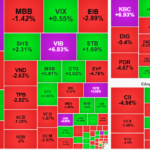

Bank stocks continued to be the market’s focus, with VPB hitting the ceiling price. VPBank Securities Joint Stock Company (VPBankS) has just issued a resolution of the Board of Directors on approving the list of existing shareholders to collect opinions in writing. However, the company has not yet announced the details of the content to be voted on.

At the same time, financial forums buzzed with news that VPBankS is planning an IPO in Q4 2025. Bloomberg also cited sources saying that VPBank is preparing for an initial public offering of its subsidiary securities company, which could take place as soon as Q4. This development quickly created a strong impact on the market. VPB shares soared to the ceiling price of 34,200 VND per share, with buyers outnumbering sellers.

IPO activities

in Vietnam have been thriving recently, with a string of new deals. In May, Vinpearl (coded VPL), a hospitality company under the Vingroup conglomerate (VIC), officially listed on the Ho Chi Minh Stock Exchange (HoSE) after raising approximately VND 5,000 billion from its IPO in February. Techcom Securities Joint Stock Company (TCBS) also opened its IPO subscription today.

Bank stocks surge with VPB hitting the ceiling.

Another prominent bank stock, HDB, also touched the ceiling price during the day, closing up 6.6% at 32,500 VND per share. LPB approached the ceiling price as well. ACB and TPB rose over 5%, while other bank stocks were painted in green.

After the first corrective session, the green color returned to dominate many sectors, including securities. VDS and BSI hit the ceiling price, while leading securities firms with high liquidity such as SSI, VND, SHS, and HCM also saw price increases.

Stocks in the securities and oil & gas sectors continued to attract investors, with strong buying pressure pushing some stocks to the ceiling price. In the oil & gas sector, BSR and PET hit the ceiling price. Meanwhile, real estate stocks KBC, HAR, HPX, CII, and DIG also surged to the maximum daily limit.

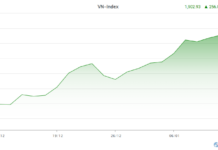

At the market close, the VN-Index rose 17.83 points (1.09%) to 1,654.20. The HNX-Index gained 0.91% to close at 286.45, and the UPCoM-Index climbed 0.74% to 109.78. Liquidity picked up, especially in the afternoon session, pushing the value of transactions on HoSE to nearly VND 54,000 billion. Foreign investors net sold over VND 1,527 billion, focusing on MWG, KDH, HPG, FPT, VIC, and VPB, among others.

Stock Market Outlook for August 21: A Potential Buying Opportunity for Bank and Retail Stocks

“(NLĐO) – Investors may want to keep an eye out for opportunities during the session on August 21st. Any dips in the market could present a strategic moment to invest in stocks that are attracting attention and funds. Sectors to watch include banking, retail, and securities.”