Since 2024, as gold prices remained high, investors in Vietnam have started to shift their focus to silver as an alternative investment option. Notably, the demand for silver bars and ingots has significantly increased since the beginning of 2025.

Although silver is a familiar asset, it has gained prominence due to the surge in global market prices and more vibrant domestic transactions compared to previous years.

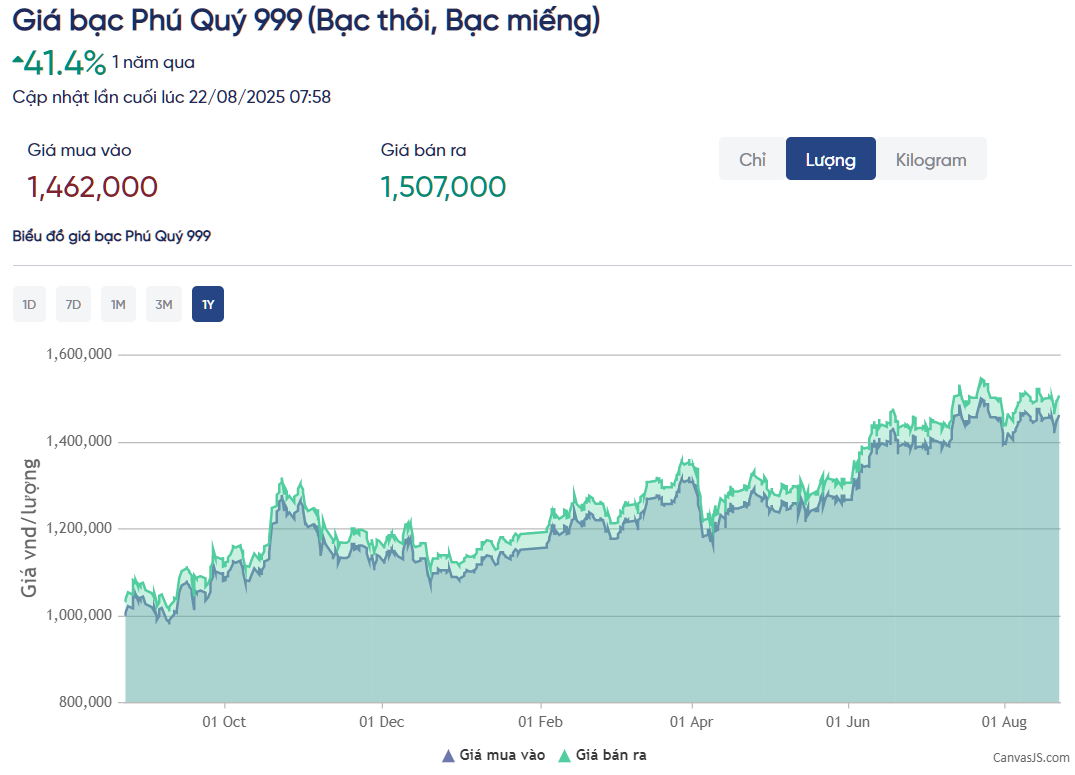

As of August 22, silver prices were trading around $38 per ounce, equivalent to a 28.6% increase since the beginning of the year. Converted to Vietnamese Dong, silver prices are at VND 1,008,000 per ounce (buying) and VND 1,013,000 per ounce (selling).

Domestically, silver bar prices have surged to nearly VND 40.2 million per kilogram, an increase of about VND 10.5 million compared to the beginning of the year, or approximately 35.4%.

As of August 22, the silver ingot and bar prices of Phu Quy Gold and Gems Group were listed at VND 1,462,000 per tael (buying) and VND 1,507,000 per tael (selling). One tael is equivalent to 37.5 grams. Converted to kilograms, the buying and selling prices of Phu Quy silver bars are VND 38,986,569 and VND 40,186,566 per kilogram, respectively.

Phu Quy Silver Price Movement in the Last Year

Despite the significant increase in silver prices since the beginning of the year, the price of one kilogram of silver is still much lower than that of SJC gold bars (currently trading at a record high of VND 125.4 million per tael, a nearly 49% increase since the beginning of the year). This price difference creates a more accessible mentality for buyers, especially those purchasing for long-term storage.

“I used to invest in gold, but as the price of gold rose, my daughter’s savings were not enough to buy it, so I guided her to buy silver as a long-term investment,” said Ms. Ngoc Mai from Ba Dinh, Hanoi.

According to a representative of Phu Quy Group, recently, there has been a significant increase in customers visiting the store to buy silver for investment and storage purposes. For customers purchasing small quantities, the products are delivered immediately at the payment counter. However, for those buying in bulk, the store has to schedule silver deliveries, which can take up to 20 days, depending on the production progress. This situation was uncommon in the past for silver, which was not as sought-after as gold.

Investing in silver is emerging as a new trend in Vietnam and worldwide, given the surge in gold prices. Silver prices often move in tandem with gold prices as both are precious metals that investors turn to as safe havens during geopolitical instability, tariff risks, or inflation.

Additionally, silver is widely used in various industries, including electronics (circuitry and contacts), healthcare (antibacterial and medical devices), solar energy (solar panels), electric vehicle batteries, photography, jewelry, and currency.

According to the Silver Institute’s report, silver demand has outpaced supply for the past five years, resulting in continuous deficits. In 2024, the deficit reached 182 million ounces, and a deficit of 117.6 million ounces is expected in 2025. Global silver production has peaked and is now declining as easily exploitable mines are depleted.

Silver Price Movement from 2011 to Present (Source: Kitco)

However, investing in silver still entails risks due to its more significant price fluctuations compared to gold. Silver prices can vary up to 2% in a single trading day, so prospective buyers need to be well-informed and mentally prepared.

Historically, silver prices reached a record high of nearly $50 per ounce in 2011, dropped below $14 per ounce in 2015, and are now hovering around $40 per ounce. In contrast, gold prices have steadily climbed over the past half-century, from about $40 per ounce in the early 1970s to $3,400 per ounce today.

The Soaring Price of Gold: USD Hits All-Time High

This morning (August 20th), the price of SJC gold soared to a staggering peak of VND 125 million per tael, firmly establishing a new high. In tandem with this ascent, the value of USD in Vietnam’s banking system breached the threshold of VND 26,500 per USD, marking yet another record in its own right.