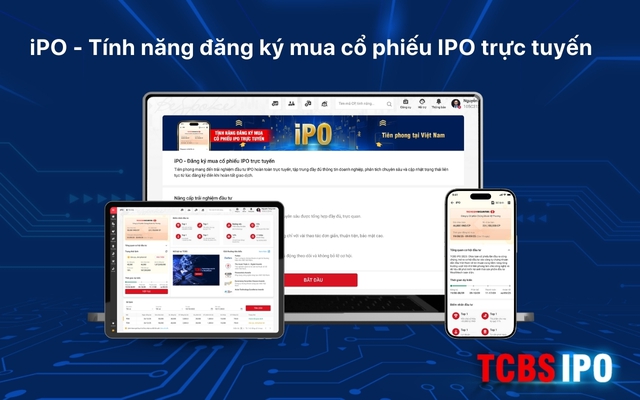

Techcom Securities Joint Stock Company (TCBS) has officially opened registration for its initial public offering (IPO) of shares from 8 am on August 19 to 4 pm on September 8, 2025. The company is offering a total of 231.15 million common shares at a price of VND 46,800 per share, equivalent to a total capital mobilization of over VND 10,800 billion. In addition to the option of registering to buy directly at TCBS’ announced business locations or through the two official agents, SSI and HSC, investors now have a quicker and more convenient choice: registering to buy online directly on TCBS’ TCInvest platform.

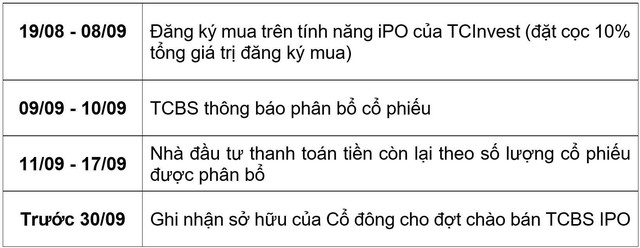

Investors who wish to register to buy TCBS’ IPO shares online through the iPO feature on TCInvest should take note of the important deadlines from August 19 to before September 30.

In the event that the total number of registrations exceeds the number of shares on offer, TCBS will apply a pro-rata allocation based on the total number of shares on offer divided by the total number of shares that all valid investors have registered to buy across all sales channels (online through the iPO platform, directly at TCBS’ business locations, and through the official agents SSI and HSC) during the period from August 19 to 4:00 pm on September 8. In other words, each investor will be allocated shares according to a single, fair pro-rata ratio based on the number of shares ordered, ensuring transparency and equality for all. The allocation results will be announced from September 10.

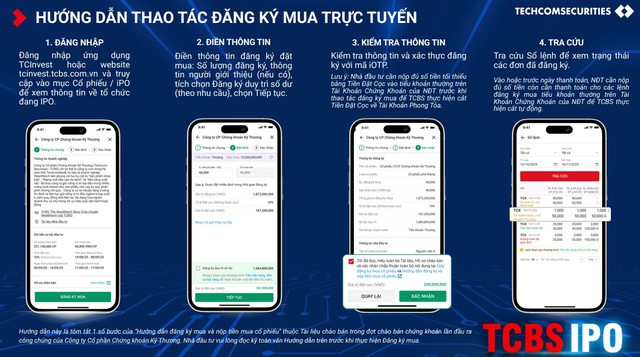

The registration process for the online channel through the iPO feature on the TCInvest application consists of three steps: (1) Register to buy and deposit 10% of the total value of the order into the main sub-account of the securities account before placing the order. The order will not be confirmed if the account does not have sufficient deposit; (2) Once the order is confirmed, TCBS will send a notification via email and the message box on TCInvest; (3) After the registration period ends, investors will receive a notification of the allocation results and proceed to make the remaining payment as per the regulations.

After the payment period, based on the amount paid by the investor, TCBS will execute the matching process for each individual. The following matching principles will be applied to each investor: (1) Orders that are registered first will be given priority in matching; (2) Orders that are not fully paid will not be matched, and the investor will lose the deposit for that order; (3) In the event of a surplus, investors will be refunded the excess amount, calculated as the amount paid minus the total of (the value of successfully matched orders plus the deposit of unmatched orders).

According to the latest updates from TCBS, customers who register to buy TCBS IPO shares through the online channel will be offered free custody of IPO shares for 360 days. Especially for customers who successfully register to buy online from 5,000 shares during the period from August 19 to 4:00 pm on September 8 will receive additional benefits from the Premium Wealth package when trading investment products at TCBS such as bonds, margin loans, etc.

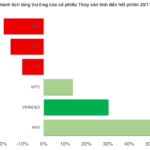

‘Hot’ Rumor-Driven Surge in Bank Stock Ahead of Alleged IPO

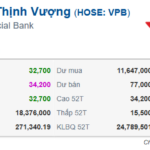

The VN-Index soared to new heights today, reaching a peak of 1,654 points. This remarkable surge was fueled by the strong performance of large-cap stocks, particularly the banking sector. VPB stood out with an impressive ceiling-high increase, while HDB also witnessed significant upward momentum during the trading day.

The Evolution of an Enterprise: Chairman Nguyen Duc Tai on the Internal Debate to Rename The Gioi Di Dong to The Gioi Ban Le

The name The Gioi Di Dong was considered for a change by the board of directors; however, it has been retained as it has become a trusted and well-recognized brand among consumers.