As Vietnam embarks on a transformative journey, entering an era of national advancement, the economy has been witnessing robust quarterly growth. This has made various investment avenues, especially the stock market, increasingly attractive. There has been a surge in new stock trading accounts, with a notable shift towards younger investors, whereas previously, middle-aged individuals dominated the scene. According to a report by Knight Frank, Vietnam is home to over 5,400 individuals with a net worth exceeding $10 million, and this number is expected to grow, particularly among the youth. However, are the traditional investment approaches still relevant in this era of change, and what are the emerging trends in investment for the younger generation?

Discussing this topic on the Talk show Phố Tài chính (The Finance Street) on VTV8, experts opined that with economic progress and rising incomes, investment and financial asset management are gaining prominence, especially among the youth.

BTV Khánh Ly: We’ve noticed a trend of younger investors entering various investment avenues, especially the stock market, in recent years. What, in your opinion, are the reasons behind this phenomenon?

Mr. Truong Vinh An, CFA, Deputy General Director of Investment, KIM Vietnam Fund Management Company Limited: I’ve observed a significant shift in investment trends over the past 10 to 20 years. Traditionally, individuals used to work and save a portion of their monthly income, eventually accumulating a substantial sum to purchase a house. However, this trend has evolved, and people are now exploring more modern investment avenues beyond just savings. For instance, they are venturing into the stock market.

I attribute this shift to a few key reasons. Firstly, savings account interest rates have significantly dropped over the last decade or so. Previously, interest rates were around 8% – 10%, and sometimes even higher. In contrast, current rates hover between 4% and 5% annually, making savings less lucrative. Secondly, traditional investment options like gold and real estate have certain drawbacks. For instance, purchasing gold involves physical storage, which can be challenging and insecure. On the other hand, real estate investments often entail complex legal issues. Consequently, the stock market has emerged as a convenient and appealing alternative for investors, especially the younger generation. They can easily buy or sell stocks with a simple tap on their smartphones, and the liquidity is exceptionally high.

Moreover, the stock market doesn’t require a substantial amount of capital. Unlike real estate investments, which typically demand a large sum of money, one can start investing in the stock market with a small amount of VND 5-10 million, or even as little as VND 1-2 million. Additionally, the stock market can offer assured long-term profits. Notably, investors can also entrust their investments to professional fund management companies, a trend that is not only prevalent in Vietnam but also gaining popularity worldwide. For instance, KIM, a company originating from South Korea, has witnessed a rapid increase in young investors, especially post-COVID, who are not only investing in the South Korean stock market but also exploring international markets like the US and Vietnam, along with various digital assets.

According to our statistics, approximately 74% of investors in the KDEF fund at KIM are relatively young, ranging from their twenties to thirties. A fascinating survey by Investing Pro revealed that about 30% of first-time stock market investors prefer indirect investment, opting to entrust their funds to fund management companies.

BTV Khánh Ly: What are your observations regarding the investment habits of young people, and how have they evolved over time?

Mr. Truong Vinh An, CFA, Deputy General Director of Investment, KIM Vietnam Fund Management Company Limited: I recall that when I graduated 20 years ago, investors had to physically go to a trading floor, fill out paper forms, and hand them over to brokers to place orders, which was a cumbersome and time-consuming process. Nowadays, investors can conveniently trade using their smartphones, making the process more accessible, efficient, and time-saving.

On the other hand, traditional investment avenues like gold and real estate have not witnessed significant technological advancements, making them less appealing to young investors. Young investors today are tech-savvy and quick to embrace new technologies and information. They are also more inclined to take higher risks for higher returns. However, they may lack the necessary knowledge and experience, as investing in the stock market is not a simple task. It requires in-depth analysis of various factors, including businesses, finances, products, markets, and corporate governance, both at the macro and micro levels, which can be quite complex. Moreover, young investors often lack patience and are susceptible to emotional decisions, which can lead to inaccurate investment choices and hinder long-term investment goals. These shortcomings are not unique to young investors but are common among newcomers to the market.

Mr. Truong Vinh An in conversation with BTV Khánh Ly at Talk show Phố Tài chính

BTV Khánh Ly: The economy and investment avenues have been vibrant in the first two quarters of 2025. What are your expectations for the remaining quarters, and how do you foresee the macroeconomic landscape shaping up in the coming years?

