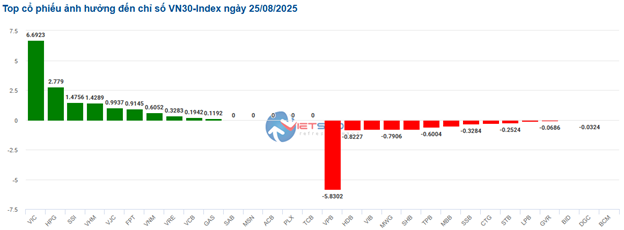

The VN30-Index basket witnessed a mixed performance, with 10 stocks advancing, 15 declining, and 5 remaining unchanged. Specifically, VIC and HPG were the top contributors to the index’s gains, adding nearly 10 points collectively. On the flip side, VPB faced selling pressure, dragging the index down by 5.8 points.

Source: VietstockFinance

|

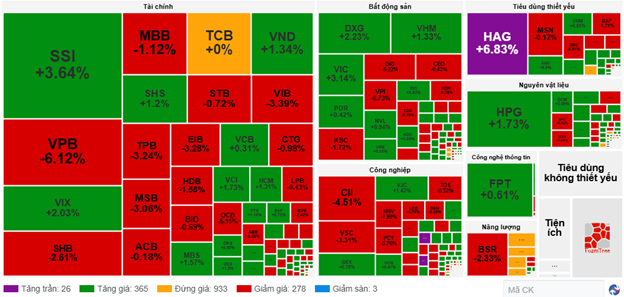

Most sector indices traded in positive territory, led by the real estate sector, which surged 1.57%. Notable gainers within the sector included VHM (+2.34%), VIC (+6.54%), NVL (+5.8%), and VRE (+0.35%)

The materials sector also contributed significantly to the market’s advance, with prominent gainers such as HPG (+1.92%), DCM (+2.49%), DPM (+2.28%), HT1 (+2.81%), and PRT (+8.18%)

Meanwhile, the financial sector exhibited a mixed performance, with selling pressure slightly outweighing buying interest. VPB (-6.12%), SHB (-2.61%), TPB (-3.24%), VIB (-3.39%), and MSB (-3.06%) witnessed selling pressure, while SSI (+3.64%), VIX (+2.03%), VND (+1.34%), SHS (+1.2%), and MBS (+1.57%) traded in the green.

As of the writing, 365 stocks were in the green, while 278 stocks were in the red.

Source: VietstockFinance

|

Open: Positive Start to the Week

After facing profit-taking pressures last week, the stock market kicked off the new week on a positive note. As of 9:30 am, the VN-Index had gained over 6 points to reach 1654.3, while the HNX-Index hovered around 274 points.

On Friday (August 22), Federal Reserve Chairman Jerome Powell, in his speech ahead of the Fed’s annual symposium, signaled a potential interest rate cut in September amid challenges posed by rising inflation risks and a weakening job market. This news immediately boosted US stock markets.

This morning, Vietnam’s stock market rebounded from last week’s decline, with VIC, HPG, and VCB leading the VN-Index higher, contributing a collective gain of 3.5 points. On the other hand, VPB and LPB dragged the index lower by more than 3 points.

The information technology sector index led the gains, largely driven by FPT (+2.22%). Additionally, the real estate sector contributed significantly to the overall index’s advance, with many stocks rising over 1%, including VIC, VHM, KBC, NVL, PDR, KDH, DXG, IDC, DIG, and HDC, among others.

In contrast, the financial sector turned increasingly negative as multiple stocks faced intense selling pressure at the beginning of the session, including VPB (-3.06%), TPB (-3.7%), LPB (-3.19%), MSB (-1.67%), and OCB (-3.09%)

– 10:40 25/08/2025

The Stock Market’s Best-Kept Secret: Banking on Big Gains

Last week, from August 18 to 22, 2025, a slew of bank stocks witnessed an impressive surge, with gains exceeding 10%. This significant upward trend underscores the robust performance and resilience of the banking sector, highlighting its potential for investors seeking lucrative opportunities in the financial realm.

What Do Experts Say About the Stock Market’s “Rollercoaster” Session, With a Turnover of $2.7 Billion?

The stock market, after rallying for almost four consecutive months, has finally taken a much-needed breather. But is this a cause for concern or simply a healthy correction?

“Shareholders Receive First Dividend Payout After a 14-Year Wait”

Despite incurring losses of nearly VND 44 billion in the first half of the year, Vietnam Maritime Transport Joint Stock Company (stock code: VOS) distributed VND 154 billion in dividends to its shareholders. Notably, this marks the first time since 2011 that VOS shareholders have received dividends.

The Stock Market Crash: What’s Next for Investors?

The VN-Index is set to surge beyond all investor expectations with liquidity and cash flow doubling or even tripling from the previous cycle.