TNH Joint Stock Group Hospital Corporation (Ticker: TNH, HoSE exchange) has just announced a resolution by its Board of Directors to approve a plan to issue shares to increase charter capital from equity capital.

Accordingly, TNH Hospital plans to issue over 21.6 million bonus shares to existing shareholders to increase the company’s charter capital. The execution ratio is 100:15, meaning that for every 100 shares owned, shareholders will receive 15 new shares. The issuance is expected to take place in the third quarter of 2025.

The total issuance value, based on par value, is over VND 216 billion, with the capital source being the surplus capital at the end of December 31, 2024, as stated in the audited 2024 financial statements of TNH Hospital.

Illustrative image

If the issuance is successful, TNH Hospital’s charter capital will increase from over VND 1,441.8 billion to over VND 1,658 billion.

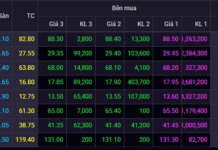

In another development, Mr. Hoang Tuyen, Chairman of the Board of Directors of TNH Hospital, recently reported on the transfer of 5 million TNH shares through a matching transaction. The transaction was executed between July 18 and August 5, 2025. Upon completion of the transaction, Mr. Hoang Tuyen’s ownership decreased from 9.6 million shares, or 6.67%, to 4.6 million shares, or 3.2% of TNH’s charter capital, and he is no longer a major shareholder of TNH Hospital.

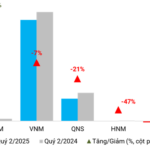

TNH Hospital has just announced dismal business results, reporting a post-tax loss of over VND 20 billion in the second quarter of 2025, a significant decrease compared to a profit of over VND 38 billion in the same period last year.

During the quarter, TNH recorded VND 122 billion in net revenue, a 7% decrease compared to the previous year. Soaring cost of goods sold caused gross profit to evaporate by 80% compared to the same period, leaving only VND 10.6 billion.

The increase in cost of goods sold, coupled with pressure from expenses, led to TNH’s reported loss. According to the explanation, the company stated that the quarter included many holidays and prolonged unfavorable weather, which disrupted medical examination and treatment activities at TNH’s health facilities.

Additionally, the newly operational TNH Viet Yen Hospital has not yet registered for health insurance for initial medical examinations and treatments, resulting in unstable patient numbers and impacting revenue.

Furthermore, in the second quarter of 2025, the company incurred additional costs for the completion and implementation of e-health projects at TNH Pho Yen Hospital and TNH Viet Yen Hospital, as well as investments in AI applications for image diagnosis…

In the first half of the year, TNH Hospital recorded a slight 3% decrease in revenue, totaling VND 216.3 billion. After deducting expenses, the hospital reported a loss of over VND 55.1 billion, while in the same period last year, it posted a profit of VND 53 billion.

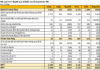

As of June 30, 2025, TNH’s total assets amounted to VND 2,735 billion, a 7% increase from the beginning of the period. Cash and cash equivalents stood at VND 42 billion, a 23% decrease.

Construction work in progress accounted for VND 403 billion, a 40% increase. This primarily comprised of the TNH Lang Son Hospital construction project with VND 332 billion, the Phase 3 construction project of the International Hospital of Thai Nguyen with VND 61 billion, and an additional VND 10 billion for the construction project of the Danang Oncology Hospital.

TNH’s total liabilities stood at VND 942 billion, a 35% increase from the beginning of the year. Borrowings and finance lease liabilities amounted to VND 893 billion, a 36% increase.

The Fat Race Chairman: Another 14.7 Million Shares Sold Off

In just three sessions from August 19 to 21, DFF Chairman Le Duy Hung witnessed the forced sale of over 14.7 million shares by his brokerage, leading to a significant drop in his ownership stake from 42.16% to 23.73%. This development comes as the company extends its losing streak to an eighth consecutive quarter.

The Soaring Price of Bitcoin Entices Companies to Join the Fray.

The number of public companies holding bitcoin globally rose from 89 at the beginning of April to 113 by the end of May, with the top holder boasting a staggering 580,000 bitcoins in its reserves.

The Capital Conundrum: Strategies for Navigating the Financial Maze.

“Capital flows freely as banks introduce a plethora of loan packages with attractive interest rates. However, many small and medium-sized enterprises (SMEs) are left behind due to various reasons such as ineligible requirements, lack of collateral, and other factors that prevent them from accessing these financial opportunities.”

Wealth of Funds: OCBS’s Strategic Investments in Securities and Deposits

On August 5th, OCBS Securities Joint Stock Company purchased government bonds worth nearly VND 154 billion, accounting for 11.1% of total assets on the reviewed financial statements for the first half of 2025. However, just a day later, the company sold a slightly higher value of government bonds. In recent times, the company has also approved numerous other large-scale investments in deposits and stocks, worth hundreds of billions of dong.