev Canada, and JICA, in a groundbreaking partnership. Together, they have secured a landmark loan, a pivotal step towards financing Vietnam’s sustainable and eco-friendly future. This collaboration marks a significant milestone in the country’s journey towards a greener tomorrow.”

The Looming Maturity Pressure on Real Estate Bonds in August Intensifies: Marking the Market’s Most Strained Period

“August sees a significant spike in the maturity value of non-bank group bonds, with an estimated face value of VND 27.4 trillion, a substantial 51.7% increase from the previous month’s value of VND 18.1 trillion. This surge in maturity value makes August the peak month for bond repayments in 2025.”

The Quiet Giant: Unveiling the Purchase of Vinhomes Ocean Park 2 with a Twist

Prior to the issuance of the 1,000 billion VND bond, this company had mortgaged its contractual rights as collateral at a bank.