Kinh Bac City Development Holding Corporation is Vietnam’s leading industrial real estate developer, focusing on the Northern region, with over 6,000 ha of industrial land and more than 1,000 ha of urban land. The company is also a pioneer in attracting FDI to Vietnam, with prominent clients such as Foxconn, LG, and Canon.

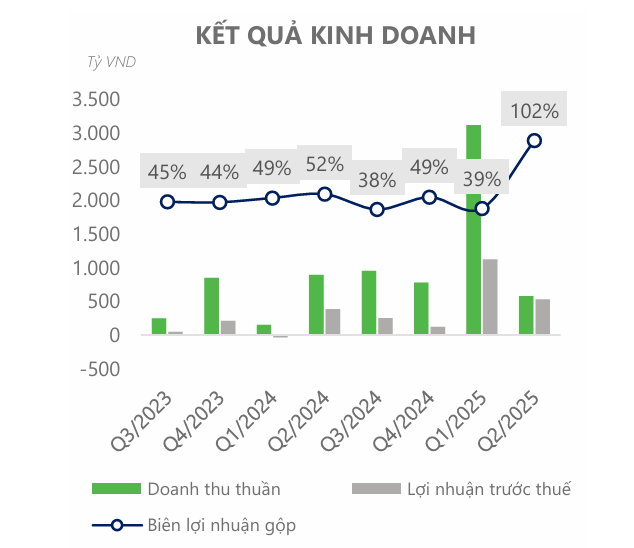

In the first half of 2025, KBC’s revenue and net profit saw positive growth, reaching VND 3,696 billion and VND 1,655 billion, respectively. The revenue from industrial land leasing amounted to VND 2,830 billion, derived from leasing 86 ha of land (mainly in Hung Yen Industrial Park). The real estate segment also witnessed the delivery of a series of affordable housing products, boosting revenue to VND 412 billion.

In the second quarter, KBC’s gross profit margin surged to 102% due to negative cost of goods sold, resulting from the company’s reversal of previously incurred costs related to a land lot delivered in Hung Yen Industrial Park in Q1/2025. DSC believes that KBC’s revenue will continue to grow as the company has signed MOUs for leasing approximately 50 ha of land to projects in the semiconductor and AI fields.

Source: Kinh Bac, DSC Consolidated

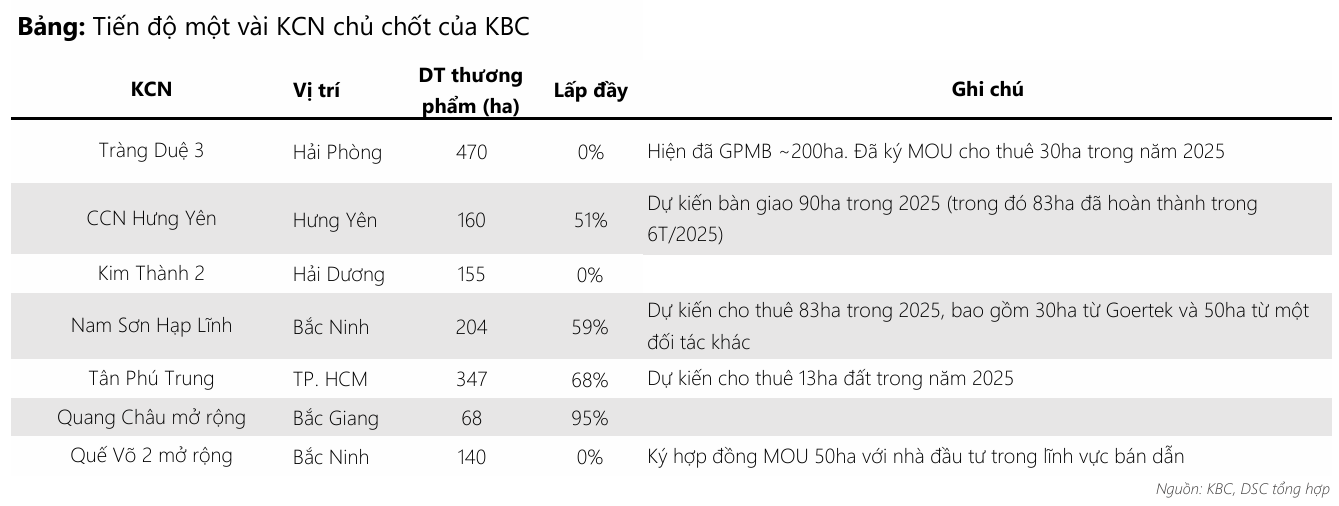

KBC is on track to deliver a record-high amount of land this year. The company plans to hand over 83 ha in Nam Son-Hap Linh Industrial Park (to Goertex and another partner) and approximately 13 ha in Tan Phu Trung Industrial Park.

Furthermore, KBC is proceeding with business operations in industrial parks that have completed their investment policies (Trang Due 3, Kim Thanh 2, and four other IPs), increasing the total land available for lease to ~3,000 ha. With this extensive land bank, DSC anticipates that KBC will continue to secure new MOUs, and the leasing activities will remain vibrant, with an expected additional 130 ha to be leased this year.

Currently, KBC is expediting land clearance for Hung Yen Urban Area (Trump International) with the expectation of investing in infrastructure development and commencing sales by 2026. The Trang Cat Urban Area has also completed land use fees and is ready for land handover to partners. This year, KBC is in the process of selling ~20 ha in bulk to foreign investors.

DSC believes that KBC will utilize this cash flow as direct capital to develop the remaining area of Trang Cat. Overall, KBC’s real estate business outlook for the following year is promising, which is expected to generate significant cash flow for the company.

“NO1 Shares Surge 15% Post-Review, Electrifying the Taxi Industry”

The HOSE-listed 911 Corporation (NO1) witnessed a significant drop in its audited net profit for the first half of 2025, which now stands at just over VND 14 billion. This comes as the company channels its resources into its ambitious 911 Taxi project, a VND 500 billion endeavor that aims to introduce 400 VinFast vehicles into operation by the end of the third quarter.

The Second Quarter Boom for Industrial Park Businesses

The industrial real estate sector has witnessed a significant surge in land and factory rentals during Q2, resulting in substantial profit growth for numerous businesses. While some companies struggle with declining core revenues, others are reaping the benefits of this increased demand. VCI attributes this positive outlook to the influx of FDI and the expansion of land banks, anticipating continued growth in the industry.

Profits Plummet for Tire Manufacturing Group

The second quarter of 2025 witnessed a distinct dichotomy within the rubber industry, with a clear divide between product manufacturers and latex harvesters. While rubber tappers thrived amidst sustained high latex prices, tire manufacturers faced significant challenges due to soaring raw material costs, resulting in their lowest gross profit margins in a decade.