Chairman of Dua Fat continues to be forced to sell over 14.7 million shares

In the three sessions on August 19, 20, and 21, Mr. Le Duy Hung – Chairman of the Board of Directors of Dua Fat Joint Stock Company (UPCoM: DFF) was forced to sell over 14.7 million shares by a securities company, reducing his ownership ratio from 42.16% to 23.73%, equivalent to nearly 19 million shares.

Based on the average closing price of the above three sessions at VND 1,567/share, the estimated value of the Chairman’s DFF shares that were forcibly sold was over VND 23 billion.

Previously, in the two sessions on February 18 and 19, 2025, Mr. Hung was also forced to sell by a securities company for more than 4 million shares, reducing his ownership ratio from over 47% to over 42%. Thus, since the beginning of the year, the Chairman of DFF has been forced to sell more than 18.7 million shares, equivalent to more than 23% of the capital.

Swap of ownership between father and son of Bau Duc at HAG

Mr. Doan Nguyen Duc (Bau Duc), Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG), reported a successful sale of 25 million HAG registered shares through the matched order method, reducing his ownership ratio from 31.2% to 28.84%, equivalent to nearly 305 million shares. The transaction took place from August 18-22.

On the opposite side, Mr. Duc’s son, Doan Hoang Nam, successfully bought 27 million new HAG shares also through a matched order on August 22, increasing his ownership ratio from 0% to 2.55%.

The 2025 semi-annual management report shows that Bau Duc’s family also includes his daughter, Doan Hoang Anh, holding 13 million shares, or 1.23% of the capital. In total, the three of them currently hold approximately 32.62% of HAGL’s capital.

Chairman of MBG‘s company sells 4.25 million shares

From August 8 to 15, Quoc Bao Van Ninh Joint Stock Company sold 4.25 million MBG shares of MBG Group Joint Stock Company (HNX: MBG), equivalent to 3.54% of MBG‘s capital. After the transaction, Quoc Bao Van Ninh no longer holds any capital here. Based on the average closing price during the period from August 8 to 15 at VND 4,300/share, the transaction was valued at nearly VND 18.3 billion.

Mr. Pham Huy Thanh – Chairman of the Board of Directors of MBG is also the Chairman of the Board of Directors of Quoc Bao Van Ninh. Currently, Mr. Thanh holds more than 11.5 million MBG shares (9.58%).

A related organization of FCS‘s leader intends to sell 2 million shares

Song Moc Investment Joint Stock Company has just registered to sell 2 million shares of Ho Chi Minh City Food Joint Stock Company (Foodcosa, UPCoM: FCS) from August 22 to September 19 to restructure its investment portfolio.

If the transaction is successful, the ownership ratio of Song Moc Investment in FCS will decrease from 24.25% (over 7.1 million shares) to 17.46% (over 5.1 million shares). The deal is expected to bring in about VND 16.2 billion based on the price of VND 8,100/share of FCS in the afternoon session of August 21.

Song Moc Investment has a close relationship with FCS as three leaders, including Ms. Nguyen Ngoc Mai Trinh – Supervisory Board member, Ms. Phan Thi Bich Tuyen – Member of the Board of Directors and Deputy General Director, and Ms. Pham Thi Thuy Hang – Deputy General Director, are representatives of the organization’s capital contribution, but they do not hold FCS shares under their personal names.

CEO of QPH wants to divest entirely

Mr. Le Thai Hung – Member of the Board of Directors and CEO of Que Phong Hydropower Joint Stock Company (UPCoM: QPH) registered to sell all of his more than 1.3 million shares (7.18%) for portfolio restructuring purposes.

The expected transaction period is from September 8 to October 6. Based on the current market price of QPH shares (VND 36,500/share), Mr. Hung could earn nearly VND 49 billion from this deal.

Mr. Hung is currently one of the two major shareholders of QPH. The other major shareholder is the parent company, Trung Son Power Company, with an ownership ratio of 85.52%.

Vice Chairman of RCC registered to sell all shares

Mr. Ta Huu Dien, Vice Chairman of the Board of Directors of Railway Construction Joint Stock Company (UPCoM: RCC), registered to divest all of his more than 6.24 million shares, equivalent to 19.46% of the capital. The transaction is expected to take place from August 20 to September 18 through matched orders and order matching methods for personal investment purposes.

