Viglacera Corporation – Joint Stock Company (code: VGC) on August 22, 2025, announced the resolution of its Board of Directors, approving the innovation of the organization and operations of its real estate segment to implement the tasks under the strategic orientation of the Corporation’s development in the new phase.

Accordingly, the Corporation will transfer the operational apparatus, functions, and tasks of Viglacera Construction Company to Viglacera Infrastructure Development Investment Company; and transfer the operational apparatus, functions, and tasks of Viglacera Mechanical Construction Company to Viglacera Infrastructure and Urban Development Company.

At the same time, Viglacera’s Board of Directors also decided to innovate the organizational operation of Viglacera Infrastructure Development Investment Company and Viglacera Infrastructure and Urban Development Company after the transfer. It is expected to implement the new organizational model of these two companies before December 31, 2025.

In the short term, among its subsidiaries, Viglacera will maintain the capital ownership structure in Viglacera Consulting Joint Stock Company and Viglacera Visaho Joint Stock Company, and divest these two companies at an appropriate time.

Visaho Joint Stock Company is the operator of Thang Long Number One Apartment Building

Among the above-mentioned member companies of Viglacera, Visaho Joint Stock Company was established in 2015 by four shareholders: VGC; Sankei Building Management Company belonging to Japan’s Sankei Building Group, Hoang Thanh Infrastructure Development and Investment Joint Stock Company, and OWI Joint Stock Company.

Currently, Visaho is the management operator of many high-end projects such as Capital Place, an office building in Hanoi, and high-end apartment buildings such as Swanlake Residences, The ZEI, Hoang Thanh Tower, and Thang Long Number One. As of June 30, 2025, Viglacera recorded a contribution capital value of VND 5.4 billion in Visaho.

Previously, VGC approved the capital contribution to VIHOCE Tien Duong Joint Stock Company as a founding shareholder owning 55%, equivalent to VND 825 billion.

It is known that VIHOCE Tien Duong was established on July 26, 2025, headquartered in Hanoi, with a charter capital of VND 1,500 billion.

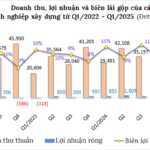

According to the audited semi-annual financial statements for 2025, Viglacera recorded net revenue of VND 6,083 billion, up 14%; of which revenue from the real estate segment reached VND 133 billion, up 85%, accounting for only 2% of the total revenue. Pre-tax profit was VND 1,142 billion, and net profit was VND 759 billion, both doubled compared to the same period last year.

Viglacera set its 2025 business targets with consolidated revenue of VND 14,437 billion and pre-tax profit of VND 1,743 billion, up 21% and 7%, respectively, compared to the previous year. With this plan, the Company has achieved 42% and 66% of its targets in the first half of the year.

“SWC Finalizes Cash Dividend with a Payout of VND 3,500 per Share”

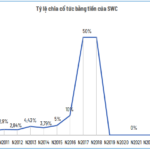

Southern Waterways Joint Stock Company (UPCoM: SWC) will finalise the list of shareholders eligible for the 2024 cash dividend payout at a rate of 35% (equivalent to VND 3,500 per share). The ex-dividend date is set for August 28, and payments will be made starting from September 15.

The Construction Industry’s Profit Crunch: Burdened by Outstanding Debts

The Q2 2025 financial results paint a varied picture of the construction industry. While some businesses are thriving with exponential profit growth, others are mired in a cycle of losses and mounting debt. This quarter’s performance reveals a sector with a diverse range of fortunes, highlighting the complex and dynamic nature of the construction industry.

Unlocking Home Ownership for Foreign Nationals: A Comprehensive Guide

“Ho Chi Minh City is not just a destination for work or leisure; it’s a place to put down roots and build a life. This vibrant metropolis offers a unique blend of rich cultural history and modern conveniences, creating an alluring environment that draws people in and keeps them wanting to stay.”