At the MWG’s Investor Meeting for Q2 2025, the CEO, Vu Dang Linh, addressed the company’s plans regarding share repurchases.

Mr. Linh stated that current regulations permit companies to buy back shares for treasury stock at least six months after issuing shares under an employee stock ownership plan (ESOP). As MWG recently concluded its ESOP issuance in April, the company must wait until at least October to submit the necessary documents to the authorities.

The CEO also shared that the company is working on finalizing the paperwork, with a potential maximum purchase price of 100,000 VND per share. As of the market’s close on August 20, MWG’s share price stood at 69,400 VND.

Previously, in 2024, MWG had planned to repurchase shares and reduce its charter capital, but the process could not be completed due to procedural issues and the management’s reluctance to convene an extraordinary general meeting of shareholders.

At the 2025 annual general meeting of shareholders, the shareholders approved the plan to repurchase up to 10 million treasury shares (approximately 0.68% of the circulating shares). The company intends to use profits after tax as the source of funding, based on the latest audited financial statements. The timing of the transaction will be decided by the Board of Directors, subject to the approval of the State Securities Commission, and will be executed when market conditions are favorable.

MWG’s management expressed confidence in this decision, stating that it aligns with the company’s stable business performance.

Growth Drivers in the New Phase

During the meeting, the Chairman of the Board of Directors, Nguyen Duc Tai, shared the company’s overall business direction for this new phase.

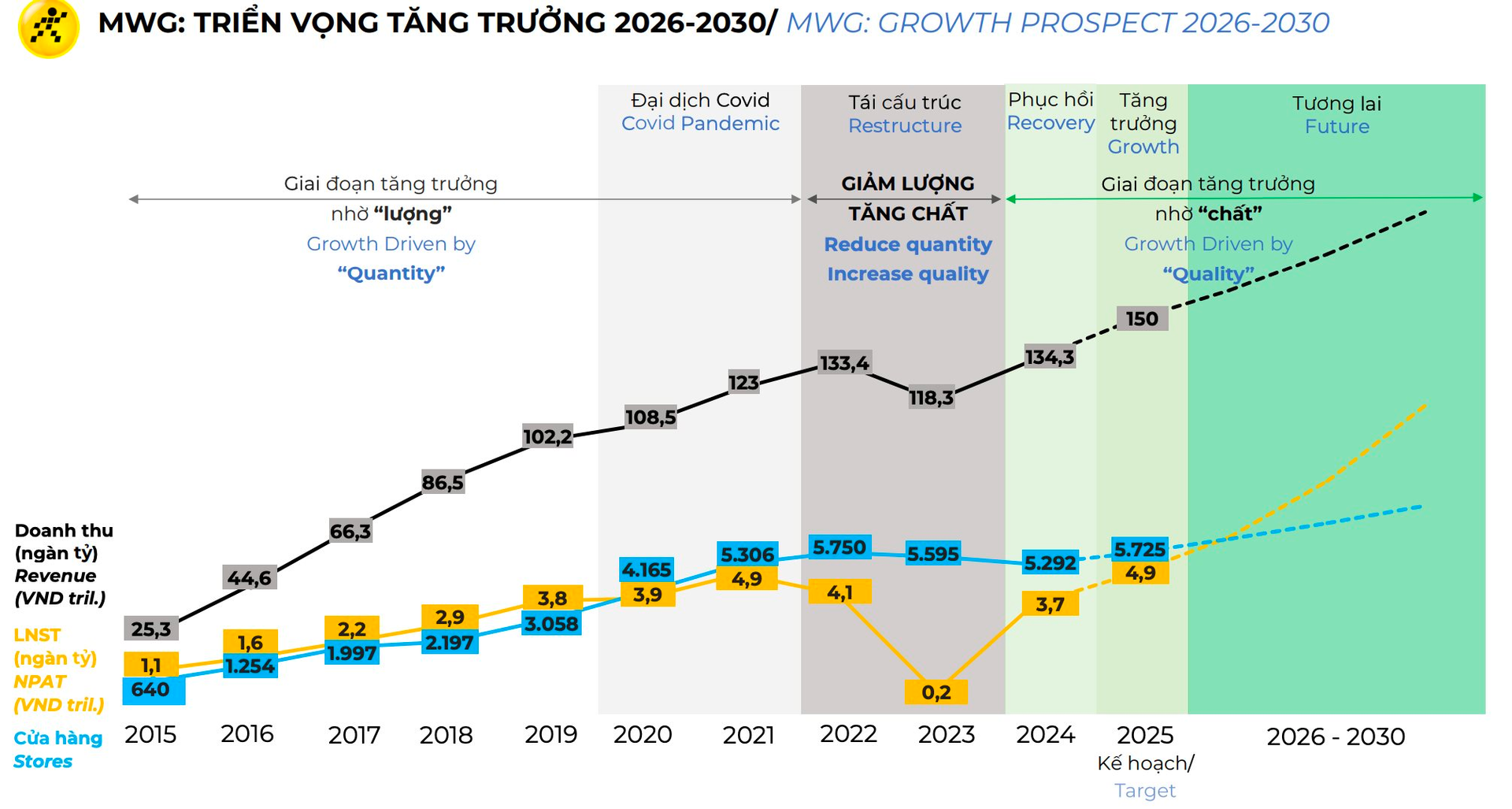

According to Mr. Tai, MWG has entered a new growth cycle, focusing on qualitative development. In the initial stage, revenue growth will outpace profit growth, but subsequently, profit growth will accelerate relative to revenue growth.

Mr. Tai emphasized that while both quantity and quality are important, the company will prioritize quantity in the near future to rapidly increase market share. As a result, he predicted that Bach Hoa Xanh’s revenue would grow faster than its profits.

Meanwhile, the two chains, The Gioi Di Dong and Dien May Xanh, continue to be the primary contributors to MWG’s financial performance, and their profit growth is expected to outpace revenue growth. The qualitative shift will be evident in the after-sales service, with customers experiencing significant improvements in both online and offline purchases, setting MWG apart from its competitors.

“We take responsibility for the products our customers are using. For instance, if a customer experiences any issues with an air conditioner within four years of purchase, we will handle it; essentially, we provide lifetime service for our products. This approach generates a new stream of revenue and profit while also differentiating us from the competition. Building this model is challenging and requires preparation in terms of resources and personnel,” Mr. Tai explained.

Looking ahead, MWG plans to conduct initial public offerings (IPOs) for its separate business chains, recognizing the need for distinct generations of leadership in its diverse business portfolio. Mr. Tai believes that IPOs can help foster a passionate second generation of leaders. Currently, the technology and electronics chains and the grocery chain are managed by two separate teams.

Unlocking Capital Challenges: LPBank Empowers Businesses to Thrive with Cost Optimization

“LPBank has been at the forefront of offering flexible financial solutions to empower businesses to access capital safely and cost-effectively. With a range of tailored services, LPBank is dedicated to helping enterprises surge ahead in their production and operations, overcoming financial barriers and achieving success.”

“Inspiring Businesses to Soar: The Made by Vietnam Forum Advantage.”

On August 8, 2025, at the Ho Chi Minh City Television Theater, the Plenary Session of the ‘Made by Vietnam’ event – honoring Vietnamese brands organized by Ho Chi Minh City Television – brought together leaders, experts, and enterprises to discuss solutions to help the business community thrive in this new era.

The New Vinhomes: Unlocking Growth with a Strategic 67% Stake Acquisition

Our company has successfully purchased 247 million treasury shares, an impressive 67% of the registered 370 million.