During the same period, Mr. Dien’s daughter-in-law, Ms. Nguyen Thuy Linh – Administration Manager of the Company, also registered to sell more than 440,000 RCC shares for personal investment purposes.

Trung Son Power intends to divest its entire 86% stake in SVH

After more than 7 years of holding, Trung Son Power Joint Stock Company registered to sell all of its 12.7 million shares, equivalent to 86.01% of the capital of Song Vang Hydropower Joint Stock Company (UPCoM: SVH) from September 8 to October 6. Based on the reference price of VND 6,000/share, the deal value is only about VND 76.5 billion, while the initial investment capital was more than VND 127 billion.

The Chairman of the Board of Directors of SVH – Mr. Le Thai Hung is also the General Director of Trung Son Power. In addition to the holding of the parent company, Mr. Hung directly owns nearly 1.5 million SVH shares, equivalent to 10.03% of the capital, making him the second largest shareholder of SVH.

|

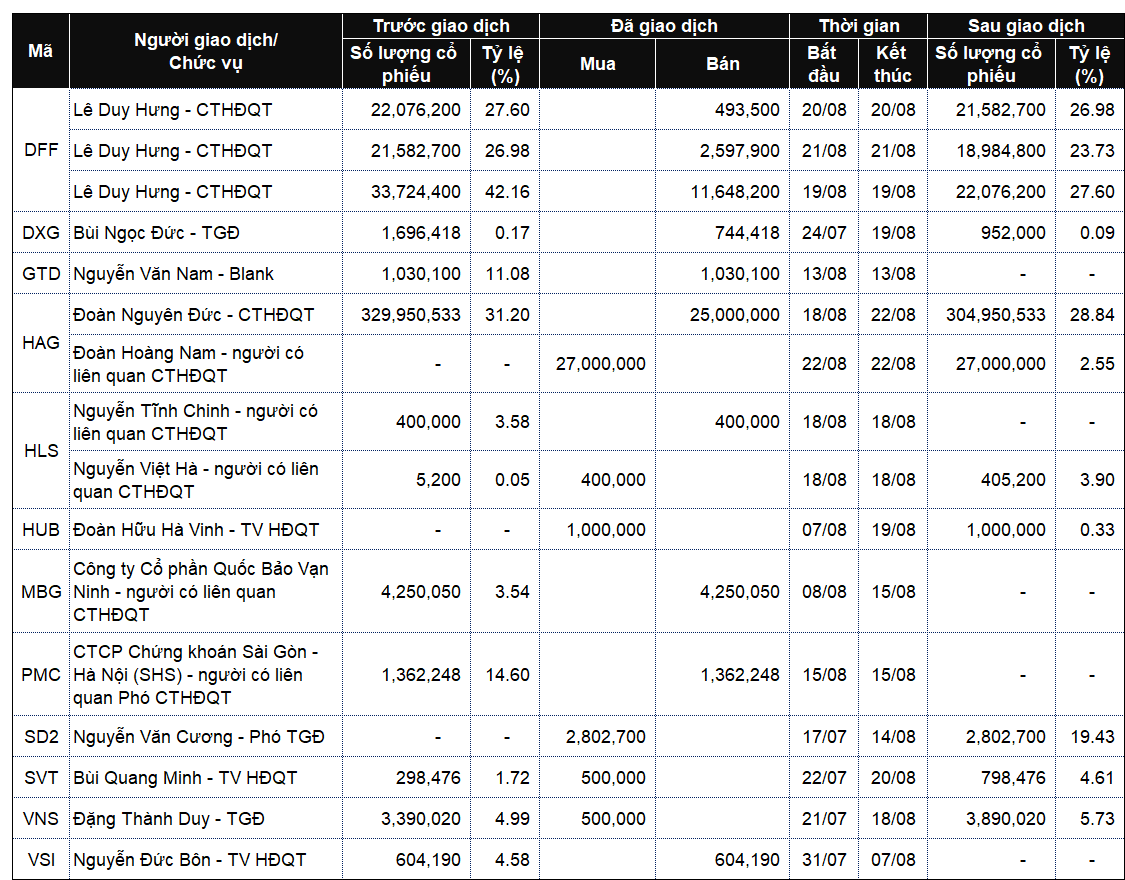

List of company leaders and relatives trading from August 18-22, 2025

Source: VietstockFinance

|

|

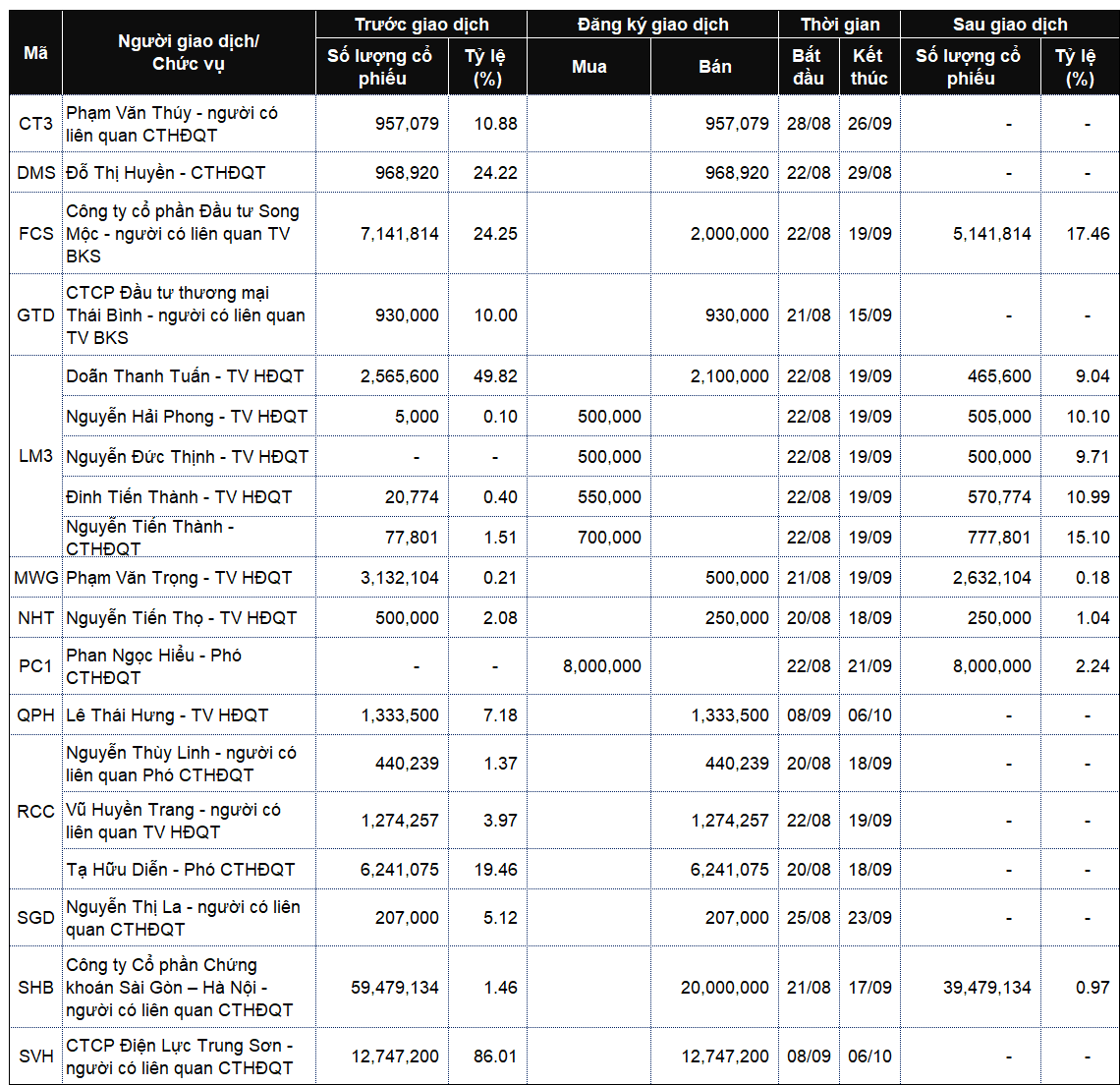

List of company leaders and relatives registered for trading from August 18-22, 2025

Source: VietstockFinance

|

– 14:53 25/08/2025

The Stock Market Crash: What’s Next for Investors?

The VN-Index is set to surge beyond all investor expectations with liquidity and cash flow doubling or even tripling from the previous cycle.