I. MARKET ANALYSIS OF SECURITIES AS OF AUGUST 18, 2025

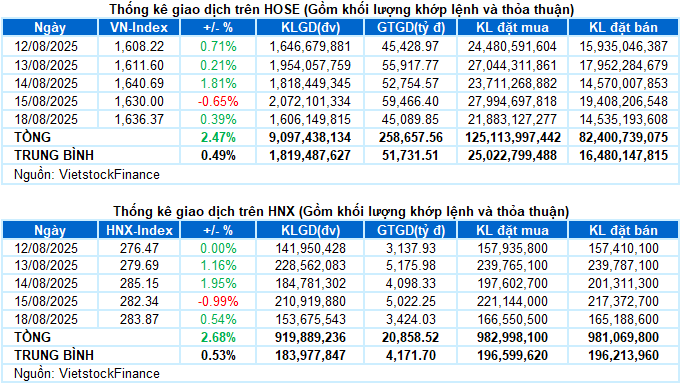

– The main indices recovered during the trading session on August 18. Specifically, VN-Index increased by 0.39%, reaching 1,636.37 points. HNX-Index also rose by 0.54%, reaching 283.87 points.

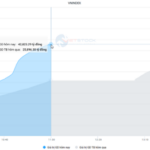

– The matching volume on the HOSE floor decreased by 24.7%, reaching 1.5 billion units. HNX recorded 152 million matching units, a decrease of 23.9% compared to the previous session.

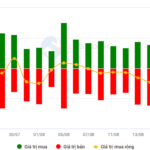

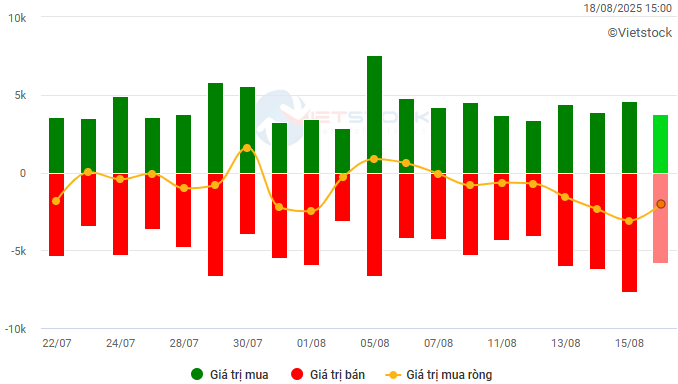

– Foreign investors continued to sell a net of VND 1.9 trillion on the HOSE and nearly VND 98 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

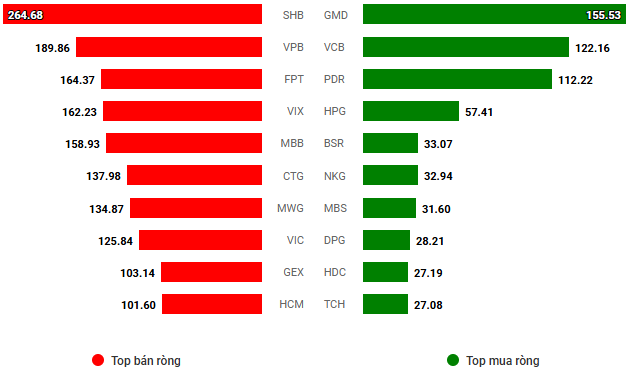

Net trading value by stock code. Unit: VND billion

– After a strong profit-taking session last weekend, the stock market opened the new week on a positive note. However, the pressure of fluctuations quickly emerged as the market became more polarized. VN-Index fluctuated with trading volume dropping in the morning session. In the afternoon, the index continued to fluctuate around the reference level before buying pressure at the end of the session helped VN-Index regain its recovery momentum. At the end of the trading day, VN-Index stood at 1,636.37 points, up 6.37 points from the previous session.

