Vietnam Stock Index: Analyzing the Week’s Trading Dynamics and Expert Insights

The Vietnam Stock Index (VN-Index) witnessed a remarkable surge during the first four sessions of the week, before intense selling pressure caused a significant decline in the final trading day. At the close of August 22, the VN-Index dipped by 42.53 points (-2.52%) to 1,645.47, yet still managed to gain 15 points compared to the previous week. Trading liquidity continued to soar, averaging approximately VND 45,400 billion per session.

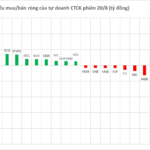

In terms of foreign investment flows, this group of investors continued to aggressively sell off holdings, with a net sell position of over VND 7,815 billion in the past five sessions across the entire market.

So, what’s in store for the upcoming trading week?

Expert Insights: Understanding the Market Dynamics

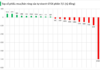

Mr. Nguyen Thai Hoc, Securities Analyst at Pinetree, commented that the Vietnamese stock market concluded the week with a steep decline of over 40 points as profit-taking pressures intensified among banking stocks and previously high-flying securities. The concentration of funds in large-cap stocks to prop up the index left investors holding small and mid-cap stocks with minimal gains, and many portfolios were in negative territory before Friday’s session. The negativity peaked as banking stocks witnessed a sharp sell-off, while mid-cap sectors like real estate and securities also faced substantial pressure despite not witnessing significant gains previously.

According to Mr. Hoc, this dynamic indicates a potential outflow of funds from the market following the recent heated rally. However, it’s important to recognize that a corrective phase after the VN-Index’s relentless ascent over nearly four months is a healthy development. “A pullback of 5% or more is not a negative signal but rather an opportunity for the market to rebalance and consolidate,” he asserted.

In the near term, Mr. Hoc anticipates persistent corrective pressures, with the VN-Index likely to retreat towards the 1,570-1,580 support zone, which could serve as a foundation for accumulation before the market discovers fresh upward momentum.

Furthermore, the upcoming week is expected to witness pronounced differentiation, with mid-cap and select large-cap stocks that have entered oversold territories or lagged in the previous rally poised for a stronger recovery. In contrast, large-cap stocks that have soared, particularly in the banking sector, will likely continue exerting downward pressure on the index.

Given these dynamics, investors still holding stocks are advised to remain cautious: for mid-cap stocks that have undergone deep corrections, consider retaining positions for further observation, while for stocks that have rallied significantly, profit-taking should be considered to secure gains.

Additionally, refrain from chasing stocks during this volatile period, and prioritize observing the VN-Index’s behavior around the 1,570-1,580 support zone before making new investment decisions.

Sector Focus: Banking and Securities Sectors in the Spotlight

Mr. Ngo Minh Duc, Founder of LCTV Investment Finance Company, noted that from April 9 to the recent peak at 1,688 points, the VN-Index surged by over 600 points, approximately 60%, within four months. This impressive growth was bolstered by favorable macroeconomic factors, including accommodative fiscal and monetary policies, accelerated public investment disbursement, Resolution 68 supporting the private sector, stable exchange rates, and low-interest-rate environments.

When compared to previous robust growth periods, such as 2006 (Vietnam’s WTO accession) and 2021 (post-COVID economic stimulus), the current cycle presents even more favorable conditions.

However, all markets require periods of consolidation to absorb supply pressures, especially after a relentless 600-point ascent without significant corrections. The sharp decline in the final trading session of the week exemplifies this dynamic. According to LCTV’s statistics, the majority of newly purchased stocks since August 15 have resulted in short-term negative returns.

Mr. Duc forecasts that the market is undergoing a short-term technical correction rather than a trend reversal. While trading liquidity remains elevated, with over 2 billion shares traded daily, reflecting investors’ enthusiasm, the exchange rate has hovered at elevated levels, and government bond yields have climbed to 3.67%, the highest level in many months.

It’s worth noting that the current liquidity is driven by “hot money,” leveraging relatively high margin trading. During market corrections, this type of liquidity can quickly exit, as witnessed during the recent sell-off. Therefore, while the current liquidity is positive for maintaining trading volumes, it shouldn’t be expected to sustain a continuous upward trend without rotation across sectors.

Consequently, the market’s corrective phase is understandable and serves as a necessary breather after the heated rally. It also presents an opportunity for the market to solidify price levels before establishing a new trajectory.

Amid the current landscape, two sectors stand out for their prominent “economic moats”:

Banking Sector: This sector has been a clear beneficiary of accommodative monetary policies, low-interest rates, and supportive measures such as Resolution 42. Major banks with comprehensive ecosystems, including MBB, ACB, SHB, TCB, and VPB, have remained attractive destinations for investment funds. Additionally, the State Bank’s expansion of credit growth and reduction in reserve requirements have provided a distinct boost to this sector.

Securities Sector: With robust market liquidity and expectations of an upgrade, leading securities companies like VND, SSI, HCM, and VIX are poised for substantial profit growth, driven by increased trading volumes, high margin levels, and effective proprietary trading strategies.

These sectors offer stocks with attractive valuations, strong liquidity, solid fundamentals, and direct beneficiaries of market liquidity and macroeconomic tailwinds, making them ideal for medium to long-term investment strategies.

Investment Strategies: Navigating the Market with a Disciplined Approach

Mr. Duc emphasizes the importance of adopting a differentiated investment strategy based on individual portfolio conditions:

For investors utilizing high margin levels, it’s crucial to restructure and reduce leverage to safer levels (preferably avoiding margin trading). During periods of market consolidation or sideways movement, elevated leverage can exert significant pressure if unfavorable price movements occur.

Investors holding strong positions in quality stocks can consider maintaining their holdings and gradually taking profits as stocks reach target levels. Prioritize retaining positions in banking and securities stocks that have consolidated previously.

For investors who haven’t entered the market yet, refrain from rushing into bottom-fishing during the next 1-2 sessions. Instead, observe market behavior, especially around the 1,650 level. If this level holds, the technical correction could swiftly conclude, presenting new opportunities at more attractive price levels.

The Foreign Sell-Off Cools, Yet a Bank Stock Still Takes a 500 Billion Dong Hit

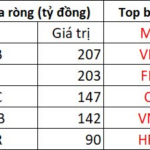

In the afternoon trading session, foreign investors net bought SHB and VIX stocks the most in the market, with a value of over 200 billion VND each.

The VN-Index: An Astonishing Last-Minute Turnaround

Despite a sea of red with nearly 260 stocks in the negative, the VN-Index defied the odds and staged a remarkable comeback on Tuesday (August 20), surging over 10 points led by a resilient banking sector.