Vietnam’s Stock Market Surge: A Tale of Contrasting Fortunes

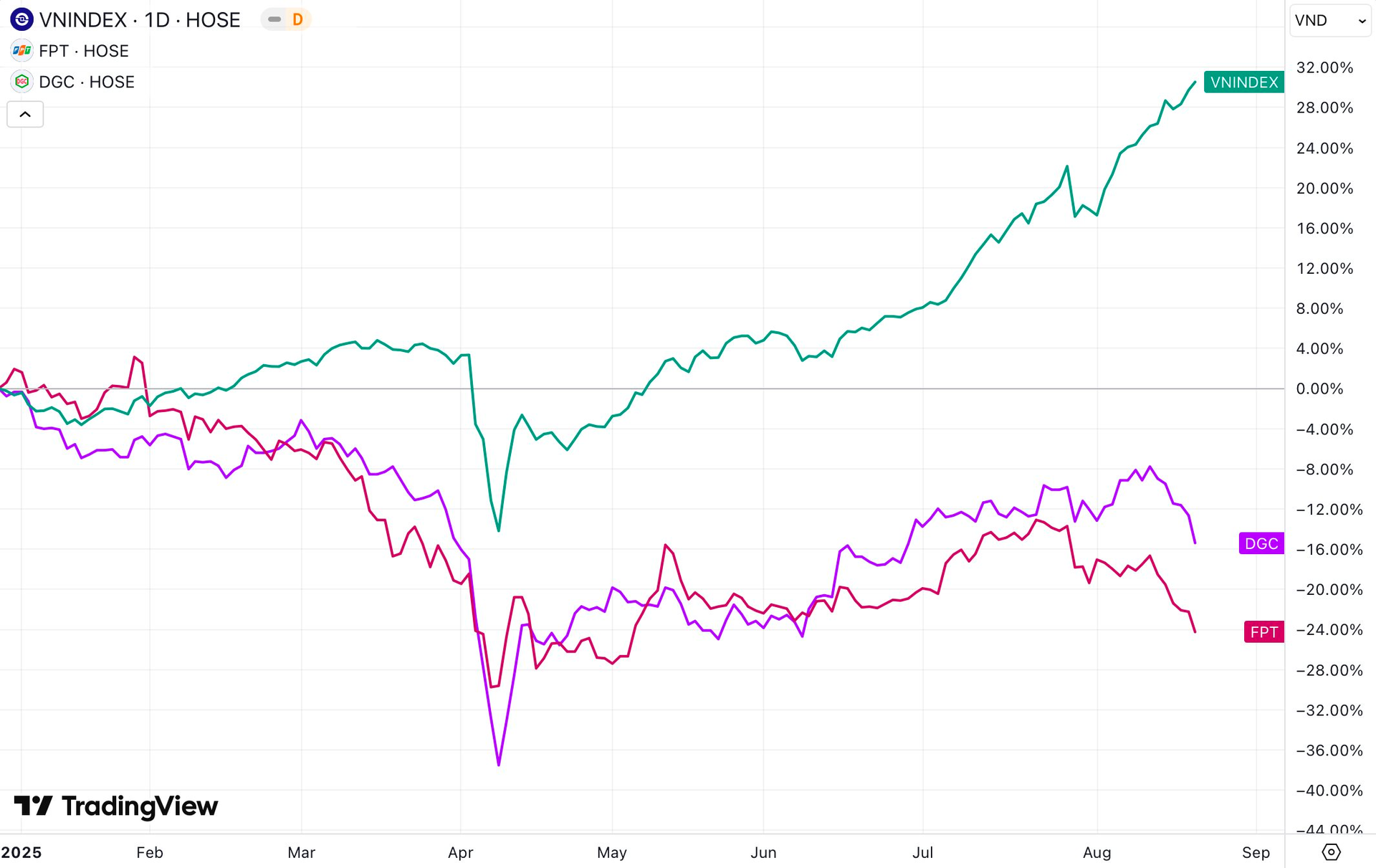

Vietnam’s stock market is experiencing its most vibrant period in recent years. The VN-Index has been on a strong upward trajectory, brushing off volatility to reach an all-time high of over 1,664 points.