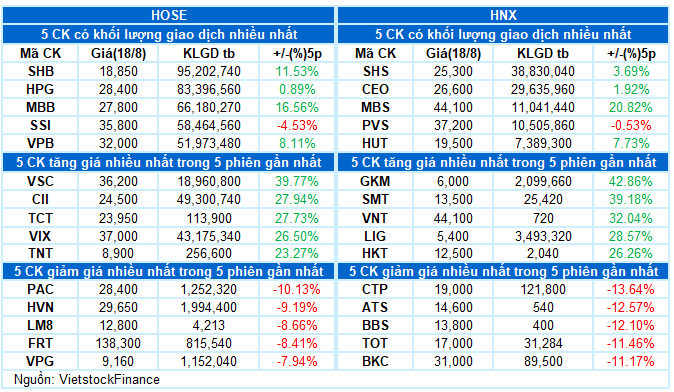

– In terms of impact, VPB and BSR were the main drivers, contributing 1.7 points and 1.3 points to the VN-Index respectively. Following were VIX, LPB, and HPG, which added 2.4 points to the overall gain. On the other hand, MBB and CTG had the most significant negative impact, causing the index to lose 1.2 points.

– VN30-Index closed slightly higher by 0.17%, reaching 1,786.37 points. The basket showed polarization with 17 declining stocks, 12 advancing stocks, and 1 stock closing unchanged. On the upside, TPB stood out with a 3.3% gain. Meanwhile, VPB, LPB, and SHB also attracted buying interest, all rising over 2%. In contrast, VJC, SSI, and STB all corrected more than 2%.

In terms of sectors, energy led the market with an outstanding gain of 3.08%, mainly driven by the standout performance of BSR hitting the ceiling price, PLX (+0.78%), PVS (+0.81%), PVT (+2.41%), VIP (+1.5%), and TD6 (+2.33%).

With their large market capitalization, the real estate and financial sectors also made significant contributions to today’s gain, with buying interest focused on stocks such as KBC, PDR, CRE, NHA hitting ceiling prices, CEO (+1.14%), KDH (+4.23%), HDC (+1.38%), VPI (+1.59%), DXS (+4.45%); SHB (+2.17%), VPB (+2.89%), EIB (+2.69%), TPB (+3.33%), VIX (+6.63%), LPB (+2.82%), and DSE also hitting ceiling prices.

On the opposite side, the media and communications services sector lagged with a 2.41% correction, mainly due to selling pressure in VGI (-2.53%), FOX (-3.8%), TTN (-1.69%), and MFS (-1.97%).

The VN-Index‘s gain amid intraday fluctuations, coupled with trading volume dropping below the 20-session average, suggests that investors remain cautious. The Stochastic Oscillator indicator continuing to fall after giving a sell signal in the overbought region, while foreign investors maintain net selling, indicates that short-term fluctuations may persist.

II. TREND AND PRICE MOVEMENT ANALYSIS

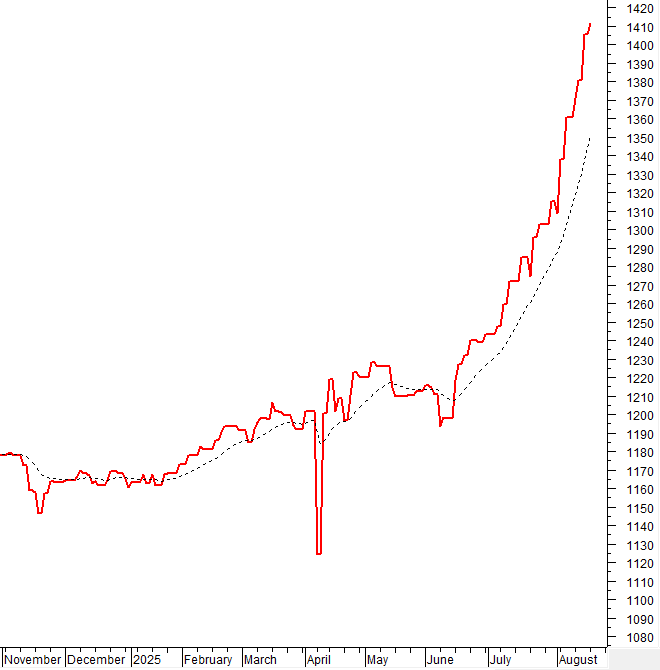

VN-Index – Stochastic Oscillator indicator continues to fall after giving a sell signal

VN-Index advanced amid intraday fluctuations, but trading volume dropped below the 20-session average, indicating investors’ cautious sentiment.

