I. MARKET DEVELOPMENT OF WARRANTS

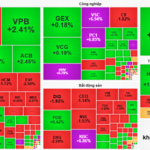

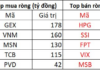

As of the trading session on August 22, 2025, the market closed with 28 advancing codes, 215 declining codes, and 16 reference codes.

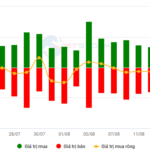

Market breadth over the last 20 sessions. Unit: Percentage

Source: VietstockFinance

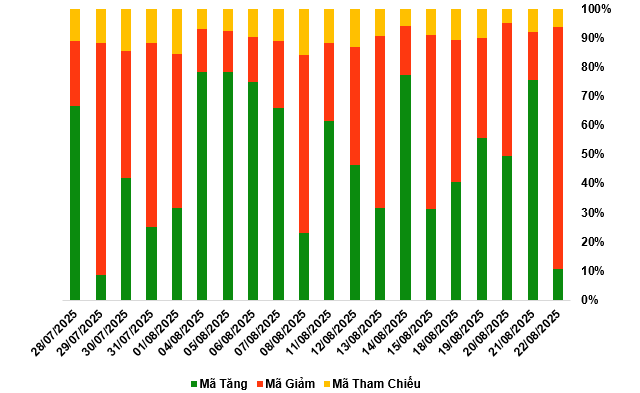

In the trading session on August 22, 2025, sellers dominated the market, causing most of the warrant codes to decline in price. Specifically, the large cap warrant codes in the declining group were CVPB2513, CVHM2511, CMBB2511, and CTCB2507.

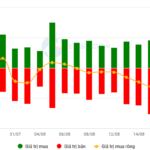

Source: VietstockFinance

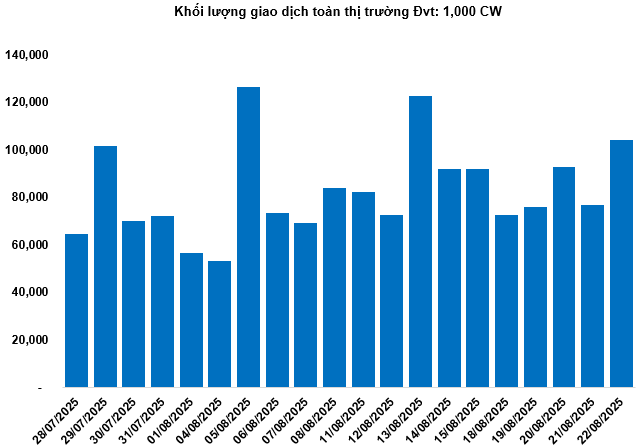

The total market trading volume in the August 22 session reached 104.21 million CWs, up 36.16%; the trading value reached VND 305.28 billion, up 55.7% compared to the August 21 session. Of which, CVIB2504 was the code that led the market in terms of volume and value, with a total volume of 5.17 million CWs, equivalent to a value of VND 21.85 billion.

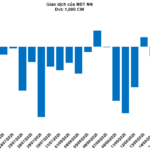

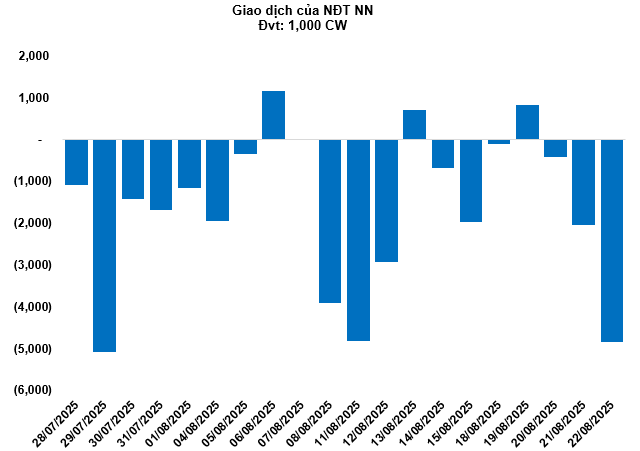

Foreign investors continued to sell a net in the August 22 session with a total net selling volume of 4.84 million CWs. In particular, CHPG2512 and CMSN2506 were the two codes that were net sold the most. For the whole week, foreign investors net sold more than 6.57 million CWs.

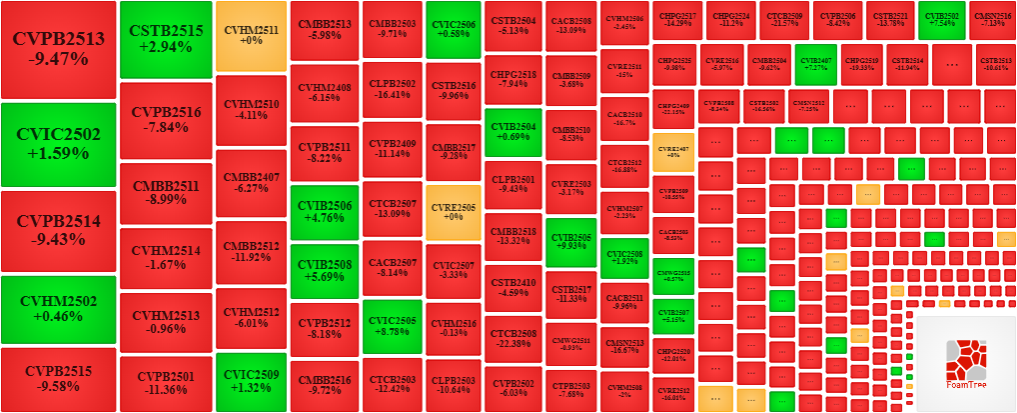

Securities companies SSI, ACBS, KIS, HCM, and VPBank are currently the organizations with the most warrant codes in the market.

