In a surprising turn of events, the stock market took a sharp downturn during the opening session, contrary to investors’ expectations of a continued rally. The VN-Index plummeted by over 40 points in the morning session alone, falling from the 1,690-point region to 1,646 points. The index extended its losses to 50 points at the start of the session before narrowing the decline thanks to bottom-fishing efforts.

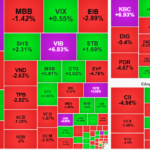

Despite this, a slew of stocks across various sectors, including banking, securities, real estate, oil and gas, fertilizer, chemicals, and port services, witnessed declines ranging from 3% to 5%, with many stocks hovering near the floor price.

A sea of red swept across the stock market during the morning session

Banking stocks exhibited a notable divergence, with VCB, BID, OCB, MSB, and NAB trading in positive territory and helping to buoy the overall market. On the flip side, VPB, TCB, MBB, and ACB faced intense selling pressure, with VPB plunging by 6.34%, TCB falling by 4.2%, and MBB declining by 3.55%…

Notably, during this market downturn, the stocks of several Vietnamese billionaires also witnessed adjustments after a prolonged upward trajectory.

Stocks affiliated with billionaire Pham Nhat Vuong’s Vingroup, including VIC, VHM, and VRE, declined by 1% to 5%. Stocks belonging to billionaire Nguyen Thi Phuong Thao, such as HDB and VJC, also retreated by 3.6% to 4.9%. Additionally, billionaire Tran Dinh Long’s HPG stock fell by 3.8%…

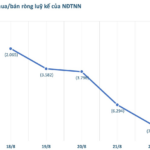

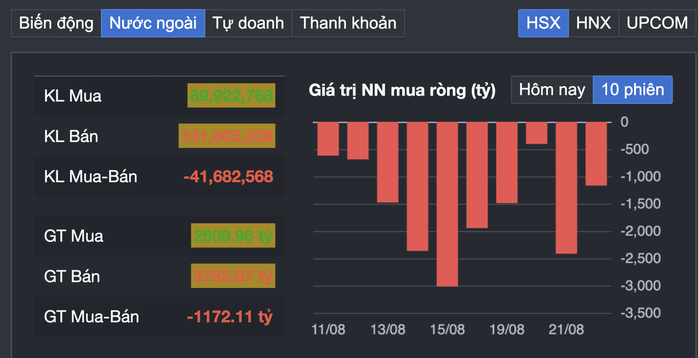

The trading value on the HOSE alone neared VND32 trillion in the morning session. Foreign investors net sold for the tenth consecutive session, with a net sell value of over VND1,200 billion in the morning session alone.

Heavy Losses Incurred on Recently Purchased Stocks

According to NLD reporters, numerous investors across various forums and investment groups shared that they had purchased stocks in the real estate and securities sectors one to two days prior. However, by the morning session, these stocks had yet to be credited to their accounts, and they were already facing losses of 10% to 15%. For those utilizing margin trading, the losses were even more substantial.

Foreign investors net sold for ten consecutive sessions

“In recent sessions, real estate stocks have shown signs of stagnation and decline, so I kept buying at average prices. This morning, however, stocks like CEO, DIG, DXG, NTL, HDC, and HBC all dropped by 6% to 8%, and my account is now facing significant losses,” shared Hoang Tien, an investor from Ho Chi Minh City.

Mr. Phan Dung Khanh, Investment Advisory Director at Maybank Securities, opined that the short-term correction in the stock market is necessary following the overheated rally in recent months. Looking at the medium and long-term prospects, the market remains in an uptrend, and investors need to manage their portfolio risks in the short term.

Vietnam Construction Securities JSC (CSI) also advised investors to be cautious about initiating new positions and refrain from chasing prices at this juncture. They recommended maintaining a higher cash balance and patiently awaiting opportunities to deploy capital when the VN-Index establishes a more balanced accumulation range.

“The Billion-Dollar Pyn Elite Fund: Why 2025 Could be a Landmark Year for Stock Markets”

According to the Pyn Elite Fund, this could be a “Big Year” for stock market performance, based on the current fundamentals. The fund manager also highlights seven compelling reasons why a “Big Year” is feasible at this juncture.