Ho Chi Minh City Finance and Investment Company (HFIC) has reported the results of HCM Securities Joint Stock Company (HSC)’s HCM share purchase rights trading.

According to the report, from August 12-18, HFIC sold 5.37 million purchase rights (equivalent to 2.685 million HCM shares), out of the registered 121.6 million purchase rights (equivalent to 60.82 million HCM shares) through auction sales on the HoSE floor.

The number of purchase rights sold by HFIC accounted for only 4.4% of the registered amount. This was due to investors not taking up all the purchase rights offered at auction. With a selling price of VND 6,875/purchase right, HFIC earned VND 36.9 billion from this transaction.

Following this transaction, HFIC registered to sell the remaining 116.268 million purchase rights (equivalent to 58.134 million shares) through direct agreement with investors from August 27 to September 5, 2025. With the same selling price of VND 6,875/purchase right, HFIC expects to earn more than VND 799 billion from this transaction.

HFIC is currently the second-largest shareholder of HSC Securities, holding 121.638 million HCM shares, equivalent to 16.88% of the company’s charter capital.

Mr. Tran Quoc Tu – Member of HSC’s Board of Directors, is currently the Head of HFIC’s Legal Department and the representative of over 57.6 million HCM shares (8% of capital) at HSC.

In addition, Ms. Phan Quynh Anh – Deputy Head of Finance and Accounting Department of HFIC, also holds a position as a Member of HSC’s Board of Directors. She is also the representative of capital for over 43.2 million HCM shares (equivalent to 6% of charter capital) at HSC.

HSC’s largest shareholder, Dragon Capital Markets Limited, registered to exercise all 226.8 million purchase rights, equivalent to 113.42 million shares allowed to be purchased, from August 22 to September 12, 2025.

With an offering price of VND 10,000/share, Dragon Capital Markets Limited is expected to spend VND 1,134.2 billion to complete the transaction, thereby increasing its ownership to 340.25 million shares, equivalent to 31.51%.

It is known that Mr. Le Anh Minh – Vice Chairman of HSC’s Board of Directors, is currently the Director and Capital Representative of Dragon Capital Markets Limited at HSC. In addition, Mr. Le Hoang Anh – Member of the Board of Directors, is also the Capital Representative of this foreign fund at HSC.

HSC is in the process of offering nearly 360 million shares to existing shareholders at a ratio of 2:1, meaning that for every 2 shares held, shareholders will have the right to buy one new share.

The offering price is VND 10,000/share, aiming to raise nearly VND 3,600 billion. If the offering is successful, the company will increase its charter capital from VND 7,208 billion to over VND 10,800 billion.

With nearly VND 3,600 billion raised from the offering, HSC plans to allocate nearly VND 2,520 billion (70%) to supplement capital for margin lending activities and nearly VND 1,080 billion (30%) to supplement capital for proprietary trading. The disbursement is expected to take place in 2025.

In terms of business performance, in the first half of 2025, HSC recorded operating revenue of VND 2,073 billion, up 6% over the same period last year. Half of the revenue came from the lending segment, amounting to VND 1,022 billion, an increase of 41% year-on-year. Meanwhile, proprietary trading decreased by 16.5% to VND 584 billion, and brokerage activities also decreased by 15%, bringing in VND 397 billion.

As a result, pre-tax profit reached nearly VND 523 billion and after-tax profit was VND 419 billion, down 29% compared to the first half of 2024.

As of June 30, 2025, HSC’s total assets were VND 34,937 billion, an increase of approximately VND 3,597 billion.

Despite lending contributing the most to revenue, HSC reduced the scale of its lending to VND 19,813 billion, a decrease of VND 616 billion from the beginning of the year, accounting for nearly 57% of total assets.

The FVTPL financial asset portfolio had a book value of VND 12,870 billion, an increase of VND 5,190 billion from the beginning of the year. Of this, HSC invested VND 6,994 billion in bonds on the HNX floor, VND 2,000 billion in transferable certificates of deposit, and VND 3,545 billion in stocks.

The Foreign Sell-Off Cools, Yet a Bank Stock Still Takes a 500 Billion Dong Hit

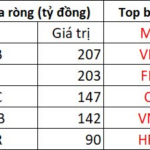

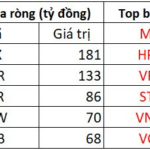

In the afternoon trading session, foreign investors net bought SHB and VIX stocks the most in the market, with a value of over 200 billion VND each.

Dabaco Takes Over Another Livestock Company in Thanh Hoa

“Dabaco is set to acquire a 98% stake in Lam Son Nhu Xuan CNC Agriculture Joint Stock Company, a Thanh Hoa-based enterprise. This acquisition involves the transfer of 9.8 million shares, representing a significant step for Dabaco as it expands its presence in the dynamic and thriving agricultural sector of Vietnam.”

The Ultimate Guide to HFIC’s Successful Equity Offering: Raising Nearly VND 800 Billion

The Ho Chi Minh City Finance Investment State-owned Company (HFIC) is looking to offload its remaining 116.3 million subscription rights of Ho Chi Minh City Securities Corporation (HSC) shares. With a set price of VND 6,875 per subscription right, the state-owned company aims to generate over VND 799 billion from this sale.