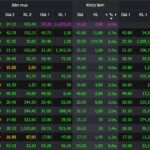

Bank stocks were the center of attention today as they plummeted across the board. Many stocks hit their daily limit downs, including VPB, SHB, and EIB. VPB and EIB struggled to find buyers, while millions of shares were left unsold at the daily limit down price by the end of the session. Other major bank stocks, such as MBB, ACB, STB, and EIB, also witnessed steep declines, falling by 4-6%.

Several stocks hit their daily limit downs, including VPB, SHB, and TCB.

Profit-taking pressure led to a surge in trading volume, with SHB and VPB recording trading values of over VND 2,930 billion and VND 2,746 billion, respectively, ranking second and third in the market in terms of trading value, only surpassed by HPG. HPG, the leading steel stock, saw a turnover of more than VND 3,500 billion and a sharp decline of over 5%, also contributing to the negative impact on the market.

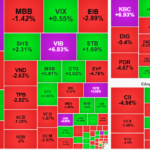

Other large-cap stocks in the VN30 index also underwent adjustments, including VJC, MSN, SSI, and FPT. The market was painted red, with 275 stocks on the HoSE dropping in price. The stocks that witnessed the sharpest declines were those that had previously witnessed strong breakouts. After five consecutive gaining sessions, including four sessions hitting the daily limit-up price, BSR reversed course and fell to its daily limit down, closing at VND 27,850 per share.

Stocks in the real estate sector, particularly smaller and medium-sized stocks like SCR, HHS, and LDG, also hit their daily limit downs. A slew of stocks, including DIG, DXS, HPX, NRC, HQC, and DRH, adjusted close to their daily limit downs, falling by more than 6% each.

At the close of the trading session, the VN-Index dropped by 42.53 points (2.52%) to 1,645.47. The HNX-Index fell by 11.91 points (4.19%) to 272.48, while the UPCoM-Index declined by 1.32 points (1.19%) to 109.26. Trading volume surged amid selling pressure, with HoSE recording a trading value of nearly VND 62,140 billion. Foreign investors net sold VND 1,541 billion, focusing on stocks like HPG, VPB, OIL, and STB.

Prior to today’s sharp decline, many bank stocks had witnessed strong rallies and reached new historical highs. The adjustment pressure was expected as the market’s upward momentum was driven by only a handful of sectors, continuously pushing the indices to new highs.

Analysts from Saigon-Hanoi Securities (SHS) noted that the market had seen a significant increase in speculative activities in the banking sector. After the recent hot streak, the market is undergoing a strong polarization phase. Short-term speculative positions are expected to wane. Investors are advised to carefully evaluate their portfolios and consider exiting positions that show signs of weakness. The market is likely to return to fundamental valuation factors and focus on the upcoming Q3 earnings season.

‘Hot’ Rumor-Driven Surge in Bank Stock Ahead of Alleged IPO

The VN-Index soared to new heights today, reaching a peak of 1,654 points. This remarkable surge was fueled by the strong performance of large-cap stocks, particularly the banking sector. VPB stood out with an impressive ceiling-high increase, while HDB also witnessed significant upward momentum during the trading day.

Stock Market Outlook for August 21: A Potential Buying Opportunity for Bank and Retail Stocks

“(NLĐO) – Investors may want to keep an eye out for opportunities during the session on August 21st. Any dips in the market could present a strategic moment to invest in stocks that are attracting attention and funds. Sectors to watch include banking, retail, and securities.”