Novaland Appoints New CFO as it Navigates Financial Challenges

On August 21, 2025, the Board of Directors of Novaland Investment Corporation (NVL) announced the appointment of Mr. Vo Quoc Duc as the new Chief Financial Officer of the company. The decision took effect immediately.

Mr. Duc is responsible for carrying out the duties and powers of the CFO in accordance with legal regulations, the company’s charter, corporate governance regulations, and other relevant internal regulations.

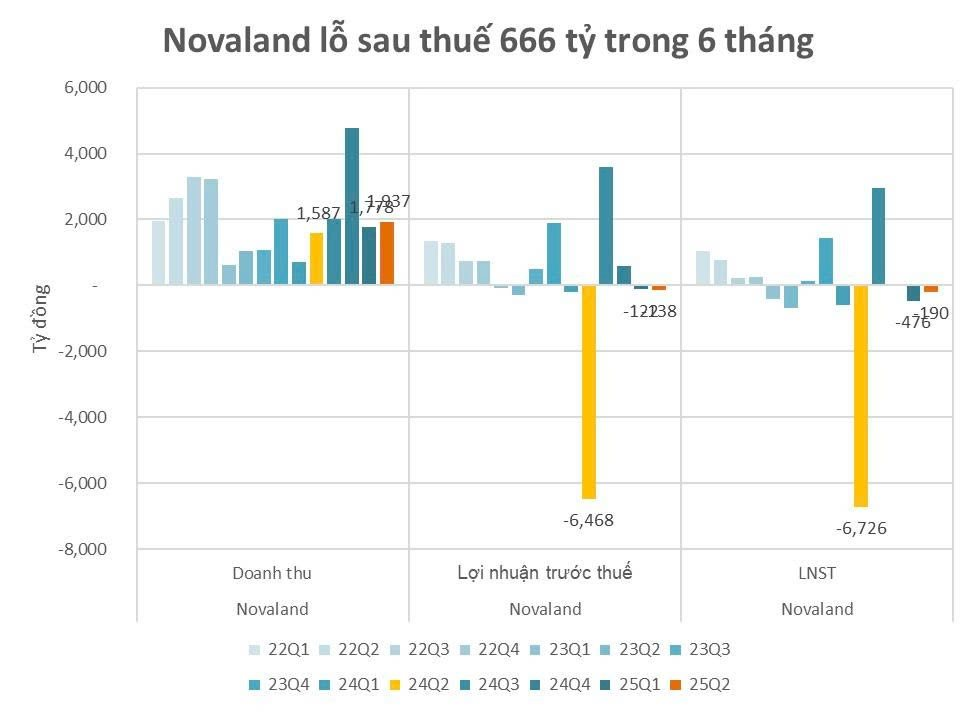

In the first half of 2025, Novaland recorded consolidated revenue of VND 3,715 billion from sales and services; however, it reported a consolidated after-tax loss of VND 666 billion, mainly due to foreign exchange losses and other operating expenses. As of June 30, 2025, the Group’s total assets amounted to over VND 238,619 billion, with total borrowings of more than VND 61,000 billion. Approximately VND 32,000 billion of these borrowings will mature within the next 12 months.

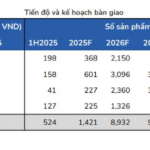

During the first two quarters, Novaland delivered 522 products, achieving 34% of its 2025 delivery target. In Ho Chi Minh City, the company issued nearly 1,300 pink books for projects such as Sunrise Riverside, The Sun Avenue, and Kingston Residences, completing 18% of its target for the year.

With slow product delivery progress, Novaland is raising additional capital to continue construction and complete all projects. This comes as key projects like NovaWorld Phan Thiet, Aqua City, and NovaWorld Ho Tram have achieved significant legal milestones in Q2 2025.

In late July 2025, the company’s The Park Avenue project, one of its prime projects in central Ho Chi Minh City, received a construction permit after years of obstacles.

On August 7, 2025, NVL’s shareholders approved three proposals regarding the issuance of shares to convert debt/execute convertible loans. Specifically, the company will issue over 168 million private placement shares at a price of VND 15,746 per share to convert a total debt of over VND 2,645 billion owed to three creditors: NovaGroup (VND 2,527 billion), Diamond Properties (VND 111.7 billion), and Ms. Hoang Thu Chau (VND 6.676 billion).

The shareholders also approved the issuance of 151.8 million shares at a price of VND 40,000 per share to convert the entire principal amount of 13 bond codes. These bonds were issued between 2021 and 2022, with maturities mainly in 2023-2025, and have a total outstanding principal amount of VND 6,074 billion.

“Novaland Issues Statement on Ho Chi Minh City Court Ruling in Dispute with Taekwang Vina Over Nearly VND 10,000 Billion Project”

The Vietnam International Arbitration Centre (VIAC) recently issued an arbitral award in a dispute between two companies, ordering the South Korean partner to continue performing its contractual obligations pertaining to a real estate project in Ho Chi Minh City.

“Novaland Could Repatriate 4.358 Trillion VND of Provisions from Lakeview Project, BSC Predicts”

“BSC predicts that the latter half of 2025 will be a supportive phase for NVL, attributed to positive legal progress across projects, significant improvement in financial performance with the reversal of 4,358 billion VND in provisions at Lakeview, and enhanced cash flow from asset sales and installment collections at Aqua City.”