In 2024, S&P noted that the bank’s profits increased due to a focus on the retail and SME customer segments. Net interest margins also improved as a result of reduced funding costs following policy rate cuts and the maturity of high-cost term deposits.

As of the end of 2024, retail customer loans accounted for 54% of Eximbank’s total loan portfolio. Leveraging a network of over 200 branches and transaction offices nationwide, along with a strategy to promote digital transformation, has contributed to Eximbank’s stable development.

Eximbank maintains its B+ rating with a stable outlook from S&P Global Ratings.

|

One notable highlight recognized by S&P was Eximbank’s return on assets (ROA), which increased from 1.1% in 2023 to 1.5% in 2024 due to improved net interest margins and lower funding costs. The rating agency forecasts Eximbank’s ROA to remain stable at around 1.25% – 1.35% in the next 12-24 months as the government encourages banks to lower lending rates to support businesses and economic growth.

S&P also assessed Eximbank’s asset quality as being well-controlled, with the non-performing loan (NPL) ratio declining to 2.5% at the end of 2024. The ratio of special mention and restructured loans also decreased significantly from 5% to 3.9%, reflecting the positive results of the bank’s credit risk management and bad debt handling measures during this period.

With a risk-adjusted capital (RAC) ratio stable at around 5.2%-5.4% this year, Eximbank is considered to have a solid capital foundation to support its credit growth in the coming period.

S&P expects the bank’s credit growth to reach 16%-18%, surpassing the government’s target for the overall banking industry (12-15%).

Notably, S&P acknowledged Eximbank’s flexibility in diversifying its funding sources, prioritizing low-cost funds.

The “stable” outlook for 2024 is based on S&P’s expectation that Eximbank will continue its effective business strategy, maintain strong asset quality, stable capitalization, and safe credit growth in the next 12-24 months. The restructuring efforts over the past years have laid a solid foundation, enhancing the bank’s adaptability to fluctuations and its pursuit of long-term sustainable development.

Eximbank’s representative stated that although the rating and outlook remain unchanged, S&P has recognized the positive efforts in restructuring, improving bank governance, diversifying funding sources, and promoting safe credit growth. This is particularly meaningful as Eximbank is undergoing a comprehensive restructuring strategy and a strong transformation in both its operating model and development vision.

The bank will continue to strengthen its financial foundation, accelerate digital transformation, optimize customer experience, and expand its target customer base beyond the current focus on retail and SME segments. Simultaneously, Eximbank will tighten credit quality control, restructure its asset portfolio, and enhance the efficiency of its centralized debt handling model.

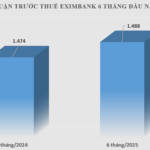

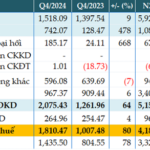

Recently, Eximbank announced its financial results for the first half of the year, reporting a pre-tax profit of 1,489 billion VND, a 0.97% increase compared to the same period last year. In Q2/2025, Eximbank achieved a profit of 657 billion VND. The bank’s credit growth was positive at 9.8%, with total credit reaching 184,663 billion VND, while total assets amounted to 256,442 billion VND, a 6.95% increase compared to the beginning of the year.

Currently, Eximbank is preparing for the process of relocating its head office to Hanoi. This strategic move is a pivotal part of the bank’s restructuring and repositioning strategy, aiming to enhance its brand and elevate its position in the market. As S&P pointed out Eximbank’s limited market coverage, this new strategy will enable the bank to expand its reach nationwide, particularly in the Northern and Central regions of Vietnam.

– 08:55 19/08/2025

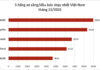

Deposit Interest Rates Remain Stable in Early August

The beginning of August witnessed a stable landscape for deposit interest rates across banks, with minimal fluctuations compared to the previous month.

“Sacombank: 33 Years of Solid Partnership with the People and Businesses of Vietnam”

After over three decades of groundbreaking work and continuous innovation, Sacombank has transformed itself with impressive growth potential, ready to embrace its 33rd year with confidence and an elevated stature.

The Eximbank Shareholder Group owning over 5% of the bank’s capital has once again proposed the dismissal of Ms. Luong Thi Cam Tu and Mr. Nguyen Ho Nam.

A group of shareholders owning over 5% of Eximbank’s capital has once again proposed the removal of Ms. Luong Thi Cam Tu and Mr. Nguyen Ho Nam from their positions as members of the Board of Directors. This proposal will be discussed at the upcoming extraordinary general meeting of shareholders scheduled for November 28.