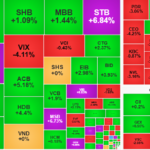

Vietnam’s stock market faced significant selling pressure from the start of the trading session on August 20th. The selling pressure intensified during the morning session, with the VN-Index plunging nearly 40 points at one point before recovering in the afternoon. The index eventually closed with a gain of 10.16 points (+0.61%), ending the day at 1,664.36. Foreign investors continued their selling trend, with a net sell value of approximately 214 billion VND across all three exchanges.

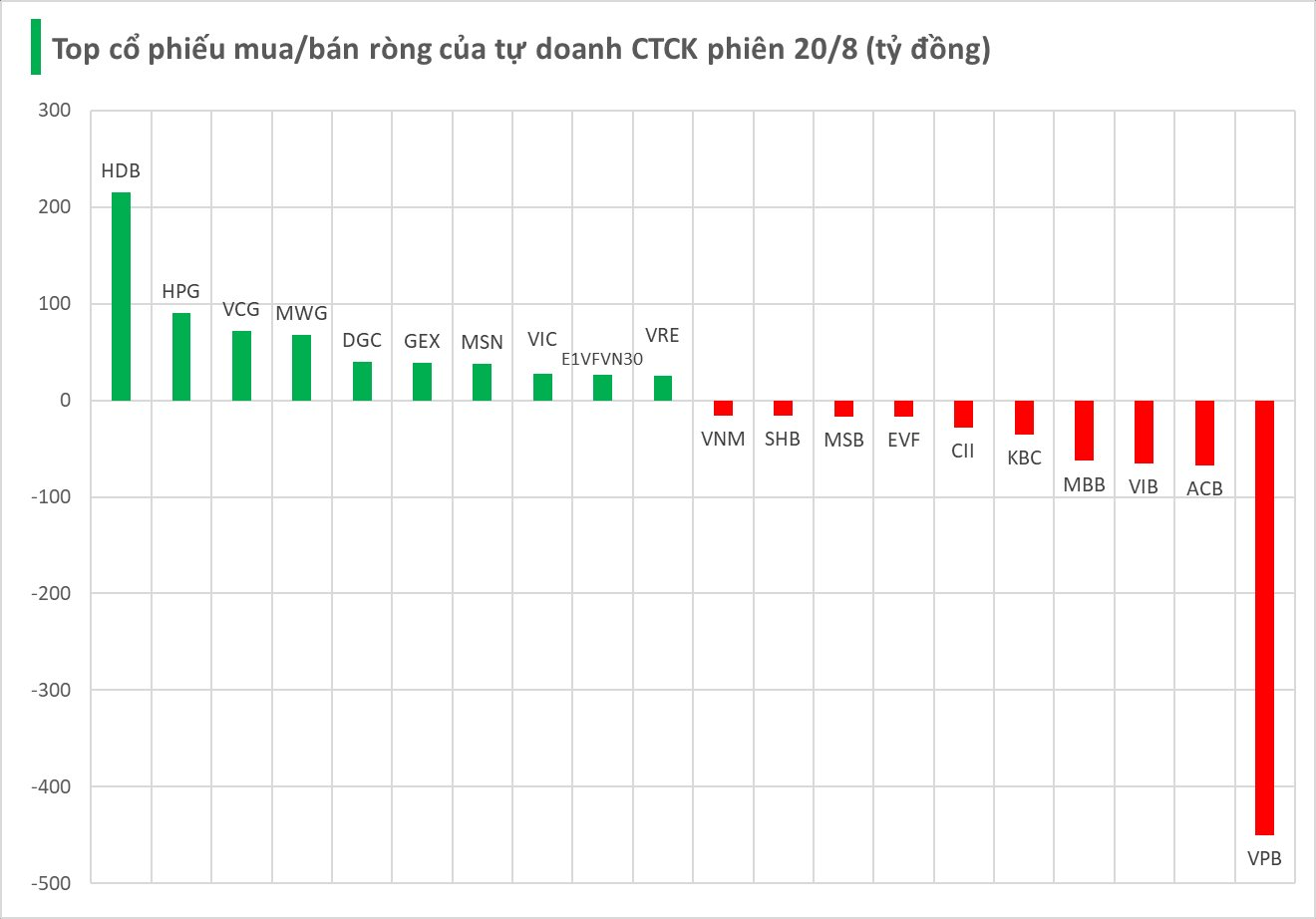

Brokerage proprietary trading bought a slight net of 77 billion VND on the HoSE.

Specifically, HDB bank stock was the most prominently bought by brokerage proprietary trading, with a net purchase value of 215 billion VND. This was followed by HPG (90 billion), VCG (71 billion), MWG (68 billion), DGC (39 billion), GEX (39 billion), MSN (37 billion), VIC (28 billion), E1VFVN30 (26 billion), and VRE (25 billion).

On the other hand, VPB witnessed the strongest net selling from brokerages, amounting to 450 billion VND, followed by ACB (67 billion), VIB (63 billion), MBB (63 billion), and KBC (35 billion). Several other stocks also experienced net selling, including CII (28 billion), EVF (17 billion), MSB (17 billion), SHB (16 billion), and VNM (16 billion).

The VN-Index: An Astonishing Last-Minute Turnaround

Despite a sea of red with nearly 260 stocks in the negative, the VN-Index defied the odds and staged a remarkable comeback on Tuesday (August 20), surging over 10 points led by a resilient banking sector.

Stock Market Update for August 22: Stocks Set for Volatile Session

The August 21st session witnessed a distinct shift in focus towards large-cap stocks, indicating a clear differentiation in cash flow. With this strategic shift, the stock market session on August 22nd is expected to be full of surprises and unpredictable twists.