Liquidity declines indicate a more cautious investor sentiment. The total trading volume of HOSE exceeded 1.6 billion shares, equivalent to a value of nearly VND 45 trillion, down 24% compared to the previous week’s session. Similarly, the trading value on the HNX floor also decreased by 32%, reaching VND 3.4 trillion.

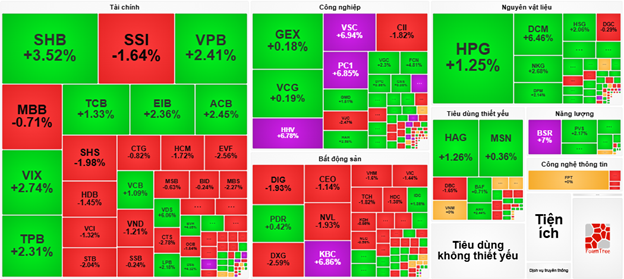

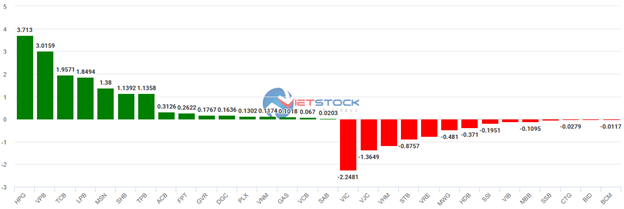

VN-Index fluctuated around the reference level in the afternoon session. Later, buying demand gradually increased towards the end of the session, helping the index close in the green. In terms of impact, VPB and BSR led the gains and contributed more than 3 points to the VN-Index. In contrast, MBB and CTG hindered the overall upward momentum by taking away more than 1.2 points from the index.

| Top 10 stocks with the strongest impact on the VN-Index on 18/08/2025 (in points) |

HNX-Index also recovered well in the afternoon session and closed near the session’s high. Today’s notable trades included IPA, VIG, EVS, and GKM hitting the ceiling price, PLC(+3.45%), CEO (+1.14%), NDN (+6.61%), NAG (+4.05%), DTD (+1.79%), LAS (+1.01%), VCS (+2.39%), etc.

|

Source: VietstockFinance

|

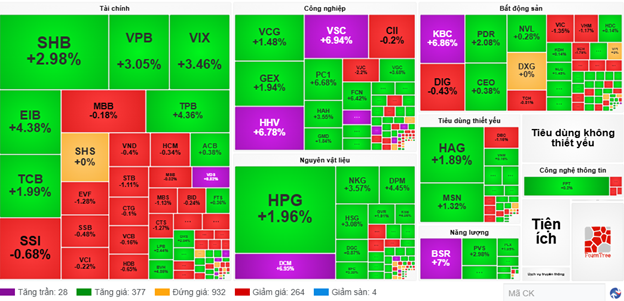

The green dominated, but the performance of industry groups was quite mixed. The energy group maintained its lead until the end of the session thanks to sustained buying interest in BSR (+7%), PVT (+2.41%), PLX (+0.78%), PVS (+0.81%), PVD (+0.44%), PVC (+0.78%)… The materials and utilities groups also traded positively, with many stocks rising over 2%, including DCM, DPM, NKG, VCS, KSB, HT1, PLC, DHC, DPR; POW, NT2, and HDG hitting the ceiling price. In the financial sector, insurance stocks remained broadly upward, while banks and securities recorded mixed performance.

In terms of foreign investors’ transactions, they continued to net sell over VND 2 trillion on all three exchanges. The strongest selling pressure was seen in SHB (VND 264.68 billion), along with a series of stocks facing net selling of around VND 150-190 billion, including VPB, FPT, VIX, and MBB. On the other hand, GMD (VND 155.53 billion), VCB (VND 122.16 billion), and PDR (VND 112.22 billion) were the three stocks most actively bought by foreign investors today.

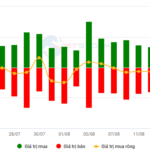

| Foreign investors’ net buying and selling activities |

Morning session: Upside momentum eased

The upward momentum showed signs of cooling towards the end of the morning session. From its highest level of more than 12 points, the VN-Index narrowed its gain to 3.67 points (+0.23%), temporarily closing the morning session at 1,633.67 points. Meanwhile, the HNX-Index ended near the reference level, reaching 282.61 points. The market breadth was relatively balanced, with 359 gainers and 339 losers.

In terms of impact, VIC and VHM were the two most negative stocks, respectively taking away 1.5 points and 1.4 points from the VN-Index. On the other hand, VCB, VPB, and BSR made the most positive contributions, bringing over 4 points of gain to the overall index.

Considering industry groups, the energy sector temporarily led the market with a significant increase of 3.17%, mainly driven by stocks such as PVS (+2.17%), PLX (+0.65%), PVD (+0.66%), PVC (+0.78%), PVT (+1.34%), and BSR hitting the ceiling price.

The industrials and financials sectors also witnessed many bright spots, with notable liquidity in stocks like VSC, PC1, HHV, LCG hitting the ceiling price, GMD (+1.51%), HAH (+2.58%), VGC (+2.3%); SHB (+3.52%), VPB (+2.41%), VIX (+2.74%), TPB (+2.31%), EIB (+2.36%), and ACB (+2.45%). However, many stocks faced strong profit-taking pressure, including ACV (-0.93%), VJC (-2.47%), HVN (-1.97%), VEF (-2.19%); SSI (-1.64%), SHS (-1.98%), HDB (-1.45%), VCI (-1.32%), STB (-2.04%), and EVF (-2.56%).

