HAGL Removed from Warning List After Billion-Dong Deal

A mix of positive and not-so-positive news has reached Hoang Anh Gia Lai Joint Stock Company, chaired by Mr. Doan Nguyen Duc (“Chairman Duc”).

Major Transaction Completed, HAG Shares Exit Warning Zone

On August 22, the Ho Chi Minh City Stock Exchange decided to remove HAG shares of Hoang Anh Gia Lai from the warning list starting August 26, 2025.

The decision was made as the listed company addressed the reason for the warning, which was accumulated losses.

On the same day, Chairman Duc announced the successful sale of 25 million HAG shares through a matched trade. Following this transaction, Chairman Duc’s ownership decreased to 28.84%, or 304,950,533 shares, from 31.2% previously.

Meanwhile, his son, Mr. Doan Hoang Nam, also reported the purchase of 27 million HAG shares through a matched trade. This transaction marked Mr. Nam’s first significant stake in the company founded by his father, rising from 0% to 2.55%.

With the HAG share price on that day at VND 16,100/share, the total value of this transaction exceeded VND 400 billion, indicating a substantial wealth transfer within the family.

Chairman Duc’s company profits from fruit business

Significant Doubt about the Ability to Continue as a Going Concern

Previously, on August 20, Hoang Anh Gia Lai explained its reviewed consolidated financial statements for the first half of 2025.

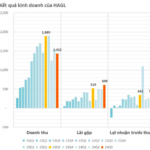

According to the report, the company’s net profit for the first six months of 2025 was nearly VND 880 billion, an increase of VND 379.5 billion compared to the same period last year, mainly due to gross profit from the fruit business.

Notably, the auditors continued to express a “material uncertainty related to going concern,” as the company’s current liabilities exceeded current assets by VND 2,767 billion in the reviewed 2025 financial statements.

However, Hoang Anh Gia Lai stated that they had prepared a 12-month business plan based on the going concern assumption. This included continued strong cash flow from banana and durian exports and other measures.

In reality, auditors have been expressing such an opinion on Hoang Anh Gia Lai’s financial statements for several years, so the public is not overly surprised.

A Tale of Contrasting Fortunes: The Intriguing Story of “Bầu” Đức and His Son

“Amidst a flurry of trading activity, Doan Nguyen Duc, Chairman of Hoang Anh Gia Lai Joint Stock Company, registered to sell 25 million HAG shares. In a fascinating turn of events, his son, Doan Hoang Nam, stepped in and registered to purchase 27 million shares through either matched orders or negotiated deals. This intriguing development has sparked interest among investors and market observers alike.”