Vietnam Container Shipping Joint Stock Company (Viconship, Stock Code: VSC) has just announced the resolution of its Board of Directors on approving the plan to be presented at the upcoming 2025 Extraordinary General Meeting of Shareholders regarding an adjustment to increase the 2025 pre-tax profit plan.

Specifically, the company plans to seek shareholder approval to adjust its 2025 pre-tax profit target from 400 billion VND to 1,250 billion VND, equivalent to a threefold increase from the previously approved plan.

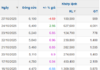

This adjustment comes as Viconship has achieved positive business results in the first half of the year. As per Viconship’s consolidated financial statements for the second quarter of 2025, the company recorded a total accounting pre-tax profit of nearly 312 billion VND in the first six months of 2025, a 53.7% increase compared to the same period in 2024.

Illustrative image

As of now, Viconship has accomplished 78% of its initially set pre-tax profit plan and 25% of the projected pre-tax profit plan to be presented to shareholders.

On August 22, 2025, Viconship will finalize the list of shareholders eligible to attend the 2025 Extraordinary General Meeting of Shareholders. The time and venue of the meeting will be announced in the invitation letter.

The meeting agenda is expected to include the adjustment of the 2025 pre-tax profit plan and other matters within the competence of the General Meeting of Shareholders.

In another development, Viconship recently sent an explanation to the State Securities Commission of Vietnam and the Ho Chi Minh City Stock Exchange (HoSE) regarding the continuous rise in its stock price, which hit the ceiling price for five consecutive sessions.

Viconship received Official Letter No. 1235/SGDHCM-GS from HoSE requesting a report and disclosure of information related to the company, which may have influenced the upward movement of VSC stock price, reaching the ceiling price for five consecutive sessions from August 12, 2025, to August 18, 2025.

According to Viconship’s assessment, the fluctuation in the price of VSC shares may be due to the objective supply and demand dynamics in the Vietnamese stock market, which is beyond the company’s control.

Additionally, the positive performance of Viconship’s business operations in the first half of the year may have also contributed to the rise in stock price.

Currently, VSC’s production and business activities are proceeding as usual, in accordance with the set plan, and there are no abnormal issues within the company’s operations.

Lastly, Viconship commits to fully disclosing information as required by law and assures that there is no intentional influence on the trading price of VSC shares in the stock market.

“ACBS Raises $86 Million in Bond Offering to Refinance Debt.”

On August 18th, ACBS issued a bond with the code ASS12501, valued at VND 200 billion with a 2-year maturity, as part of their debt restructuring strategy.

HDBank: Among the Top 50 Listed Companies of 2025

As of August 21, 2025, Forbes Vietnam unveiled its list of Vietnam’s 50 Best Listed Companies for 2025, featuring leading enterprises across vital sectors. Among them, HDBank stands out as a prominent multi-functional retail bank, solidifying its position and pioneering role in the private sector of Vietnam’s financial and banking system.

HDBank: Among the Top 50 Listed Companies in 2025

On August 21, 2025, Forbes Vietnam unveiled its list of Vietnam’s 50 Best Listed Companies in 2025, featuring leading enterprises across key sectors, representing the dynamic and resilient listed company sector of the economy. Among them, HDBank stands out as a prominent multi-functional retail bank, solidifying its position and pioneering role in the private sector of Vietnam’s financial and banking system.