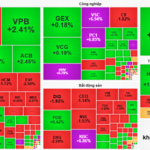

After a continuous upward trajectory and reaching new peaks, the stock market has just experienced a sharp decline with a majority of stocks in the red. Previously hot stocks such as VPB, BSR, SHB, TCB, TPB, MBB, and ACB have all witnessed significant downturns. Some stocks that had surged in the previous session suffered even more substantial losses and ended up at the lower limit.

Even stocks that hadn’t gained much recently, such as HPG, FPT, and VNM, were affected. Out of the VN30 stocks, only four managed to eke out gains, namely BID, DGC, VCB, and VIB, but their increases were modest and significantly trimmed from their session highs.

At the close of the session on August 22nd, the VN-Index dropped by 42.53 points (-2.52%) to 1,645.47. The VN30 fell by 60.89 points (-3.25%) to 1,814.02. Turnover remained elevated, with the matching value on HoSE exceeding VND 60 trillion.

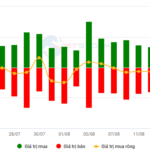

Foreign investors continued their net selling spree, offloading over VND 1,500 billion across all three exchanges. This marks the 12th consecutive session of foreign net selling in the Vietnamese stock market, totaling more than VND 17,000 billion.

Following an extended rally, profit-taking pressure was inevitable. According to MBS’s assessment, the market’s valuation is no longer as attractive. The current trailing P/E ratio of the VN-Index stands at 15.3, the highest in the last three years and equivalent to the five-year average.

While the current valuation is lower than that of 2021 when the VN-Index was at the 1,500 level and the trailing P/E ratio was 20-21 times, Vietnam’s market valuation is higher than some regional peers such as Singapore (14.6 times), Malaysia (14.4 times), and Indonesia (12 times).

From a technical perspective, MBS analysts suggest that the risk of a short-term correction is increasing. This could be a period where the VN-Index doesn’t exhibit significant gains or losses, but individual stock performances result in substantial portfolio losses. This scenario may play out in the coming week.

The market’s support zone is expected to be in the range of 1,566 – 1,588 points. MBS analysts predict that the VN-Index could retreat to this zone by the end of August.

However, MBS remains optimistic about the intrinsic potential of the market. They anticipate that the listed companies’ profit growth could reach 17%/16% svck in the 2025-26 period in a base-case scenario, which includes the factor of slower exports due to “transshipment” regulations.

In a positive scenario, if exports perform better than expected due to less stringent “transshipment” regulations, profit growth for the market in 2025-26 could be even higher at 18%/17%. Additionally, Vietnam is inching closer to the opportunity of being included in the FTSE’s emerging market group in 2025.

Market Beat: VN-Index Stays in the Green Despite Foreign Selling Pressure

The VN-Index ended the first trading session of the week on a positive note, climbing 6.37 points (+0.39%) to close at 1,636.37. Similarly, the HNX-Index witnessed a boost of 1.53 points (+0.54%), settling at 283.87. The market breadth tilted in favor of advancers, with 450 stocks rising (including 46 that hit the ceiling price) versus 368 decliners (4 of which touched the floor price).

Vietstock Daily Recap: Potential for Persistent Volatility

The VN-Index rose after a tug-of-war session, but the trading volume fell below the 20-session average, indicating investors’ cautious sentiment. With the Stochastic Oscillator continuing its downward trajectory and signaling a sell-off in the overbought territory, alongside persistent net foreign selling, the market remains vulnerable to short-term volatility.

“It’s Time to Aim for MSCI’s Market Upgrade Standard”

The Vietnamese stock market has reached a pivotal moment in its journey towards recognition as a leading emerging market. With the recent advancements and meeting the criteria set by FTSE Russell for an upgrade from frontier to emerging market status in their September 2025 review, the focus now shifts to attaining the prestigious recognition from MSCI.