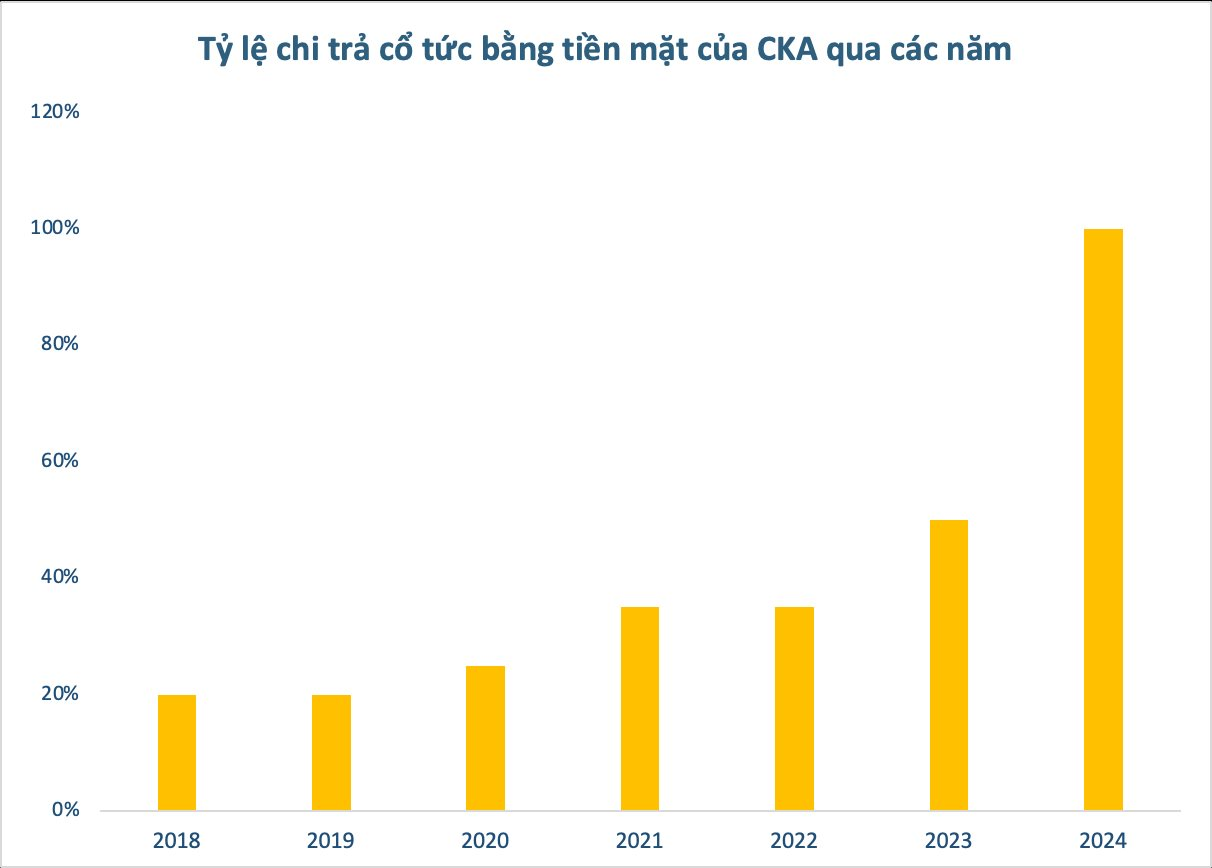

On September 17, Công ty Cổ phần Cơ Khí An Giang (CKA) will finalize its shareholder registry to distribute a cash dividend for the year 2024. The distribution ratio is set at 100% per share, entitling each shareholder to receive VND 10,000 for every share owned.

With approximately 3.3 million shares in circulation, the company expects to disburse a total of VND 33 billion. The payment date is anticipated to be October 3, 2025.

If accomplished, this will be the highest dividend that CKA shareholders have ever received since the company’s listing on the UPCoM exchange in 2018. Maintaining a tradition of annual dividend distributions, CKA has consistently offered attractive dividend ratios ranging from 20% to 35%. In 2023, the company distributed a 50% cash dividend.

Source: Cafef.vn

Regarding shareholder structure, Tổng Công ty Máy động lực và Máy nông nghiệp Việt Nam – CTCP (VEAM, VEA) is CKA’s largest shareholder, holding 47.41% of its capital. VEAM is expected to receive approximately VND 16 billion in dividends.

Formerly known as Xí Nghiệp Cơ Khí An Giang, Công ty Cổ phần Cơ Khí An Giang is a professional manufacturer and supplier of machinery and mechanical tools for agricultural and industrial production. Their expertise spans across various stages, including cultivation, harvesting, processing, packaging, storage, and transportation. Additionally, they venture into construction, road building, automobile trading, and repair.

In terms of financial performance, CKA recorded a 20% decline in revenue in 2024, amounting to VND 183 billion. After deducting expenses, the company reported a net profit of VND 24 billion, reflecting a 41% decrease from the record-high profit achieved in 2023.

For 2025, CKA has set a consolidated revenue target of VND 197 billion, representing an 8% increase from the previous year. However, the profit target is relatively conservative, with an expected net profit of below VND 22 billion, indicating a 9% decline. The company anticipates maintaining a minimum dividend ratio of 50%.

In the stock market, CKA has been witnessing positive momentum recently. Its share price surged to VND 72,400 per share, marking a 65% increase since the beginning of 2025 and reaching an all-time high. However, the average trading volume remains modest at over 12,100 shares per session.

Source: TradingView

The Fat Race Chairman: Another 14.7 Million Shares Sold Off

In just three sessions from August 19 to 21, DFF Chairman Le Duy Hung witnessed the forced sale of over 14.7 million shares by his brokerage, leading to a significant drop in his ownership stake from 42.16% to 23.73%. This development comes as the company extends its losing streak to an eighth consecutive quarter.

The Major Shareholder of LIG Continues to Increase Ownership

“In a move that further consolidates his position as a major shareholder of Licogi 13 Joint Stock Company (HNX: LIG), Mr. Dinh Quang Chien has acquired an additional 1.7 million shares. This recent purchase brings his total ownership stake in the company to an impressive 8.49%.”