The stock market witnessed another positive trading week from April 18-22, gaining 15 points compared to the previous week. Specifically, the overall index recorded an impressive surge in the first four sessions as leading sectors, such as banking, continued to attract strong capital inflows, propelling the index to new highs. However, selling pressure at higher levels caused the VN-Index to reverse course and decline sharply in the final session. Trading liquidity remained robust, with an average value of approximately VND 45,400 billion per session, a 13% increase from the previous week.

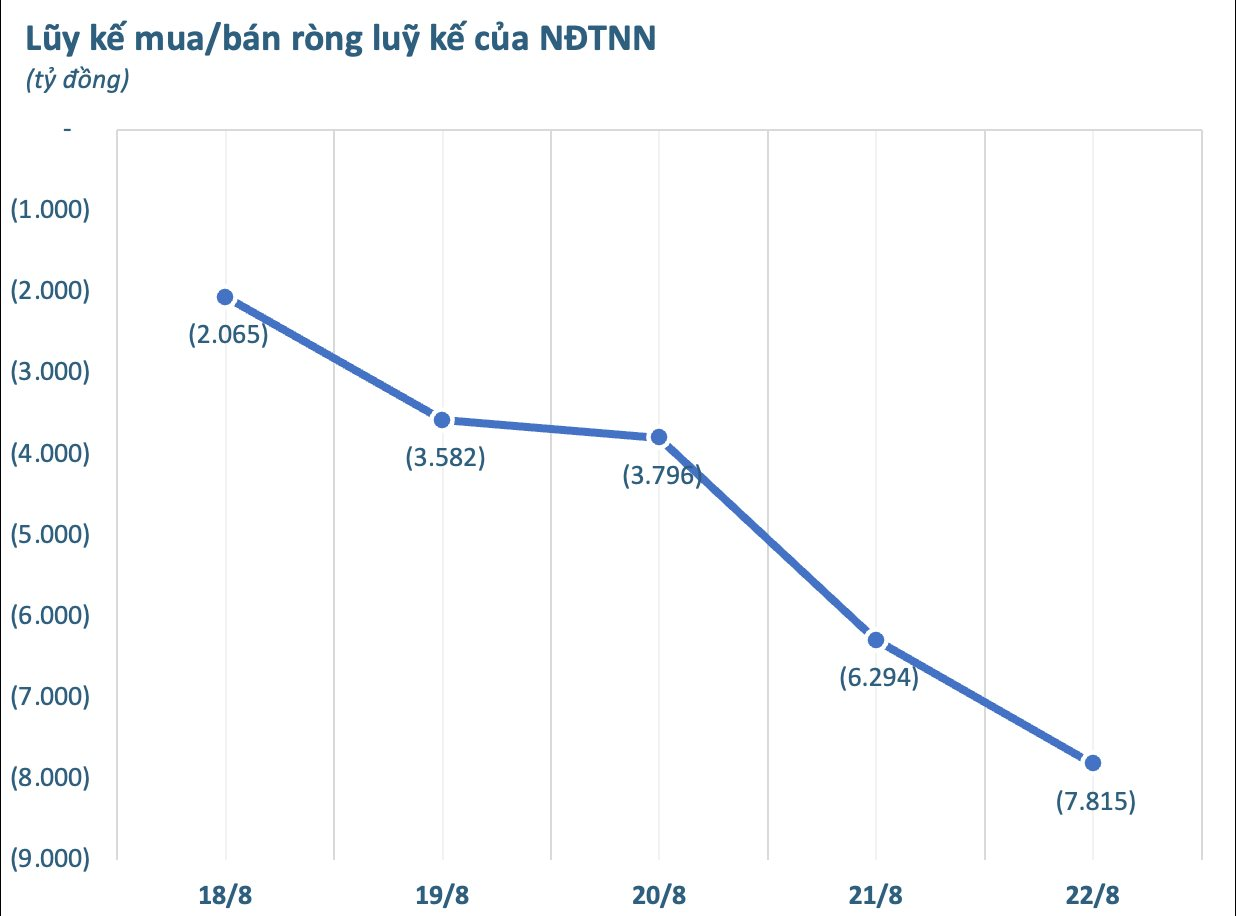

In terms of foreign investment, foreign investors continued to heavily offload Vietnamese stocks, with net selling intensifying towards the week’s end. Cumulatively, for the five sessions, foreign investors net sold over VND 7,815 billion on all markets.

Analyzing each exchange, foreign investors net sold VND 7,606 billion on HoSE, net bought VND 81 billion on HNX, and net sold VND 290 billion on UPCoM.

