The VN-Index closed at 1,664 points on August 20, a gain of 10 points or 0.61%.

Vietnam’s stock market experienced a volatile yet positive trading day on August 20, buoyed by key industry groups.

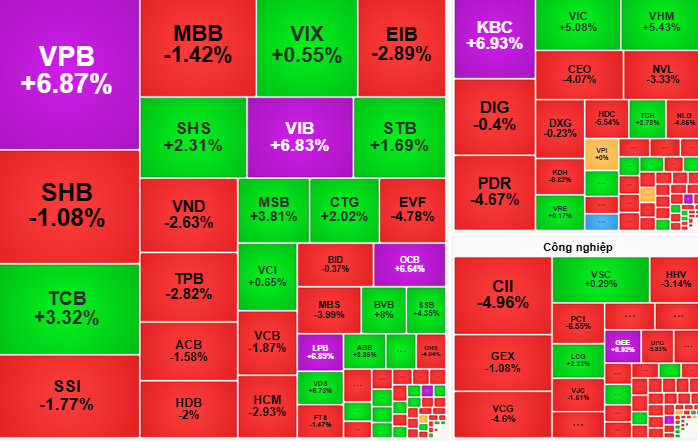

The VN-Index opened 8 points higher than the previous day’s reference, driven by concentrated buying in banking stocks (VIB, TCB, CTG, OCB), consumer goods (MWG), and the Vingroup conglomerate (VIC, VHM, VRE). However, profit-taking pressures intensified mid-morning, causing the market to dip into negative territory around the 1,650-point level.

In the afternoon session, strong buying in Vingroup stocks and a rebound in banking shares pushed the VN-Index back into positive territory. Notably, banking heavyweights VCB, TCB, and CTG played a pivotal role in the market’s recovery, driving the index back into the green in the final 30 minutes of trading.

At the close, the VN-Index stood at 1,664 points, up 10 points or 0.61%. Market-wide liquidity surpassed VND 68,000 billion, indicating robust trading activity.

According to Dragon Vietnam Securities (VDSC), despite the positive close, the sharp intraday swings suggest a tug-of-war between profit-taking and supportive inflows.

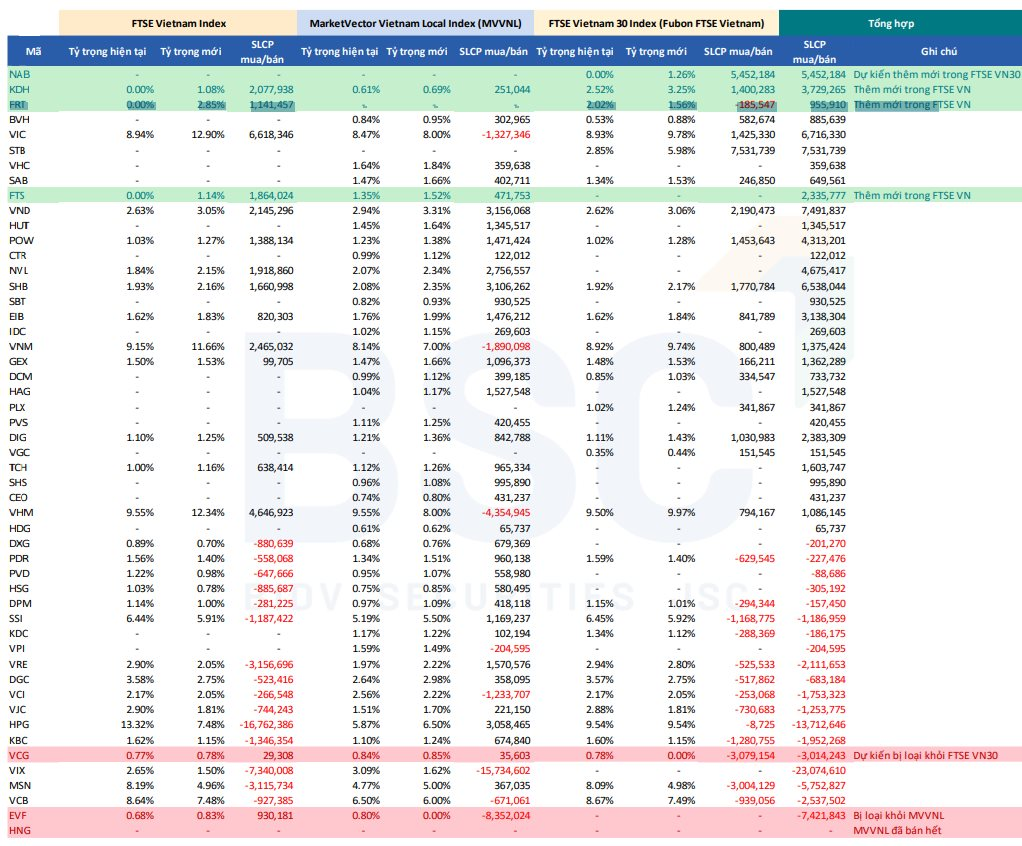

VDSC believes that if buying pressure persists, the VN-Index could overcome the 1,665-point resistance level and extend its upward trajectory in the near term. They attribute the increased liquidity to active fund inflows.

Vietnam International Securities (VCBS) shares a similar sentiment, viewing the high liquidity as a positive sign of market attractiveness to investors.

VCBS suggests that investors consider taking profits in stocks that have rallied significantly recently. They recommend using any intraday dips on August 21 as buying opportunities in sectors currently favored by investors, such as banking, retail, and securities.

Market Beat: VN-Index Stays in the Green Despite Foreign Selling Pressure

The VN-Index ended the first trading session of the week on a positive note, climbing 6.37 points (+0.39%) to close at 1,636.37. Similarly, the HNX-Index witnessed a boost of 1.53 points (+0.54%), settling at 283.87. The market breadth tilted in favor of advancers, with 450 stocks rising (including 46 that hit the ceiling price) versus 368 decliners (4 of which touched the floor price).