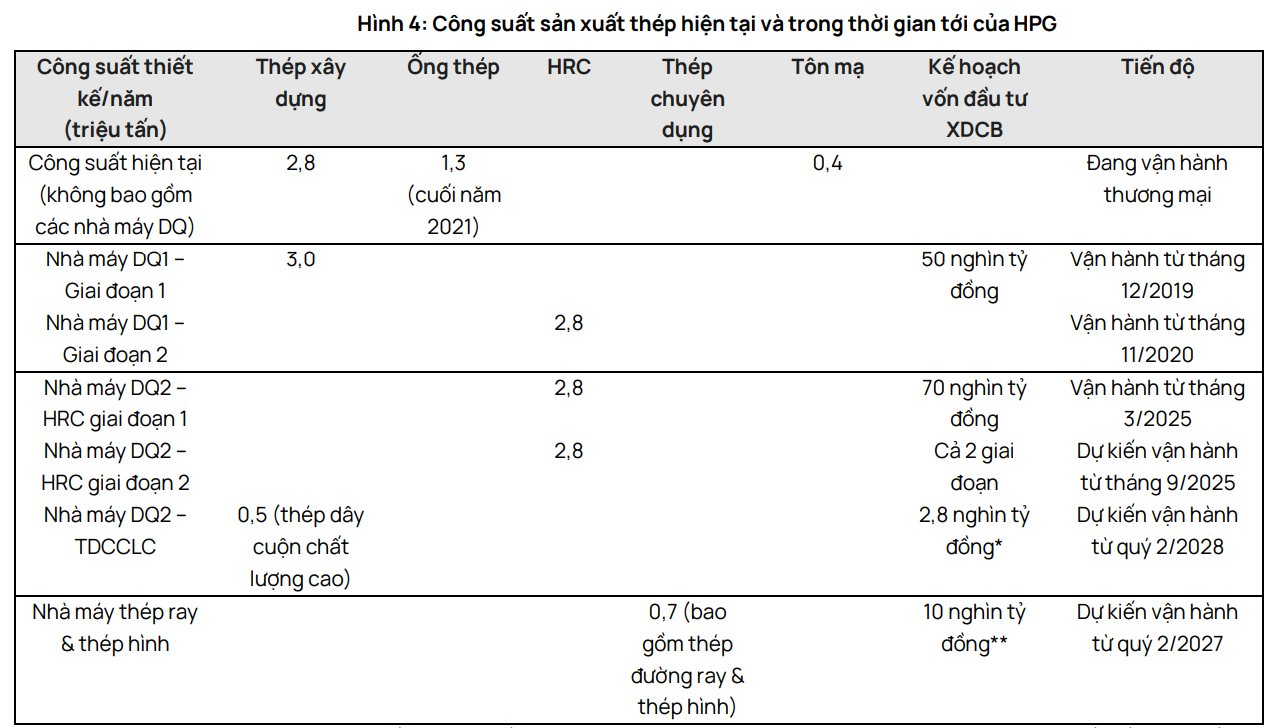

According to Vietcap’s analysis report, Hoa Phat (HPG) announced on August 19, 2025, that it will commence construction of a rail and shaped steel plant to supply the North-South high-speed railway project, the Hai Phong-Hanoi-Lao Cai railway project, and urban railway projects in Hanoi and Ho Chi Minh City.

Vietcap expects the plant to be operational in Q2 2027, following a 20-month construction period. Per HPG, the plant will have an annual capacity of 700,000 tons of rail and shaped steel, with an expected investment of VND 14,000 billion. Meanwhile, the approved investment plan by local authorities is VND 10,000 billion. Vietcap assumes that VND 10,000 billion will be allocated for fixed asset investment, while the remaining VND 4,000 billion will be used for working capital.

Since the project’s products are intended for national infrastructure, Vietcap anticipates high operational efficiency but relatively low-profit margins. This view is reinforced by our preliminary calculations based on available data. According to the investment plan, the project is expected to generate annual revenue of approximately VND 11,400 billion and contribute about VND 150 billion annually to the state budget.

Vietcap believes that the plant will benefit from a preferential corporate income tax rate of 17% for the first ten years (as per the 2025 Law on Corporate Income Tax) before returning to the standard rate of 20% for the remaining 40 years of its 50-year operating period, resulting in a weighted average tax rate of 19.4%.

Based on the expected tax contribution, Vietcap estimates an annual PBT of VND 773 billion, equivalent to a net profit margin of nearly 7%. Based on historical data, we estimate this to be equivalent to a gross profit margin of about 10%, lower than that of other steel segments (HPG’s gross profit margin in 2024 was 13.3%, despite weak steel prices).

According to Vietcap, HPG is propelled by both favorable domestic and international factors. On the domestic front, growth is driven by robust infrastructure construction demand and the expansion of HRC capacity at the Dung Quat Steel Complex. In the first seven months of 2025, public investment disbursement surged by approximately 70% year-on-year, reaching 44.4% of the annual plan. In July alone, this figure doubled compared to the same period last year, attaining 63% of the Q2 figure.

Regarding HRC, the domestic market – currently facing a supply shortage – is protected by anti-dumping duties on imports from China.

Turning to international factors, Vietcap anticipates an improvement in HPG’s profit margins due to steel price recovery in China, attributed to the Chinese government’s “anti-negative competition” policy to curb oversupply, and higher iron ore supply in 2026-27.

Concerning the “anti-negative competition” policy, Vietcap expects a slow and volatile recovery in the short term as supply cuts take time to process, while China’s real estate demand remains weak. However, stronger momentum is anticipated in the medium to long term. Vietcap believes that the new upward cycle of Chinese steel prices will lift domestic steel prices in Vietnam, thereby supporting expanded profit margins and profits for steel producers like HPG, as higher output selling prices outweigh the costs of previously purchased input materials.

The Energy Giant Awakens: Celebrating 50 Years of Power at the 80th Anniversary Economic and Social Achievements Expo

The Vietnam National Oil and Gas Group (Petrovietnam) is putting the final touches on its exhibition stand at the Socio-Economic Achievement Exhibition, taking place from August 28 to September 5, 2025, at the National Exhibition Center in Dong Anh, Hanoi.