However, not all investors are rejoicing. Shareholders of many companies, including industry leaders such as FPT and Duc Giang (DGC), have watched their accounts dwindle day by day.

On August 20, FPT witnessed a further 2.6% decline, marking its sixth consecutive loss and officially dipping below the 100,000 VND per share mark to its lowest level since early May. Meanwhile, DGC also suffered a loss of over 3% in market price, settling at 99,000 VND per share, its lowest since late June.

Year-to-date, FPT has been the worst-performing stock among the VN30 group, with a decline of nearly 26%. The market capitalization of Vietnam’s leading technology corporation now stands at approximately 166 trillion VND, failing to secure a spot in the top 10 on the stock exchange.

Similarly, DGC has lost 15% of its market price since the beginning of 2025, with the market capitalization of Asia’s largest yellow phosphorus producer falling to less than 38 trillion VND.

Notably, this situation unfolds against the backdrop of a more than 30% gain in the VN-Index since the start of the year. This only adds to the disappointment of FPT and DGC shareholders. In fact, many leading stocks in manufacturing, industry, telecommunications, and other sectors, such as VGI, BMP, VCS, and MCH, have also been largely overlooked.

The majority of investment funds are concentrated in the financial sector, including banks, securities, and insurance companies. Stocks in this sector are racing towards their peak, with explosive liquidity. While less exuberant, some stocks in the steel, real estate, and oil and gas industries have also witnessed notable gains. Only FPT and DGC are struggling to keep up.

Although FPT and DGC have brought similar sorrow to investors, their business performances differ. FPT has maintained quarterly profit growth of around 20%, but slowing revenue growth due to weakened global tech spending projections presents a significant challenge.

On the other hand, DGC’s profit growth has also decelerated. However, a recent analysis by Agriseco offers a positive outlook for DGC, citing favorable trends in yellow phosphorus prices and the amended VAT Law.

Overall, this market upturn is largely driven by the influx of investment funds rather than fundamental factors. Abnormal information, such as IPOs of subsidiaries and forays into digital assets, tends to have a more immediate impact on stock prices.

Additionally, the financial sector, particularly banks, has several anticipated developments, including the pilot removal of credit room and the reduction of mandatory reserve ratios. Consequently, it’s no surprise that these stocks are attracting substantial investment. In contrast, the second-quarter financial reporting season has passed, and fundamentally strong stocks like FPT and DGC are currently in an information vacuum.

In summary, it’s understandable that the market’s rapid rise would attract investment funds to sectors with high sensitivity. As a result, stocks that are less market-oriented inevitably face intense pressure. However, in the long run, when the hype around “hot” stories subsides, investment funds may shift their focus back to fundamental factors.

Investment Trends: Stocks, Gold or Real Estate?

The stock market has risen to prominence thanks to its high liquidity, low capital requirements, ease of access, and potential for long-term growth.

Market Beat: VN-Index Stays in the Green Despite Foreign Selling Pressure

The VN-Index ended the first trading session of the week on a positive note, climbing 6.37 points (+0.39%) to close at 1,636.37. Similarly, the HNX-Index witnessed a boost of 1.53 points (+0.54%), settling at 283.87. The market breadth tilted in favor of advancers, with 450 stocks rising (including 46 that hit the ceiling price) versus 368 decliners (4 of which touched the floor price).

Vietstock Daily Recap: Potential for Persistent Volatility

The VN-Index rose after a tug-of-war session, but the trading volume fell below the 20-session average, indicating investors’ cautious sentiment. With the Stochastic Oscillator continuing its downward trajectory and signaling a sell-off in the overbought territory, alongside persistent net foreign selling, the market remains vulnerable to short-term volatility.

The VN-Index Surges to Historic Highs: Leading Brokerages Convene for Emergency Meetings

The stock market continues to present an optimistic outlook with ample growth opportunities. The narrative for the foreseeable future remains compelling, with a myriad of attractive prospects on the horizon.