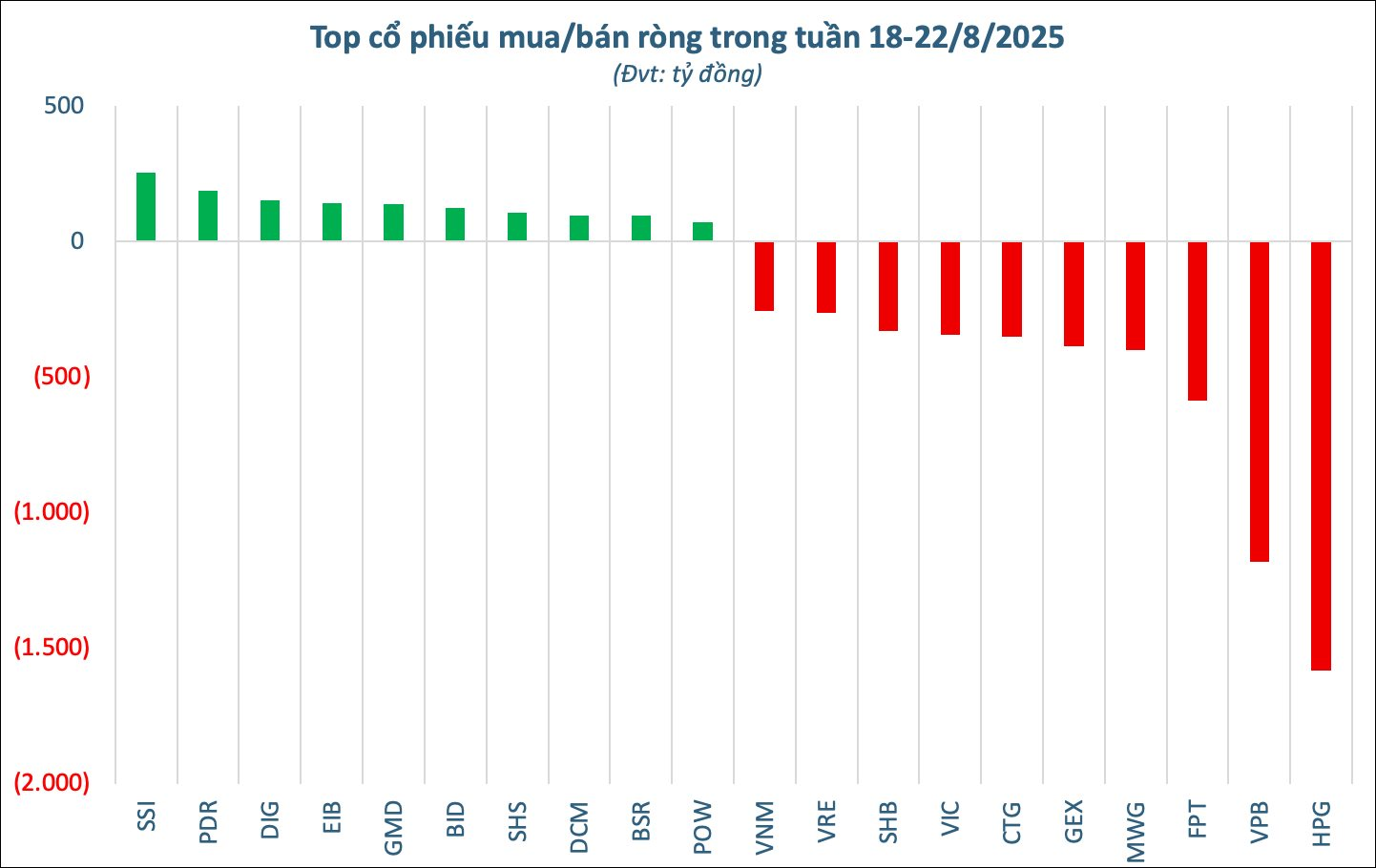

Breaking down the stocks, HPG witnessed the strongest net selling pressure, with a value of VND 1,584 billion, far surpassing other stocks. VPB followed with net selling of VND 1,181 billion, then FPT (VND 587 billion), and MWG (VND 401 billion). Several other large-cap stocks experienced capital outflows, including GEX (VND 385 billion), CTG (VND 350 billion), VIC (VND 343 billion), and SHB (VND 329 billion). VRE, VNM, STB, and KDH all recorded net selling ranging from over VND 200 billion.

On the buying side, SSI topped the list with net buying of VND 255 billion. PDR followed with VND 190 billion, DIG with VND 153 billion, and EIB with VND 142 billion. Foreign investors also showed interest in GMD (VND 140 billion), BID (VND 125 billion), and SHS (VND 106 billion). Additionally, DCM, BSR, POW, BSI, and PC1 witnessed net buying ranging from VND 66 billion to nearly VND 100 billion.

The Stock Market Plunge: VN-Index Takes a Hit with a Massive 42-Point Drop

The stock market witnessed a dramatic turnaround as several stocks that had surged or even hit their ceiling in the previous session took a sharp downturn, plunging to their daily lows.

Market Beat: VN-Index Stays in the Green Despite Foreign Selling Pressure

The VN-Index ended the first trading session of the week on a positive note, climbing 6.37 points (+0.39%) to close at 1,636.37. Similarly, the HNX-Index witnessed a boost of 1.53 points (+0.54%), settling at 283.87. The market breadth tilted in favor of advancers, with 450 stocks rising (including 46 that hit the ceiling price) versus 368 decliners (4 of which touched the floor price).