Speaking at the seminar, “From Ho Chi Minh City to the surrounding satellite cities – new opportunities for real estate,” Mr. Vo Huynh Tuan Kiet, Director of Residential CBRE Vietnam, presented striking figures on primary property prices in Ho Chi Minh City and its neighboring areas.

According to Mr. Kiet, in Ho Chi Minh City, the average primary apartment price increased by an impressive 29% per year, reflecting high demand and limited land supply. In Binh Duong (formerly known as Old Binh Duong), apartment prices rose by 14% per year, benefiting from industrial infrastructure and the housing needs of the labor force. Dong Nai (formerly known as Old Dong Nai) experienced a 15% yearly increase, driven by the Long Thanh airport project and new highways.

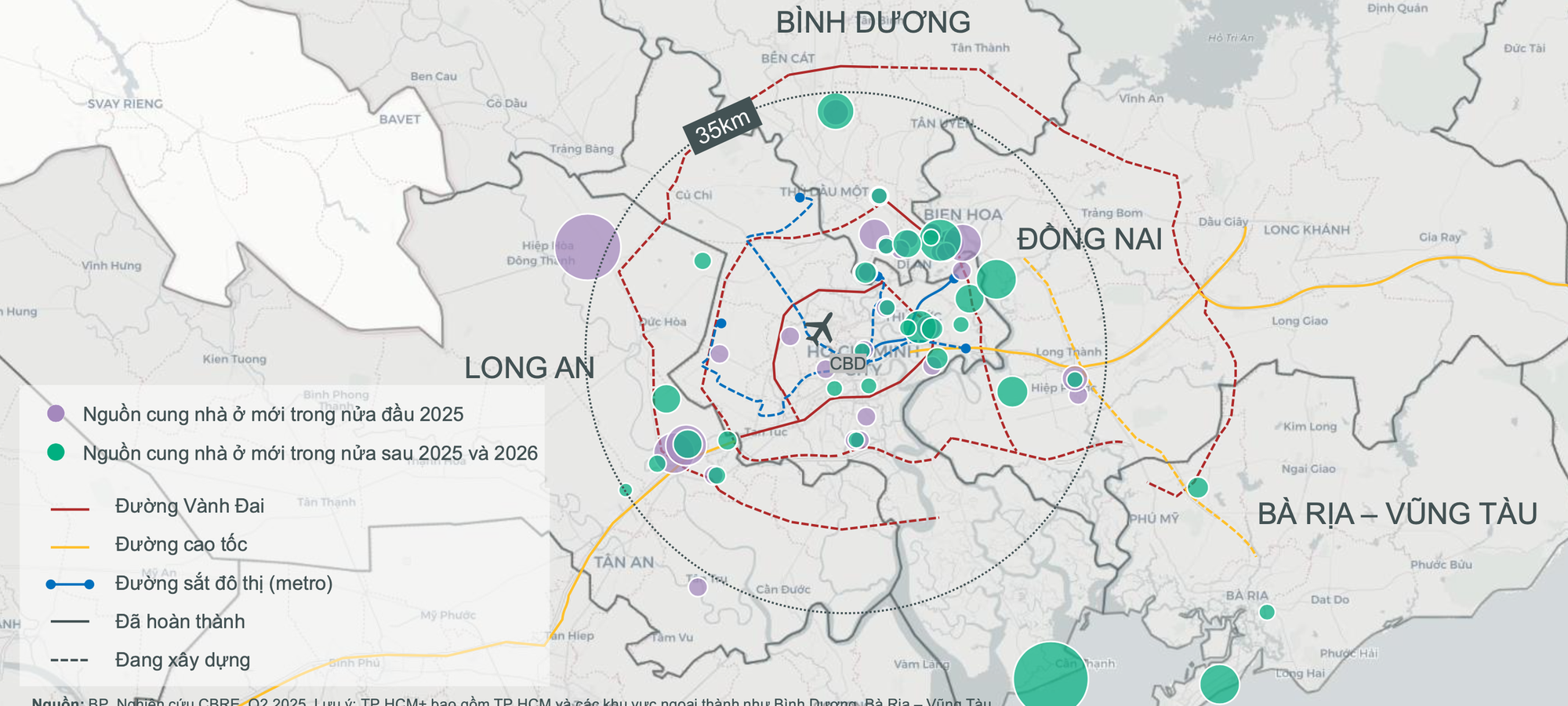

Notably, in Long An, now known as Tay Ninh, prices surged with a staggering 90% annual increase, becoming the new hotspot for price growth. “In the coming period, about 80% of new supply will come from satellite areas, instead of being concentrated in the inner city as before,” emphasized Mr. Kiet. “This reflects the growing appeal of the satellite market as regional connectivity infrastructure improves.”