On the contrary, the media and entertainment sector temporarily lagged, with selling pressure concentrated in large-cap stocks within the group, such as VGI (-1.26%) and FOX (-3.94%).

Source: VietstockFinance

|

Foreign investors continued to net sell, with a value of nearly VND 1.2 trillion on all three exchanges. The selling pressure was mainly focused on SHB and VPB, with respective values of VND 182.02 billion and VND 161.03 billion. In contrast, HPG topped the net buying list with a value of VND 82.87 billion.

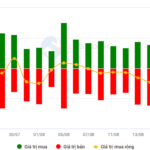

| Top 10 stocks with the strongest foreign net buying and selling |

10:30 am: Maintaining upward momentum

As of 10:30 am, the upward trend persisted after the previous fluctuations, with the VN-Index gaining more than 9 points and trading at 1,639 points. The HNX-Index fluctuated and maintained a slight increase, trading around 283 points.

The breadth of the VN30-Index basket was mixed, with 16 gainers and 14 losers. The main driving force for the increase came from the leading stocks, including HPG, VPB, and TCB, which contributed a total of more than 8.6 points to the overall index. Conversely, the negative impact was concentrated in stocks such as VIC, which decreased by 2.25 points, VJC by 1.36 points, and VHM by 0.88 points.

Source: VietstockFinance

|

The green color prevailed across most industry groups. In particular, the energy sector stood out with a significant increase, as most stocks traded in positive territory. Specifically, BSR hit the ceiling price, while PLX rose by 1.95%, PVS by 2.98%, PVD by 1.32%, PVT by 1.87%, and PVC by 2.34%.

Following closely was the materials sector, which also contributed significantly to the upward momentum, with notable gainers including HPG (+2.14%), GVR (+1.75%), HSG (+3.08%), NKG (+3.57%), DPM (+4.09%), VIF (+8.81%), and DCM hitting the ceiling price.

In contrast, the media and entertainment sector experienced mixed performance, with selling pressure slightly outweighing buying interest. Notably, the red color was observed in large-cap stocks within the group, such as VGI (-0.38%), FOX (-1.69%), and FOC (-0.61%). On the other hand, the green color persisted in SGT (+4.13%), VNB (+1.58%), YEG (+1.01%), etc.

Compared to the opening, buyers continued to dominate, with 377 gainers and 264 losers.

Source: VietstockFinance

|

Opening: Positive start

The stock market started the new week on a positive note after a strong sell-off in the previous week. As of 9:30 am, the VN-Index gained nearly 7 points, reaching 1,636.58 points. The HNX-Index traded around 282.75 points.

VPB, TCB, and BSR were the leading stocks driving the VN-Index‘s upward momentum in the early morning session, contributing 2.7, 1.4, and 1.3 points, respectively. On the other hand, VIC exerted the most considerable negative impact, taking away nearly 1 point from the overall index.

The energy sector was the most prominent bright spot, with a remarkable increase of over 3%, mainly driven by BSR hitting the ceiling price, along with gains in PLX (+1.17%), PVS (+0.54%), PVD (+0.88%), OIL (+1.56%), and PVT (+1.07%). Additionally, the financial sector also contributed significantly to the overall index, with notable buying interest in VPB (+3.79%), TCB (+1.99%), SHB (+3.79%), VIX (+4.61%), EIB (+4.04%), and VCB (+0.93%).

Many stocks in the industrials sector also impressed with their strong performance right from the start of the day, including HHV, FCN, LCG, PC1, and IPA, along with notable gainers such as HAH (+3.07%), VCG (+2.23%), VSC (+1.18%), DPG (+1.71%), C4G (+8.42%), etc.

On the contrary, the negative impact of VGI (-1.89%), FOX (-3.1%), VNB (-2.63%), MFS (-0.87%)… caused the media and entertainment sector to trade less favorably, with the sector index recording a decline of nearly

Vietstock Daily Recap: Potential for Persistent Volatility

The VN-Index rose after a tug-of-war session, but the trading volume fell below the 20-session average, indicating investors’ cautious sentiment. With the Stochastic Oscillator continuing its downward trajectory and signaling a sell-off in the overbought territory, alongside persistent net foreign selling, the market remains vulnerable to short-term volatility.

The Case for Reducing the Statutory Reserve Requirement by 50% for Four Banks

The 50% reduction in the statutory reserve requirement for banks taking over specially controlled banks is a significant move. This measure enables these banks to extend their credit offerings, reduce costs, and promote the restructuring of subsidiary banks. However, it is imperative to identify and implement control measures to prevent any potential misuse of this supportive mechanism.

The Market Maverick: Can We Expect a Resilient Reversal?

The VN-Index experienced significant volatility but managed to recover towards the end of the trading session, with above-average volume. The uptrend remains intact as the MACD indicator continues to hover above the signal line, indicating no signs of weakness. However, the risk of volatility persists as the index hovers at historical highs. In the event of increased selling pressure, the middle band of the Bollinger Bands will serve as a crucial support level.

Market Beat: Pulling Major Stocks, VN-Index Makes a Strong Comeback at the End of the Session.

The trading session concluded with the VN-Index climbing 10.16 points (+0.61%), reaching 1,664.36. In contrast, the HNX-Index witnessed a decline of 2.72 points (-0.95%), settling at 283.73. The market breadth tilted towards decliners, as 569 stocks closed in the red, while 238 stocks ended in the green. Within the VN30 basket, 17 stocks fell, 12 advanced, and 1 remained unchanged, resulting in a slightly bearish sentiment.