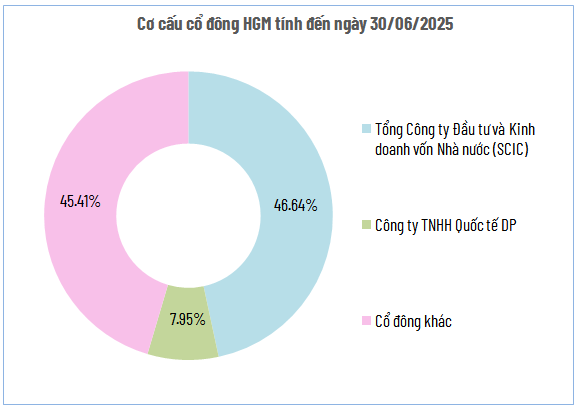

Specifically, the ex-dividend date is August 27th. With over 12.6 million shares outstanding, HGM will distribute approximately VND 57 billion in dividends for this period. The payment is expected to commence from September 26th.

Source: VietstockFinance

|

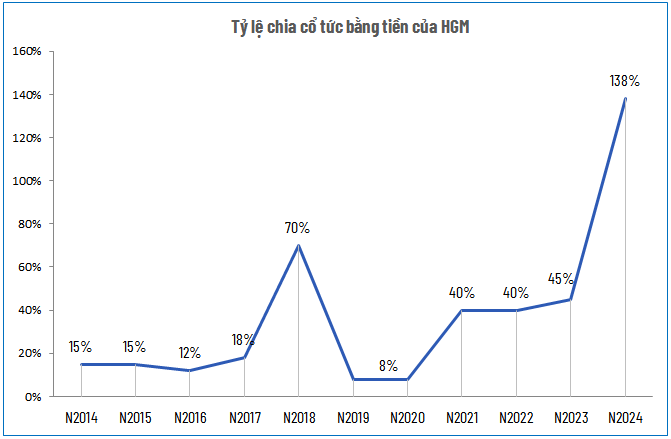

In 2024, despite setting a minimum cash dividend target of 50%, HGM paid out three installments with a total ratio of up to 138% (equivalent to VND 13,800/share). This was made possible by record-breaking business results in terms of both revenue and profit.

Entering 2025, although the production and consumption of Antimon are expected to decrease compared to the previous year, the company maintains its revenue target of VND 400 billion and a pre-tax profit of VND 248 billion. These targets represent an increase of 8% and 2%, respectively, compared to the previous year’s performance. The minimum cash dividend ratio remains at 50%.

| HGM’s Financial Performance by Quarter |

The high interim dividend for 2025 follows HGM‘s announcement of its Q2/2025 financial results, which showed record-high revenue of VND 279 billion, a threefold increase compared to the same period last year. Gross profit also surged to VND 240 billion, more than quadrupling the figure from the previous year. As a result, HGM‘s net profit reached nearly VND 205 billion, more than quadrupling the figure from the same period last year.

| HGM’s Financial Performance for the First Six Months of the Year |

In the first six months of the year, HGM achieved VND 433 billion in net revenue and VND 382 billion in pre-tax profit, exceeding its full-year plan by 8% and 54%, respectively.

Given the interim dividend payout following the company’s surpassing of its full-year plan in just six months, there is a high likelihood that HGM will announce additional dividend distributions later in the year.

Source: VietstockFinance

|

Currently, the State Capital Investment Corporation (SCIC) is HGM‘s largest shareholder, with a 46.64% stake, and is expected to receive over VND 26 billion in dividends. Meanwhile, DP International Company Limited, with a 7.95% stake, may receive VND 4.5 billion.

– 11:01, August 21, 2025

“Transforming Rural Retail: WinCommerce’s Double-Digit Growth Strategy”

The Vietnamese retail industry is undergoing a rapid evolution, with a significant shift from traditional (GT) to modern trade (MT) channels. This transformation is driven by consumers who prioritize convenient shopping experiences, quality products, and enhanced services. As consumers increasingly demand a seamless blend of physical and digital retail, the industry is responding with innovative solutions to meet their needs. This dynamic shift towards modern trade presents a pivotal opportunity for retailers to adapt and thrive in a rapidly changing market.