Mr. Vo Huynh Tuan Kiet, Director of Residential CBRE Vietnam.

According to CBRE Vietnam experts, the trend of population decentralization from Ho Chi Minh City to satellite cities is gaining momentum, facilitated by improved transportation infrastructure.

In Ho Chi Minh City, the real estate market leans towards luxury and high-end apartment products, mainly in District 1, District 3 (formerly known as Old District 3), and the new Thu Thiem urban area. Additionally, Grade A offices, shopping malls, 5-star hotels, and serviced apartments are identified for robust development, with Thu Thiem as the focal point.

In the land-attached housing segment in Ho Chi Chi Minh City, there is a limited supply, and values are very high, concentrated in closed compound urban areas. The primary demand for this market comes from the upper class, high-level experts, and international customers.

Meanwhile, in Long An – the area bordering Ho Chi Minh City – stands out with the fastest-growing property prices and the most abundant supply. Large-scale real estate projects by prominent developers such as Vingroup, Nam Long, Eco Park, T&T, BIM Group, and Prodezi can be found here, with land areas ranging from hundreds to thousands of hectares. Notable projects include Vinhomes Green City (nearly 200 hectares), Vinhomes Phuoc Vinh Tay (over 1,000 hectares), Waterpoint Nam Long (355 hectares), La Home (100 hectares), and Eco Retreat – Eco Park (200 hectares). Within the Waterpoint urban area, Nam Long introduces its most premium subdivision, The Pearl, offering 200 products, and the Solaria Rise apartment project with 700 units of 1- to 3-bedroom apartments.

In Binh Duong, the region continues to assert its position as an industrial center, with three key product lines: mid-range apartments, industrial real estate, and social housing for workers.

Ba Ria – Vung Tau province stands out with its “2-in-1” advantage of tourism and industrial sea ports. The Ho Tram – Xuyen Moc axis has become the “capital of luxury resorts,” featuring condotels, beach villas, and shophouses. Additionally, logistics real estate and industrial sea ports, linked to the deep-water port cluster of Cai Mep – Thi Vai and Phu My, benefit from strategic infrastructure projects like the Long Thanh airport and the Bien Hoa – Vung Tau expressway.

According to CBRE experts, connectivity infrastructure contributes to the trend of population decentralization.

CBRE experts assert that planning, transportation infrastructure, and changes in land prices are key factors influencing the real estate market. Among these, connectivity infrastructure is decisive in the development of expanded urban areas and population decentralization. Data shows a significant shift from the core center to satellite cities like Binh Duong, Dong Nai, Ba Ria – Vung Tau, and Long An.

The fact that 80% of new supply comes from satellite areas has led to a gradual expansion in the choices of buyers (both for living and investment), resulting in an upward trend in project prices. Currently, the price volatility in the satellite areas is catching up with, and even doubling, that of Ho Chi Minh City, indicating the establishment of new price levels in the surrounding regions.

“From now until 2027, the supply in areas neighboring Ho Chi Minh City will continue to grow, accounting for a significant proportion of the overall market. A key difference from the past is the changing demand for product quality from buyers in satellite areas. They now seek higher-quality amenities, designs, and construction,” affirmed the CBRE expert. “This presents both a challenge for developers and a factor contributing to the increase in project prices.”

The Ultimate Guide to Choosing the Best Property Investment: Unlock Exclusive Benefits of Up to 12.5%

Happy One Central offers investors a unique opportunity to reap immediate benefits. With our commitment to leaseback, complimentary furniture packages, and waived management fees, investors can enjoy peace of mind and a steady income stream from day one of ownership, eliminating the typical wait for project completion.

The Ultimate Guide to Cart Abandonment: How The 826 EC Reduces Cart Abandonment to Under 10%

The red-book land market adjacent to Phu My Hung continues to attract attention with a high volume of transactions. With a limited supply and reasonable pricing, The 826 EC Commercial City has become a sought-after choice for investors and homebuyers alike.

The New Landed Property Prices in Ho Chi Minh City Reach 230 Million VND per square meter

The real estate market in Ho Chi Minh City is set for a significant transformation, presenting immense opportunities for growth and expansion. The city’s merger paves the way for a vibrant future, with enhanced connectivity that will spur the development of surrounding satellite towns. This strategic move is a game-changer, unlocking the potential for a thriving and interconnected urban landscape.