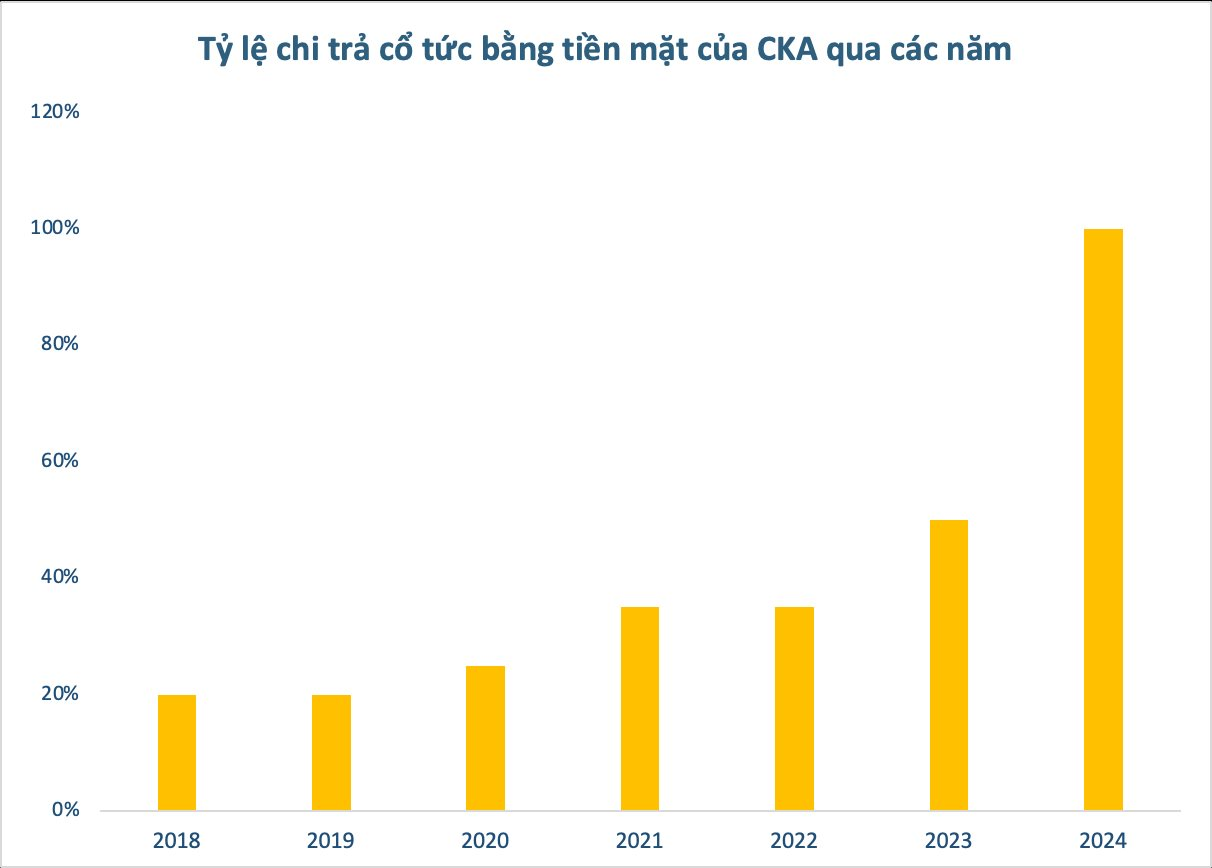

On September 17, An Giang Mechanical Joint Stock Company (code: CKA) will finalize its shareholder list to facilitate a cash dividend payout for the year 2024. The payout ratio stands at an impressive 100% per share, entitling each shareholder to VND 10,000 for every share held.

With approximately 3.3 million shares in circulation, the company is expected to disburse a total of VND 33 billion. The payment date is anticipated to be October 3, 2025.

Should this payout be completed, it would mark the highest dividend that CKA shareholders have ever received since the company’s listing on UPCoM in 2018. Maintaining a proud tradition, CKA has consistently distributed annual dividends with generous ratios ranging from 20% to 35%. In 2023, for instance, the dividend ratio stood at 50% in cash.

Delving into the shareholder structure, the Vietnam Engine and Agricultural Machinery Corporation (VEAM, code: VEA) stands as CKA’s largest shareholder, holding 47.41% of its capital. VEAM is poised to receive approximately VND 16 billion in dividends.

An Giang Mechanical Joint Stock Company, formerly known as An Giang Mechanical Enterprise, is a professional manufacturer and supplier of machinery and mechanical equipment for agro-industrial production. Their expertise spans across various stages, including cultivation, harvesting, processing, packaging, storage, and transportation. Additionally, they venture into construction, road building, automobile trading, and repair.

In terms of financial performance, CKA witnessed a 20% year-over-year decline in revenue in 2024, amounting to VND 183 billion. After accounting for expenses, the company posted a net profit of VND 24 billion, reflecting a 41% decrease from the record high achieved in 2023.

Looking ahead to 2025, CKA has set a consolidated revenue target of VND 197 billion, signifying an 8% increase from the previous year. However, their profit target remains relatively conservative, with an expected net profit of below VND 22 billion, a 9% decrease. The expected dividend ratio is maintained at a minimum of 50%.

In the stock market, CKA has been on an upward trajectory lately, with its share price surging to VND 72,400 per share, marking a 65% increase since the beginning of 2025 and reaching an all-time high. However, average trading liquidity remains modest at over 12,100 shares per session.

“Transforming Rural Retail: WinCommerce’s Double-Digit Growth Strategy”

The Vietnamese retail industry is undergoing a rapid evolution, with a significant shift from traditional (GT) to modern trade (MT) channels. This transformation is driven by consumers who prioritize convenient shopping experiences, quality products, and enhanced services. As consumers increasingly demand a seamless blend of physical and digital retail, the industry is responding with innovative solutions to meet their needs. This dynamic shift towards modern trade presents a pivotal opportunity for retailers to adapt and thrive in a rapidly changing market.

The Major Shareholder of LIG Continues to Increase Ownership

“In a move that further consolidates his position as a major shareholder of Licogi 13 Joint Stock Company (HNX: LIG), Mr. Dinh Quang Chien has acquired an additional 1.7 million shares. This recent purchase brings his total ownership stake in the company to an impressive 8.49%.”

“Novaland’s Subsidiary Defers Over VND 2,100 Billion in Bond Principal and Interest Payments”

This is not the first time that No Va Thao Dien has delayed payments on its NTDCH2227001 bond tranche; the company has struggled to secure funds on previous occasions in 2024 and earlier in June this year.