The Stochastic Oscillator indicator continuing to fall after giving a sell signal in the overbought region, while foreign investors maintain net selling, suggests that short-term fluctuations may persist.

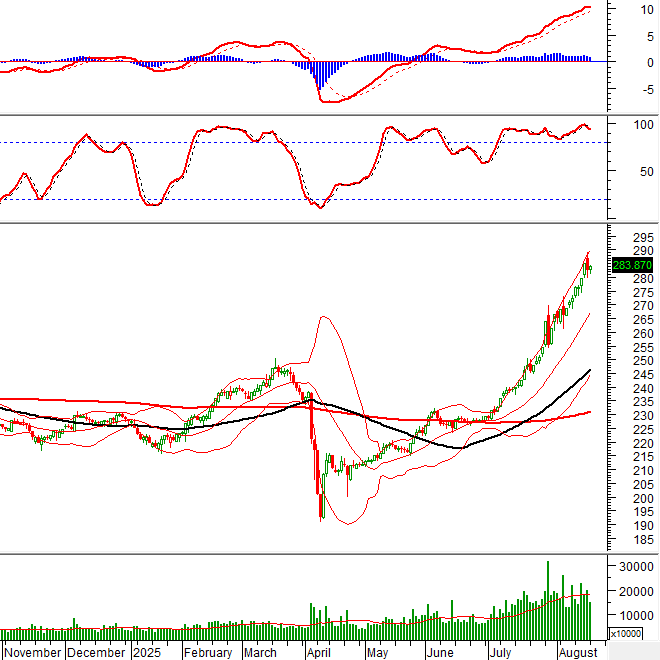

HNX-Index – Trading volume fluctuates around the 20-day average

HNX-Index rebounded after a sharp decline in the previous week. However, trading volume has been fluctuating around the 20-day average in recent sessions, reflecting investors’ unstable sentiment.

Currently, the index’s uptrend remains intact as the MACD indicator is above the Signal line and has maintained a buy signal since early July 2025. However, the Stochastic Oscillator indicator continues to weaken after giving a sell signal in the overbought region, warning of potential profit-taking pressure in the short term.

Money Flow Analysis

Movement of smart money: The Negative Volume Index indicator of VN-Index is currently above the EMA 20-day average. If this situation persists in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Foreign capital flow: Foreign investors continued to be net sellers during the trading session on August 18, 2025. If foreign investors maintain this stance in the coming sessions, the situation may turn more pessimistic.

III. MARKET STATISTICS AS OF AUGUST 18, 2025

Economic and Market Strategy Analysis Department, Vietstock Consulting

– 5:11 PM, August 18, 2025

“It’s Time to Aim for MSCI’s Market Upgrade Standard”

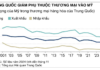

The Vietnamese stock market has reached a pivotal moment in its journey towards recognition as a leading emerging market. With the recent advancements and meeting the criteria set by FTSE Russell for an upgrade from frontier to emerging market status in their September 2025 review, the focus now shifts to attaining the prestigious recognition from MSCI.

The Market Maverick: Can We Expect a Resilient Reversal?

The VN-Index experienced significant volatility but managed to recover towards the end of the trading session, with above-average volume. The uptrend remains intact as the MACD indicator continues to hover above the signal line, indicating no signs of weakness. However, the risk of volatility persists as the index hovers at historical highs. In the event of increased selling pressure, the middle band of the Bollinger Bands will serve as a crucial support level.

Market Beat: Pulling Major Stocks, VN-Index Makes a Strong Comeback at the End of the Session.

The trading session concluded with the VN-Index climbing 10.16 points (+0.61%), reaching 1,664.36. In contrast, the HNX-Index witnessed a decline of 2.72 points (-0.95%), settling at 283.73. The market breadth tilted towards decliners, as 569 stocks closed in the red, while 238 stocks ended in the green. Within the VN30 basket, 17 stocks fell, 12 advanced, and 1 remained unchanged, resulting in a slightly bearish sentiment.