Mr. Truong Vinh An, CFA, Deputy General Director of Investment, KIM Vietnam Fund Management Company Limited: The Vietnamese economy is experiencing robust growth in 2025, targeting an 8% expansion this year, and is projected to maintain this pace or even accelerate to 8% – 10% in the coming years. This growth is attributed to increased public investment, higher credit growth, and resolute institutional reforms. With the government’s strong determination, we firmly believe that these targets are achievable.

Additionally, I’d like to highlight the significance of Resolution 68 by the Politburo regarding the development of the private economy. In my opinion, this resolution is pivotal as it transforms the growth structure of the economy. Looking back, the primary growth driver was foreign investment, with FDI playing a crucial role in technology transfer. However, moving forward, Resolution 68 indicates a shift in the dynamics of economic development. The private sector will be the new engine of growth, and I believe this potential remains largely untapped and will be a powerful force in the future.

BTV Khánh Ly: Given this macroeconomic landscape, what are your predictions for the stock market’s trajectory in the upcoming period?

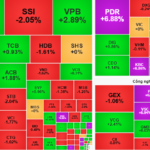

Mr. Truong Vinh An, CFA, Deputy General Director of Investment, KIM Vietnam Fund Management Company Limited: The Vietnamese stock market has performed impressively so far this year. Since the beginning of 2025, the VN-Index has risen by approximately 20%, and if we consider the low point in April following the tariff-related event, the increase is even more remarkable at 40%. Regardless of the perspective, an uptrend in the stock market is evident. Considering the challenges faced in 2022-2023 and the subsequent recovery in 2024, along with the accelerating growth signs in 2025, the economy is strengthening, and businesses are becoming more resilient than ever before.

According to our estimates, the top 100 companies listed on the HOSE are projected to achieve a 15% growth in profits this year and a further 17% in the next, indicating a positive trajectory. Additionally, there is a high probability that the Vietnamese stock market will be upgraded from a frontier market to an emerging market by FTSE at the end of this year. This significant event will create a buzz, allowing us to join a larger playing field and attract substantial investment from prominent global funds. Based on our assessment, with the current valuation of around 13 times for the Vietnamese stock market in 2025, an upgrade could boost this valuation to 17 or 18 times, representing a potential upsize of 30% in overall valuation.

BTV Khánh Ly: With the investment landscape undergoing rapid changes in this era of national advancement, what investment trends do you foresee as suitable for young people in the coming years?

Mr. Truong Vinh An, CFA, Deputy General Director of Investment, KIM Vietnam Fund Management Company Limited: I believe there are two viable options. Firstly, for investors who are passionate and willing to dedicate their time to this endeavor, they can take a proactive approach by acquiring knowledge about the stock market, analyzing businesses, and understanding macro and micro factors. Brokerage firms also provide valuable analytical reports to support investors. My advice is to start small and gradually build up experience and knowledge over the years. This will equip you with the confidence to manage larger investment amounts, as it is a complex and time-consuming activity.

Alternatively, for those who cannot commit much time, investing in professional fund management companies is a prudent choice. You can achieve this by purchasing fund certificates from investment funds operating in Vietnam. This approach ensures long-term profitability for investors. Currently, there are two popular types of fund certificates in the market. The first is the ETF (Exchange-Traded Fund) or index fund, which enables investors to achieve market-wide returns. The second type is the active fund, where fund management companies aim to outperform the market and deliver higher returns to investors. At KIM, we offer both types of fund certificates, and recently, we introduced a solution tailored for individual investors, especially the younger generations of Gen Y and Gen Z. We call it the KDEF Equity Growth Dividend Fund, focusing on two key elements: dividends and growth. Dividends provide a stable income stream and reduce the fund’s volatility over time, while the growth factor ensures capital appreciation, guaranteeing attractive long-term returns.

BTV Khánh Ly: Thank you for your valuable insights!

“It’s Time to Aim for MSCI’s Market Upgrade Standard”

The Vietnamese stock market has reached a pivotal moment in its journey towards recognition as a leading emerging market. With the recent advancements and meeting the criteria set by FTSE Russell for an upgrade from frontier to emerging market status in their September 2025 review, the focus now shifts to attaining the prestigious recognition from MSCI.

Stock Market Update: Mid and Small-Cap Stocks to Attract Investors’ Interest

The August 18th session concluded with a robust buying spree as investors sought to take advantage of discounted stock prices. For the upcoming August 19th trading day, we anticipate a shift in focus towards mid and small-cap stocks, presenting a strategic opportunity for savvy investors to diversify their portfolios and potentially capitalize on the momentum of these dynamic segments of the market.