VPS Securities JSC has just announced the resolution of its Board of Directors to convene an extraordinary general meeting of shareholders for the second time in 2025. Accordingly, the record date for determining the list of shareholders eligible to attend the meeting is September 8th. The meeting is expected to be held in October and will be conducted in person. Specific documents have not yet been disclosed.

In terms of financial performance, according to the second-quarter financial statements for 2025, VPS reported operating revenue of VND 1,723 billion, a 1% increase compared to the same period last year. After deducting expenses, VPS recorded pre-tax and after-tax profits of VND 878 billion and over VND 702 billion in the second quarter, both up 35% over the same period.

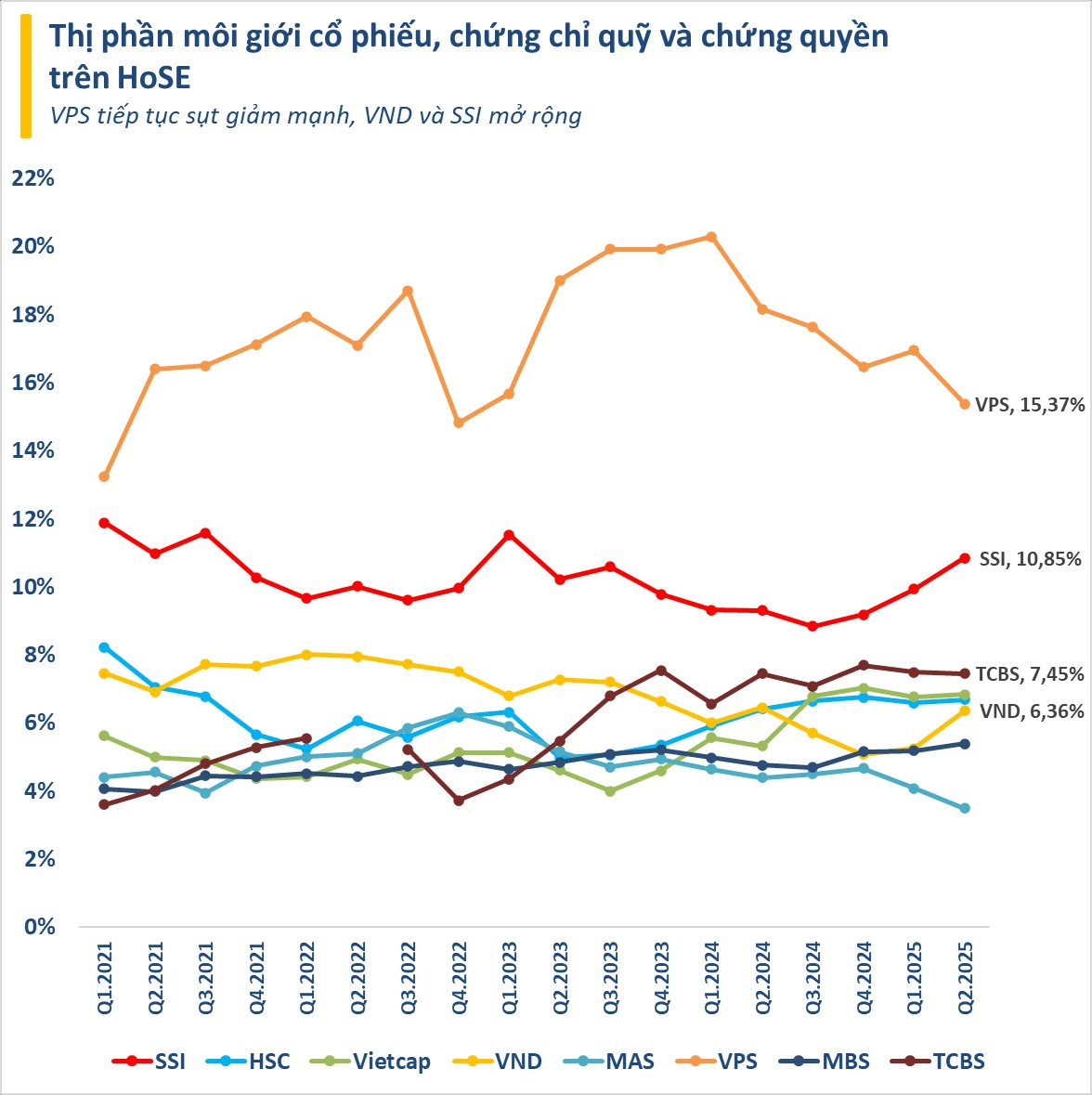

Brokerage activities continued to be the largest contributor to revenue, bringing in VND 748 billion, a 16% decrease compared to the previous year. VPS is currently the number one securities company in terms of brokerage market share on the HoSE, HNX, UPCoM, and Derivatives markets. This achievement has been maintained for 18 consecutive quarters since the beginning of 2021.

However, VPS’s market share has shown signs of narrowing recently. In the second quarter of 2025, VPS accounted for 15.37% of the brokerage market share on HoSE, a decrease of 1.57% compared to the first quarter and a 2.79% decline from the previous year.

On the other hand, other key business segments continued to grow. Lending activities increased by 16%, bringing in VND 530 billion; activities increased by 9%, contributing VND 259 billion; and interest from HTM assets increased by 115%, reaching VND 145 billion.

For the first six months of the year, VPS reported operating revenue of VND 3,192 billion, a 3% decrease compared to the same period in 2024. Thanks to cost-cutting measures, pre-tax and after-tax profits reached VND 1,797 billion and nearly VND 1,438 billion, respectively, both up 40% compared to the first half of 2024. With these results, VPS has achieved 51% of its full-year profit plan.

