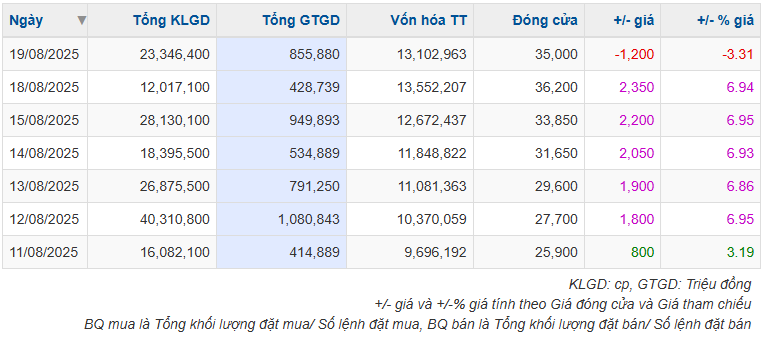

In particular, VSC stock price hit the ceiling for five consecutive sessions from August 12 to 18, surging from VND 25,900/share (August 11 session) to VND 36,200/share (August 18 session), an increase of nearly 40%.

|

VSC hit the ceiling for five consecutive sessions (August 12-18)

Source: VietstockFinance

|

After receiving a clarification request from HOSE, VSC explained that the upward movement was due to objective supply and demand dynamics in the Vietnamese stock market, coupled with the company’s positive business results for the first half of the year.

“At present, production and business activities are proceeding as usual, in accordance with the established plan, and there are no abnormal issues in the operations of VSC. We commit to having disclosed information fully in accordance with the law and that there is no subjective influence aimed at affecting the trading price of VSC shares in the stock market” – excerpt from VSC‘s clarification report.

Following the consecutive ceiling-hitting sessions, VSC stock price declined by 3.3% on August 19, closing at VND 35,000/share. Compared to the beginning of the year, VSC has posted an impressive 183% gain, accompanied by an average daily trading volume of over 8.9 million shares.

| VSC stock price has surged significantly since the beginning of 2025 |

In related news, VietinBank Capital Joint Stock Company recently announced that it is no longer a major shareholder of VSC after selling more than 15 million shares on August 14, reducing its ownership from over 25.5 million shares (6.82%) to 10.5 million shares (2.8%).

In its recent disclosures of VSC share sales, Vietinbank Capital sold 17.5 million shares on July 25, 10.1 million shares on July 29, and another 15 million shares on August 12. Thus, the fund management company has executed four sell-offs totaling over 57.6 million shares within just one month.

This significant reduction in ownership occurred just before VSC‘s ex-dividend date for the upcoming extraordinary general meeting on August 22, with the record date being August 21. The meeting aims to approve adjustments to the company’s 2025 profit-before-tax plan and other matters within the competence of the general meeting.

Previously, at the 2025 Annual General Meeting, a revenue plan of VND 2,790 billion and a profit-before-tax target of VND 400 billion were approved. With nearly VND 312 billion in profit before tax in the first half of the year (up 54% over the same period last year), the company has achieved 78% of this plan.

In another recent development, on August 15, the VSC Board of Directors passed a resolution to contribute capital to establish Hai An Green Shipping Lines Company Limited. This company is a limited liability company with two or more members, and VSC holds a 60% stake.

On the same day, Hai An Shipping and Stevedoring Joint Stock Company (HOSE: HAH) also announced its contribution of 40% capital to Hai An Green Shipping Lines. The new company has a charter capital of VND 1,000 billion, headquartered in Hai An Building, Hai Phong City. It aims to invest in building large-scale transport vessels to expand the fleet and enhance the competitiveness of both HAH and VSC in the international maritime transport market.

– 6:28 PM, August 19, 2025

“VSC Aims to Triple Profit Plans, Targeting Over VND 1,000 Billion”

The Board of Directors of Vietnam Container JSC (HOSE: VSC) has approved a proposal to be presented at an Extraordinary General Meeting of Shareholders, regarding an increase in the company’s pre-tax profit plan for the year 2025.

Stock Market Review: Foreign Investors Ramp Up Pressure

The VN-Index’s upward trajectory stalled as it dipped in the week’s final session. This pause is a necessary adjustment, allowing the market to consolidate gains and build a stronger foundation for future growth. However, the mounting selling pressure from foreign investors is a notable concern. If this trend persists, the index may face heightened challenges in the coming periods.

VietinBank Capital Divests an Additional 10.1 Million VSC Shares, Hitting a New High After Touching Bottom

VietinBank Capital continues to offload over 10 million VSC shares in a record-breaking trading session, with the transaction value estimated at a staggering 232 billion VND. Despite experiencing a market-driven dip, VSC shares swiftly rebounded, surging to new heights with two consecutive ceiling-hitting sessions.