Vietnam’s leading securities companies are set to convene shareholder meetings at a pivotal moment for the country’s stock market. VPS Securities JSC recently announced its plan to hold an extraordinary general meeting (EGM) for the second time in 2025, with a record date of September 8. The meeting is expected to take place in October, and specific details are yet to be disclosed.

About a week earlier, VNDIRECT Securities Corporation (VND) approved a plan to organize an extraordinary general meeting of shareholders in 2025. VNDirect will finalize its shareholder list on September 3, 2025, and further details regarding the timing, venue, and agenda will be communicated later.

Similarly, SSI Securities Corporation (SSI) announced that the record date for shareholders to exercise their rights to attend the extraordinary general meeting (EGM) in 2025 will be August 20, 2025, corresponding to the ex-rights date of August 19, 2025.

The EGM is scheduled for September 25, 2025, and SSI will provide detailed information about the content and venue of the meeting in the invitation letter to shareholders.

This series of shareholder meetings comes as the stock market is experiencing its most vibrant phase in history. On August 21, the VN-Index marked its fourth consecutive gaining session, closing at an all-time high of 1,688 points.

Investor enthusiasm has fueled a surge in liquidity since the beginning of August, with trading values regularly reaching VND 40-50 trillion per session and even peaking at VND 85 trillion.

Shares of securities companies have naturally joined the rally. Since the beginning of July, notable gainers include VIX (+170%), MBS (+57%), CTS (+58%), SSI (+50%), and HCM (+33%), with some stocks even reaching all-time highs.

In related news, several leading securities companies in the market are preparing for initial public offerings (IPOs). Notably, Techcom Securities JSC (TCBS) plans to offer a maximum of 231.15 million shares, or 11.1% of its current charter capital, to the public at a starting price of VND 46,800 per share. Following the IPO, TCBS’s market capitalization is expected to reach approximately USD 4.1 billion.

According to inside sources, VPBank Securities also intends to conduct an IPO in Q4 2025.

In reality, securities stocks are still considered to have significant growth potential, given the compelling narratives surrounding the industry’s future. One such narrative is the anticipated upgrade of Vietnam’s market status by FTSE Russell.

According to prominent domestic and foreign institutions, there is a strong likelihood that Vietnam will be promoted to a secondary emerging market by FTSE Russell during their year-end review. This upgrade is expected to attract billions of dollars in foreign capital, boosting the market’s growth in terms of scale and liquidity.

In this context, securities companies are positioned to be among the direct beneficiaries. Additionally, the emerging digital asset sector in Vietnam is expected to provide another attractive avenue for securities companies to explore, alongside the traditional stock market.

“It’s Time to Aim for MSCI’s Market Upgrade Standard”

The Vietnamese stock market has reached a pivotal moment in its journey towards recognition as a leading emerging market. With the recent advancements and meeting the criteria set by FTSE Russell for an upgrade from frontier to emerging market status in their September 2025 review, the focus now shifts to attaining the prestigious recognition from MSCI.

Seafood in Q2: Capitalizing on the Tax “Loophole” from the US

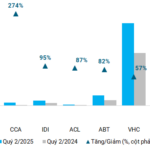

The second quarter of 2025 witnessed a remarkable surge in seafood exports, particularly tra fish, as the US postponed its retaliatory tariffs for an additional three months until after July 9. This strategic move provided a window of opportunity for businesses to ramp up their shipments to key markets, resulting in exceptional revenue and profit growth for the industry.

The Stock Market’s Stealthy Strategists: In-House Traders Unveil their Tactics with a $9 Million Shopping Spree on August 18th.

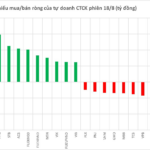

The proprietary securities firms continued their net buying streak on the HoSE, with a total value of 208 billion VND. The focus was on the leading technology stock, which saw a significant boost in trading volume and value. This strategic move by the proprietary firms showcases their confidence in the tech sector’s potential and strengthens their position in the market.

The Stock Market Soars to New Heights

“An array of stocks with impressive returns, often exceeding multiples of the initial investment, has captivated the attention of many individuals, enticing them to channel their funds into this lucrative avenue.”