Recent Developments at EVNFinance: A Comprehensive Overview

On August 20, EVNFinance, the Finance Joint-Stock Company, announced its name change to EVF, the Power Finance and Comprehensive Finance Joint-Stock Company. This development comes on the heels of the State Bank of Vietnam’s inspection authority identifying numerous violations within EVF’s operations.

The inspection authority of the State Bank of Vietnam has uncovered a series of violations in EVF’s activities, leading to punitive measures. A decision on administrative violations in the field of banking was issued, imposing a fine of VND 635 million for three violations, including improper credit granting, incorrect asset classification, and domestic credit issuance in foreign currency contrary to regulations.

In a separate development, on August 15, EVF’s Board of Directors received resignation letters from Mr. Mai Danh Hien, the General Director, and Mr. Le Manh Linh, the Vice Chairman of the Board of Directors for the 2023-2028 term. The Board promptly issued resolutions accepting their resignations and appointing Mr. Le Manh Linh as a member of the Board and Interim General Director, effective August 21, 2025.

The Board also approved Mr. Le Manh Linh as the candidate for the position of General Director, pending the State Bank of Vietnam’s approval. Meanwhile, Mr. Mai Danh Hien was appointed as the Vice Chairman of the Board of Directors for the 2023-2028 term, effective from the same date.

Additionally, the Board of Directors reappointed Mr. Le Anh Tuan as Deputy General Director for a five-year term, effective September 15, 2025. The company’s leadership transition was completed with the announcement of Mr. Pham Trung Kien, Chairman of the Board of Directors, as the legal representative of EVF from August 21, 2025.

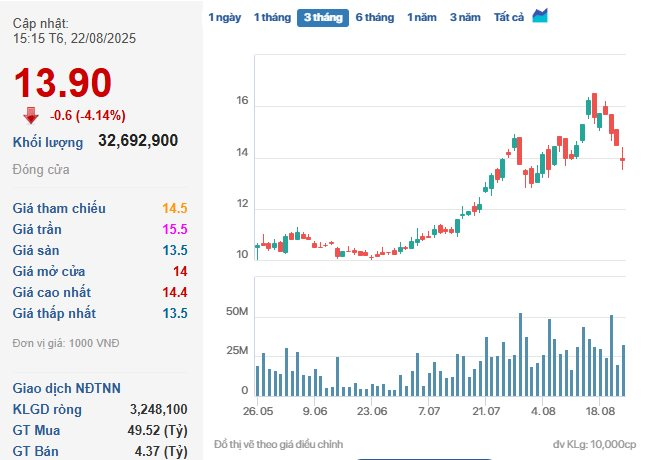

EVF stock has been on a downward trend in recent trading sessions. (Source: Cafef)

In the stock market, EVF closed at VND 13,900 per share on August 22, a 4.14% decrease from the previous session, with a matched volume of nearly 32.7 million shares. Since August 15, EVF stock has fallen in 5 out of 6 sessions, erasing nearly 15% of its value. This downward spiral has resulted in a significant market capitalization decline to VND 10,571 billion.

The Race to the Top: How Vietcombank, MB, VPBank, and HDBank Soar After a 50% Cut in Reserve Requirements

The decision by the State Bank of Vietnam to reduce the mandatory reserve ratio by 50% for credit institutions participating in the restructuring process has provided a significant liquidity boost for the four banks involved in the transfer. This policy move has had a multifaceted impact, simultaneously reducing funding costs, directly enhancing liquidity, and promoting credit growth.

Does Loosening Credit Room Affect Savings Deposits?

The credit growth landscape is set for a potential surge, however, we shouldn’t expect a rush to increase lending rates. This surge won’t spark a rate race, and it’s important to note that deposit savings of the public remain secure and unaffected.

The Golden Rush: Prices Soar to Record Highs

This afternoon (August 5th), the SJC gold bar price surged to 123.8 million dong per tael, just 200,000 dong shy of the historical peak on April 22nd. The State Bank of Vietnam has announced that it will continue to coordinate with ministries and sectors to ensure transparency and take strict action against speculation and market manipulation in the gold market.

“Central Bank Meets with Commercial Banks to Discuss Interest Rates”

The State Bank of Vietnam (SBV) has instructed credit institutions to follow the directives of the Government, the Prime Minister, and the SBV itself by maintaining stability in deposit interest rates. Institutions are also encouraged to further streamline operating expenses, embrace digital transformation, and be prepared to share a portion of their profits to reduce lending rates, demonstrating a commitment to supporting the broader economic landscape.