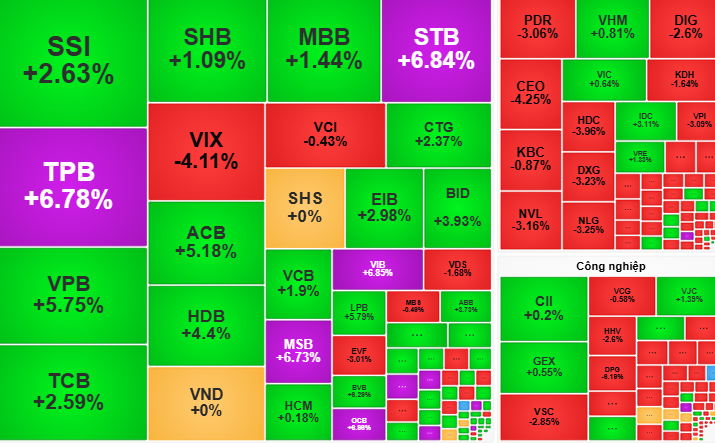

The VN-Index closed at 1,688 points on August 21st, a gain of 23 points or 1.42%.

VN-Index opened on August 21 with an 11-point surge, propelled by robust demand for bank stocks. The upward momentum was sustained and expanded as money flowed into stocks such as TPB, MSB, STB, VIB, and OCB, with many reaching the ceiling price. However, the market also exhibited polarization, with the number of declining stocks (194) surpassing rising ones (119), indicating uneven capital distribution.

In the afternoon session, the VN-Index maintained its positive trajectory thanks to the banking sector’s resilience. However, profit-taking pressures at higher levels narrowed the gains. A bright spot emerged in the latter half as strong buying interest resurfaced in large-cap stocks like MWG and FPT, coupled with continued strength in banking stocks, propelling the VN-Index higher.

At the close, the VN-Index settled at 1,688 points, marking a solid gain of 23 points or 1.42%. Foreign investors continued heavy selling, offloading stocks worth 2.416 trillion VND, particularly in VPB, HPG, and CTG, exerting downward pressure on the market.

VCBS, the Investment Banking Division of Vietcombank, observes that money flow is becoming more polarized, concentrating on large-cap stocks and specific sectors, notably banking.

This information may lead some investors to anticipate heightened volatility in the next session as profit-taking pressures could intensify at higher levels.

Meanwhile, other brokerages predict unexpected developments in the market on August 22, especially regarding large-cap and highly liquid stocks. Investors are advised to closely monitor resistance and support levels to make informed trading decisions.

Nevertheless, VCBS recommends continuing to hold stocks with stable upward trends, absent strong selling pressure. Investors are also encouraged to selectively buy stocks that successfully break through resistance for short-term trading opportunities.

The Bank Stock Blues

The domestic stock market ended the week with a significant drop in the VN-Index, the largest decline seen this month, shedding over 42 points. This development comes on the back of a heated rally in previous sessions, particularly in the banking sector.

‘Hot’ Rumor-Driven Surge in Bank Stock Ahead of Alleged IPO

The VN-Index soared to new heights today, reaching a peak of 1,654 points. This remarkable surge was fueled by the strong performance of large-cap stocks, particularly the banking sector. VPB stood out with an impressive ceiling-high increase, while HDB also witnessed significant upward momentum during the trading day.

The Stock Sell-Off by Vietnamese Billionaires: VN-Index Plunges Over 40 Points

The stock market rout wiped out over 40 points from the VN-Index, with a slew of stocks belonging to Vietnam’s billionaire club taking a hit.