Mr. Doan Hoang Nam, son of Mr. Doan Nguyen Duc – Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG) has successfully purchased 27 million HAG shares through a negotiated deal on August 22, 2025, as reported in a recent filing.

Following this transaction, Mr. Nam officially became a shareholder of HAGL, owning 27 million HAG shares, equivalent to a 2.55% stake in the company.

Based on the closing price of HAG shares on August 22, 2025, of VND 16,100 per share, Mr. Nam, son of Mr. Duc, is estimated to have spent more than VND 434 billion to acquire this significant stake.

Illustrative image

On the other hand, Mr. Duc (known as “Bầu Đức” in Vietnamese) has recently sold 25 million HAG shares through negotiated deals between August 18 and August 22, 2025.

As a result of these transactions, Mr. Duc’s ownership in HAGL decreased from over 329.95 million shares to more than 304.95 million shares, reducing his stake from 31.2% to 28.84% of the company’s capital.

In other news, HAGL recently announced its reviewed consolidated financial statements for the first six months of 2025, along with an explanation of its business results and the auditor’s emphasis of matter paragraph.

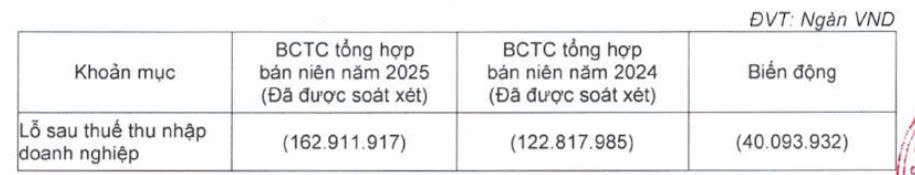

For the six-month period ending June 30, 2025, HAGL reported revenue of over VND 4,797 billion, a 39.2% increase compared to the same period in 2024. However, after deducting taxes and expenses, the company incurred a net loss of nearly VND 163 billion, a 32.7% increase compared to the previous year.

Source: HAG

The auditors highlighted HAGL’s net loss of nearly VND 163 billion for this period. As of that date, the company had accumulated losses of over VND 3,552 billion, and its current liabilities exceeded current assets by more than VND 4,947 billion.

Additionally, as of June 30, 2025, the company was in breach of certain covenants related to its bond contracts and had outstanding unpaid bond interest. These conditions raise significant doubts about HAGL’s ability to continue as a going concern.

In response to the auditor’s emphasis of matter, HAGL explained that, as of the date of the reviewed financial statements for the first six months of 2025, the company had prepared a plan for the next 12 months, including expected cash flows from the disposal of financial investments, asset disposals, recovery of loans from partners, borrowing from commercial banks, and cash flows from ongoing projects.

Furthermore, the company is in discussions with lenders to amend the breached terms of the relevant bond contracts and provide additional collateral. This will enable the company to repay its debts as they become due and continue its operations for the next 12 months.

Simultaneously, the company is seeking shareholder approval through a written resolution to convert long-term loans and amounts payable to related parties into equity.

Based on these plans and expectations, the Board of Directors of HAGL has prepared the semi-annual financial statements for 2025, assuming the company will continue as a going concern.

The Thrilling Saga of “Bầu” Đức and Hoàng Anh Gia Lai: Unveiling the Latest Sensational Updates

“Vietnamese business tycoon, known as ‘Bầu Đức’, and his son have finalized a substantial stock transaction involving HAG shares, valued at approximately 400 billion VND. This significant deal underscores the dynamic nature of Vietnam’s evolving business landscape, where influential families continue to shape the country’s economic trajectory.”

“Bond Contract Buyback Boosts TVSI’s Profits by Nearly VND 20 Billion Post Half-Year Audit”

“Tan Viet Securities Joint Stock Company (TVSI) reported a profit of nearly VND 20 billion for the first half of 2025, according to its semi-annual audited financial statements. This impressive performance showcases the company’s resilience and growth amidst a dynamic market landscape.”