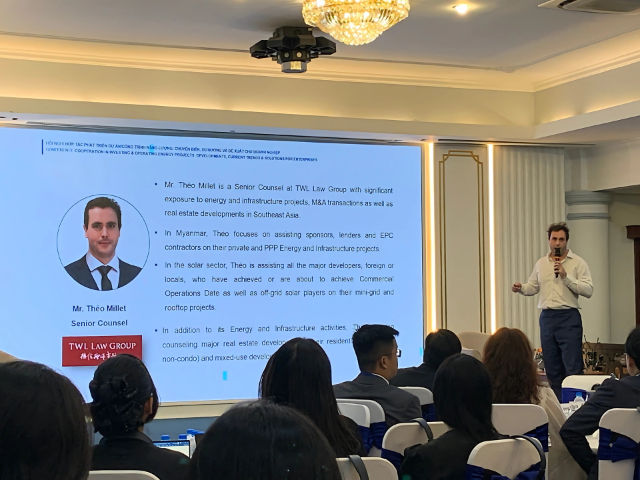

Theo Mr. Theo Millet, Senior Advisor at TWL Law Group, Decree 57/2025/ND-CP on direct power purchase agreements (DPPAs) requires power generators to not only produce but also invest, build, and operate transmission systems in the physical DPPA model.

This poses an infrastructure challenge for solar and wind power companies, especially small and medium-sized enterprises (SMEs), in addition to their core production activities. “Do they have the expertise, manpower, and desire to take on transmission themselves?” Mr. Millet questions.

Mr. Theo Millet believes that the current regulations on direct power purchase agreements are unreasonable – Photo: Tu Kinh

|

In reality, many entities lack experience in managing complex power grids, while specialized companies have not played a significant role in the current model. The most feasible form of collaboration at present is an operation and maintenance (O&M) contract, but the ownership and legal responsibilities remain with the power generator.

This makes investors cautious. In the long run, Mr. Millet suggests that it is necessary to separate generation and transmission licenses to allocate risks reasonably and create space for specialized infrastructure enterprises.

Another issue that makes foreign capital cautious is the legal framework. Mr. Millet believes that no one wants to be the “pioneer” bearing the risks for those who come later. However, he also noted that it is challenging to keep policies static throughout the 20-year power contract. Hence, investors need to incorporate legal risk factors into their financial models, provided that the changes are not retroactive.

“The government is experimenting to find the most suitable mechanism. If we refuse to participate just because of the fear of change, it does not reflect the true spirit of investment”, he emphasized.

In the past decade, Vietnam’s energy policies have undergone several changes: from the time of BOT and PPP in hydropower to the “fever” of solar power in 2017 due to the FIT price. However, this wave has caused the grid to overload, forcing a reduction in capacity and putting EVN in a difficult position. When the FIT was abolished, the bidding mechanism was applied according to the amended Law on Electricity, which took effect in February 2025, and related decrees. However, the constant changes have made investors more cautious, especially when EVN proposed to renegotiate the signed FIT contracts.

Mr. Nguyen Quoc Vinh – Founding Lawyer of Scientia Law LLC, Arbitrator of VIAC, emphasized the basic principle of contract law: “once signed, it must be respected”. Keeping commitments has legal significance and strengthens trust. Mr. Millet added that in the region, countries like Thailand and Malaysia had stopped FIT but did not revoke the incentives already granted, except for Europe after the 2008 crisis. Therefore, investors in Vietnam feel disadvantaged when there is no significant event, but the contract is still adjusted. According to him, it is necessary to have a fair dialogue to ensure profits and reduce financial burdens on EVN.

Mr. Theo Millet (middle) and Mr. Nguyen Quoc Vinh – Photo: Tu Kinh

|

In addition to legal factors, the role of local partners was also emphasized. Mr. Vinh believes that in the context of entanglements related to the power grid, land, and procedures, cooperation with reputable Vietnamese enterprises is mandatory. Domestic partners provide legal support and help navigate the project in a dynamic environment. Mr. Millet agreed and expected this role to go further: instead of just connecting relationships, local enterprises need to become strategic allies, sharing risks and participating in management to make the project more sustainable, thereby strengthening foreign investors’ confidence.

Meanwhile, opportunities for SMEs remain limited due to high capital requirements and the absence of specific preferential policies. According to Mr. Vinh, SMEs are more suitable to participate as subcontractors or technical service providers rather than project owners of billion-dollar projects. Mr. Millet suggested that while waiting for a clear legal framework, SMEs should choose to participate indirectly through service contracts to reduce risks.

|

Collaboration agreements need clarity on the scope of work Decree 57/2025/ND-CP, issued in March 2025, paved the way for the direct power purchase agreement (DPPA) model through a dedicated grid connection. In this model, renewable energy plants sell electricity directly to large customers through a dedicated line constructed between the two parties. The advantages include a simplified process, comprising only four steps from completing legal procedures to notifying the power utility. The parties also enjoy autonomy in price negotiation, independent of the national grid, resulting in high operational flexibility. However, to operate a physical DPPA, businesses must make significant infrastructure investments. The cost of building transmission lines increases with the distance between the power plant and the consumption point. If it passes through multiple localities, investors also face a series of complex procedures related to land and planning. Longer distances also result in higher energy losses. In a discussion with the author, Mr. Theo Millet provided two key recommendations for both domestic and international enterprises engaging in energy investment collaborations. According to him, the most important aspect of collaboration is having a contract that clearly defines the scope of work and a mechanism for allocating risks. Many disputes do not arise from a lack of goodwill but from vague responsibilities and unclear task ownership. Therefore, investors need to ensure that all terms are transparent from the outset. His next recommendation is for both domestic and foreign enterprises to accept the reality that policy changes are inherent in rapidly developing markets like Vietnam. “The government has its own agenda and will not change just to please investors or increase their profits. So, investors need to always anticipate and calculate this factor into their overall business strategy”, concluded the expert. |