As of June 30, 2025, VPS’s total assets stood at VND 32,138 billion, an increase of 5.8% from the beginning of the year. Cash and cash equivalents surged from VND 1,732 billion to VND 5,154 billion. Term deposits with a maturity of over three months amounted to VND 6,000 billion, an increase of VND 1,200 billion compared to the previous quarter. Lending balances increased by more than VND 4,900 billion in the first six months to VND 17,436 billion.

Notably, the fair value of VPS’s financial assets classified as FVTPL decreased significantly from VND 8,092 billion to VND 2,499 billion. This decline was due to a reduction in investments in market instruments from VND 6,953 billion to VND 600 billion. Meanwhile, listed bonds maintained a balance of over VND 1,500 billion, and an investment of more than VND 300 billion was made in unlisted bonds.

“HGM Shareholders to Receive Cash Dividend of VND 4,500 Per Share”

In just 6 months, Hanoi Mechanical and Mineral Joint Stock Company (HNX: HGM) has surpassed its annual profit plan, prompting the company to declare an interim cash dividend for 2025 at a remarkable 45% rate, equivalent to VND 4,500 per share. This payout ratio almost reaches the 50% minimum target set by the company for the entire year.

“Transforming Rural Retail: WinCommerce’s Double-Digit Growth Strategy”

The Vietnamese retail industry is undergoing a rapid evolution, with a significant shift from traditional (GT) to modern trade (MT) channels. This transformation is driven by consumers who prioritize convenient shopping experiences, quality products, and enhanced services. As consumers increasingly demand a seamless blend of physical and digital retail, the industry is responding with innovative solutions to meet their needs. This dynamic shift towards modern trade presents a pivotal opportunity for retailers to adapt and thrive in a rapidly changing market.

The Great Unveiling: Unraveling the Third Payment Installment for Bondholders in the Truong My Lan – Van Thinh Phat Case

The THADS Ho Chi Minh City team has successfully recovered 376 billion VND in assets related to the case of Mrs. Truong My Lan. With this significant recovery, the team has proceeded with the third payment round, distributing funds to 42,141 creditors. This distribution represents a 1.25% payout rate on the remaining enforced debt, bringing much-needed financial relief to those impacted by this case.