Source: VietstockFinance

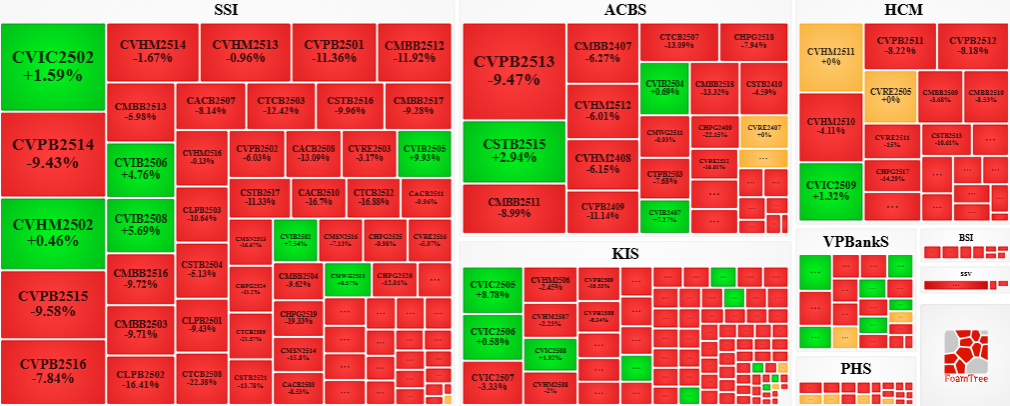

II. MARKET STATISTICS

Source: VietstockFinance

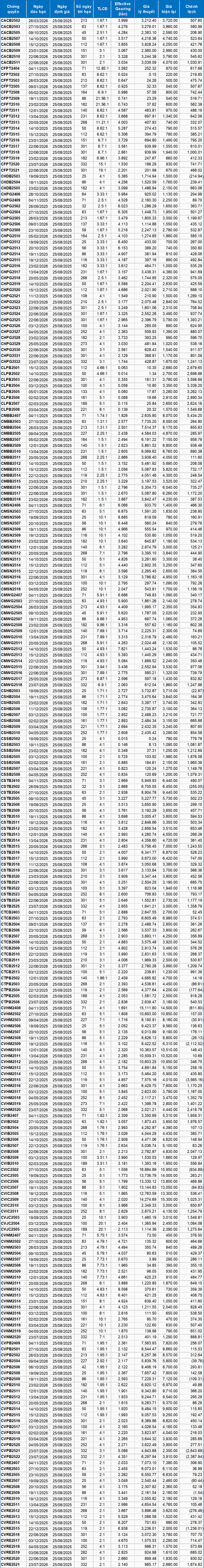

III. WARRANT PRICING

Based on the appropriate pricing method for the initial period of August 25, 2025, the reasonable prices of the warrants currently traded in the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the pricing model is adjusted to suit the Vietnamese market. Specifically, the risk-free bill rate (government bill rate) will be replaced by the average deposit interest rate of large banks with term adjustments suitable for each type of warrant.

According to the above pricing, CVHM2515 and CVPB2521 are currently the two warrant codes with the most attractive pricing.

The higher the effective gearing ratio of a warrant code, the greater the increase/decrease in its price relative to the underlying stock. Currently, CVNM2512 and CMSN2506 are the two warrant codes with the highest effective gearing ratios in the market.

Economic Analysis and Market Strategy Department, Vietstock Consulting Department

– 18:58 24/08/2025

The Bank Stock Blues

The domestic stock market ended the week with a significant drop in the VN-Index, the largest decline seen this month, shedding over 42 points. This development comes on the back of a heated rally in previous sessions, particularly in the banking sector.

Market Beat: VN-Index Stays in the Green Despite Foreign Selling Pressure

The VN-Index ended the first trading session of the week on a positive note, climbing 6.37 points (+0.39%) to close at 1,636.37. Similarly, the HNX-Index witnessed a boost of 1.53 points (+0.54%), settling at 283.87. The market breadth tilted in favor of advancers, with 450 stocks rising (including 46 that hit the ceiling price) versus 368 decliners (4 of which touched the floor price).

Vietstock Daily Recap: Potential for Persistent Volatility

The VN-Index rose after a tug-of-war session, but the trading volume fell below the 20-session average, indicating investors’ cautious sentiment. With the Stochastic Oscillator continuing its downward trajectory and signaling a sell-off in the overbought territory, alongside persistent net foreign selling, the market remains vulnerable to short-term volatility.

The Derivatives Market on August 19, 2025: A Tug of War

The trading session on August 18, 2025, concluded with a mixed performance across the market. Out of all the stocks traded, there were 105 gainers, 126 losers, and 28 stocks that remained unchanged. Foreign investors continued their net-selling trend, offloading a total of 98,500 CW worth of shares.

“VN-Index: A Clear Path to Conquer the 1,700-Point Threshold?”

The VN-Index climbed for the fourth consecutive session, closely hugging the upper band of the Bollinger Bands. While trading volume has been volatile in recent sessions, indicating investor sentiment is not yet firmly established, the rally has been largely driven by large-cap stocks. Nonetheless, the MACD indicator continues to trend upward without showing any signs of weakness, suggesting the VN-Index could soon breach the 1,700-point threshold in upcoming sessions.