Domestic Money Flow is Deciding the VN-Index Trend

Foreign investors continued their net selling streak on August 19, offloading more than VND 1,500 billion on Vietnam’s stock market, marking the 9th consecutive session of net selling.

At the event “Vietnam and the Indices: Financial Prosperity”, Mr. Nguyen Viet Duc, Director of Digital Business at VPBank Securities JSC (VPBankS), shared his insights on the foreign investors’ net selling. He opined that the net selling by foreign investors is not a significant concern for investors in the past 1-2 years. Previously, foreign transactions accounted for 16-20% of market share, and their selling activities could cause market turmoil.

However, recently, foreign transactions only account for 6-8% of market share. Therefore, their net selling may slightly impact market psychology, but according to the VPBankS expert, domestic money flow is the primary driver of the VN-Index trend.

According to Mr. Duc, predicting the market peak is challenging, and one is likely to be wrong twice out of three times. While it’s difficult to pinpoint the exact peak, identifying the peak region is not as tricky.

“Since the beginning of the year, VPBankS has been optimistic about the market reaching 1,800-1,900 points. I believe that the market has not peaked yet. However, there are signs that the peak region is being established from the early sessions of this week,” said Mr. Duc.

Typically, in the past phase, the market witnessed robust growth in both prices and trading volume, but there was no FOMO (fear of missing out). However, FOMO is starting to emerge as investors focus on waves in different sectors. This is the first sign indicating that the market is entering the peak region.

Additionally, a technical indicator suggests that the market is in the overbought zone and has been rising rapidly. According to Mr. Duc, this indicator has appeared 16 times since he started monitoring the VN-Index in 2000, with an accuracy rate of about 80%. The indicator implies that the market is in its hottest phase historically but has not peaked yet.

Furthermore, when this indicator signals, the market can still rise for about 2-3 weeks before a correction sets in, and it’s challenging to determine if it’s the peak. In some cases, after the aforementioned correction, the market can continue to climb.

If you have a substantial cash position and are considering short-term investments, you can invest for a very short period, about 1-2 weeks. However, if you are looking at opportunities in the next 3-6 months, investors will still have the chance to buy at attractive prices from the middle of September onwards.

VN-Index Has Not Formed a Major Peak

During the event, Mr. Duc also addressed the question of whether to hold all cash or maintain a reasonable stock ratio. He advised that in Vietnam, successful investors tend to hold a higher proportion of stocks, usually around 80%, and rarely go below 70%. Therefore, the first recommendation is that investors should maintain a relatively high stock ratio regardless of market conditions.

Many investors worry about buying at the market peak. While everyone prefers buying cheap, the stock market differs from the real economy. “If vegetables are too expensive, consumers will not buy them, but in the stock market, buying at the peak is even safer than buying during a correction,” Mr. Duc stated.

The reason behind this is that a market correction can last from six months to two years. Investors have to wait a long time for the market to bottom out and recover. On the other hand, in an uptrend market, investors who buy at the peak will profit the very next day when the market reaches a new peak.

In reality, investing on days when the stock index hits new peaks has proven to be more profitable than investing at other times.

For instance, after five years, if one invests a fixed amount daily, the return would be only 71.4%. However, if one invests only on days when the index hits new peaks, they can avoid the waiting period for the market to recover and achieve a higher return of 78.9%.

Moreover, we can only identify the peak region and not the exact peak level. Waiting for a 3-5% market correction is not worth it. If the VN-Index corrects by about 10%, investors may want to wait a bit. “Market timing” investments are valuable when the stock index drops by about 20%. However, in the history of Vietnamese and global stock markets, these 20% corrections are rare, occurring once every two years for the S&P 500 and once every three years for the Vietnamese stock market.

Instead of “waiting too long for the right girl,” investors can invest a portion immediately. Currently, the possibility of the VN-Index forming a significant peak is low. The stock market may experience a short-term mid-peak in September, but a significant peak is unlikely.

Historically, the VN-Index has only formed major peaks under two conditions: when the market is extremely hot and FOMO drives the P/E ratio to 20 times. The two most recent peaks in 2018 and 2022 had P/E ratios of 20 and 22, respectively. Currently, the P/E ratio is only 15, so for a peak to form, the market would need to rise by another 20% while profits remain unchanged. If profits increase, the market might need to climb by 20-30% to indicate an overheated market that requires a correction. Additionally, the market is currently supported by the robust growth in corporate profits.

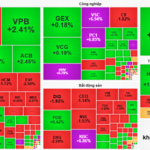

Market Beat: VN-Index Stays in the Green Despite Foreign Selling Pressure

The VN-Index ended the first trading session of the week on a positive note, climbing 6.37 points (+0.39%) to close at 1,636.37. Similarly, the HNX-Index witnessed a boost of 1.53 points (+0.54%), settling at 283.87. The market breadth tilted in favor of advancers, with 450 stocks rising (including 46 that hit the ceiling price) versus 368 decliners (4 of which touched the floor price).

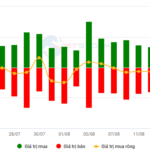

Vietstock Daily Recap: Potential for Persistent Volatility

The VN-Index rose after a tug-of-war session, but the trading volume fell below the 20-session average, indicating investors’ cautious sentiment. With the Stochastic Oscillator continuing its downward trajectory and signaling a sell-off in the overbought territory, alongside persistent net foreign selling, the market remains vulnerable to short-term volatility.

“It’s Time to Aim for MSCI’s Market Upgrade Standard”

The Vietnamese stock market has reached a pivotal moment in its journey towards recognition as a leading emerging market. With the recent advancements and meeting the criteria set by FTSE Russell for an upgrade from frontier to emerging market status in their September 2025 review, the focus now shifts to attaining the prestigious recognition from MSCI.

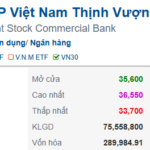

The Secret Behind the Surge in Bank Stocks?

The banking sector, with its large capitalization and far-reaching influence, has always been a key pillar of support for the VN-Index. However, experts caution that a correction is likely on the cards following the sector’s prolonged rally.

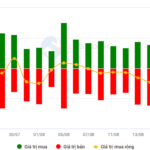

The Market Maverick: Can We Expect a Resilient Reversal?

The VN-Index experienced significant volatility but managed to recover towards the end of the trading session, with above-average volume. The uptrend remains intact as the MACD indicator continues to hover above the signal line, indicating no signs of weakness. However, the risk of volatility persists as the index hovers at historical highs. In the event of increased selling pressure, the middle band of the Bollinger Bands will serve as a crucial support level.