The simultaneous offloading of inventory by multiple developers during this period stems from a combination of seasonal and positive macroeconomic factors. (Photo: MarketTimes)

This assessment is provided by Mr. Tran Minh Tien, Director of the One Mount Group’s Market Research & Customer Insights Center, based on market observations and data.

Explosion of Supply

According to data from the One Mount Group’s Market Research & Customer Insights Center, in July and August 2025, the Hanoi market witnessed the announcement or launch of 19 residential projects, offering approximately 12,000 high-rise apartments and 6,000 low-rise units (villas, townhouses, and shophouses).

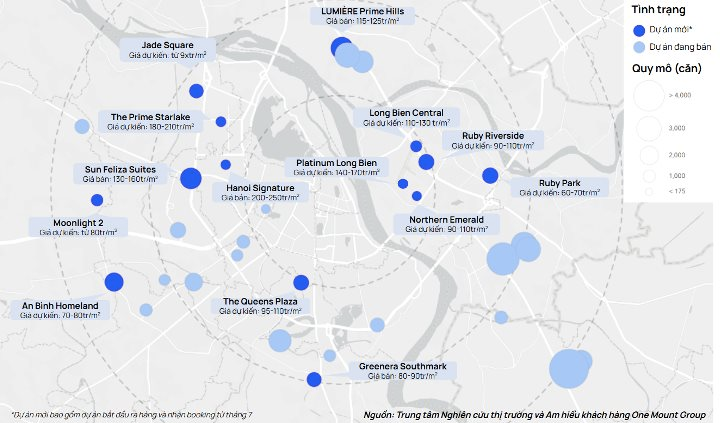

Map of newly launched high-rise projects and existing projects in July 2025

In the high-rise segment, the supply is spread across various areas, from the center to peripheral districts and counties. The portfolio of projects launched during this period is quite diverse, ranging from high-rise apartments like Lumiere Prime Hills and The Prime Starlake to low-rise developments such as Alluvia City and Noble Palace Tay Thang Long. In addition to the traditional East-West axis of previous years, the supply has expanded southward to Hoang Mai and Thanh Tri and northward to Dong Anh—areas earmarked as new development hubs.

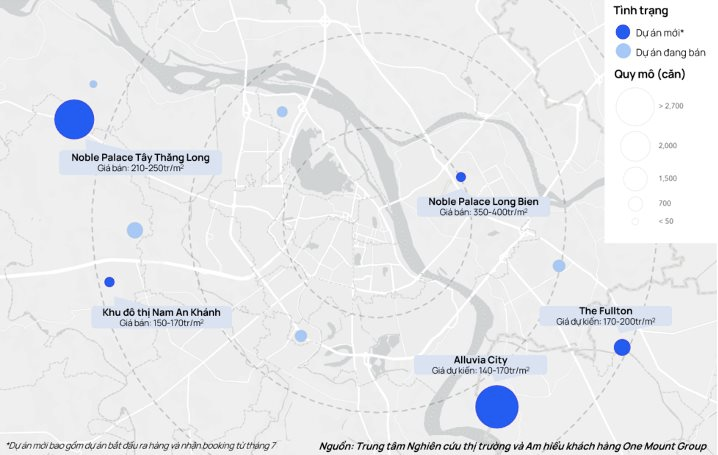

Map of low-rise projects launched in July 2025

While high-rise supply is evenly distributed, the low-rise segment is concentrated mainly in the East and West regions, where there is more available land and development potential, notably in Dong Anh, Gia Lam, and Hoai Duc districts, which are benefiting from key infrastructure projects.

Mr. Tran Minh Tien, Director of the One Mount Group’s Market Research & Customer Insights Center, attributes this trend to the scarcity of large land parcels in the inner city, prompting developers to focus on peripheral areas where infrastructure is being significantly upgraded.

Diverse Pricing and a More Positive Market

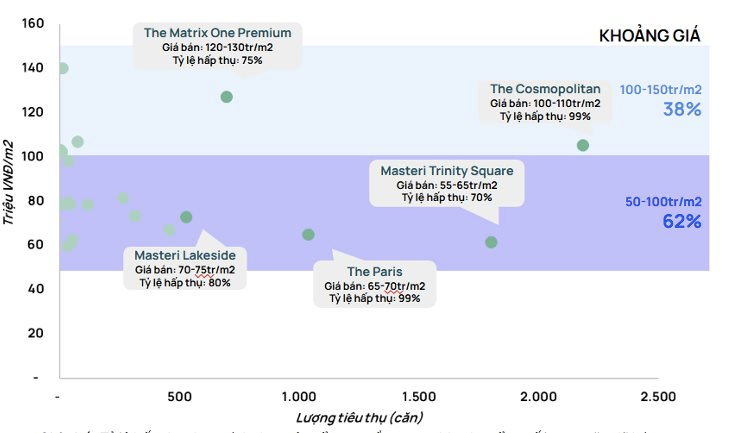

In addition to the quantitative increase, there is also greater diversity in pricing and product segments. High-rise apartments range from 70-90 million VND/sqm in the luxury segment to over 100 million VND/sqm in the ultra-luxury category, with some projects even approaching the 200 million VND/sqm mark.

Despite these high prices, according to One Mount Group’s Q2 Hanoi real estate market report, new projects still achieved absorption rates of 75% or higher, indicating sustained strong demand, especially for inner-city projects. This underscores the resilience of real estate demand, even amidst elevated price levels.

Apartment absorption rates by project, Q2 2025

Mr. Tran Minh Tien attributes the simultaneous offloading of inventory by multiple developers during this period to a combination of seasonal and positive macroeconomic factors.

Seasonally, it is customary for many customers to make early purchases before the lunar month of “Ngau” to avoid the traditionally taboo period for transactions. This is also when developers typically launch projects to maintain market liquidity.

On the macroeconomic front, borrowing rates for home purchases have remained low at 6-8%/year, favoring both owner-occupiers and investors. The expansion of the credit “room” has improved capital access for businesses and customers alike. Moreover, public investment disbursement has been accelerated, with significant infrastructure projects such as Ring Road 3.5, Ring Road 4, metro lines, and new bridges (Ngoc Hoi, Tran Hung Dao, Van Phuc) being initiated, thereby enhancing the value of real estate in adjacent areas.

Additionally, improved market sentiment is another factor contributing to the market’s positivity. A Q2 2025 survey revealed that 87% of customers (with household incomes of 25 million VND/month or higher) intend to purchase real estate this year, an increase compared to the end of 2024 and the same period in 2023.

“The market in 2025 presents a confluence of three critical factors for continued growth: abundant supply, stable demand, and restored confidence,” asserts Mr. Tran Minh Tien. “Selecting projects that align with one’s needs and financial capabilities will enable buyers to optimize their investments in this burgeoning market.”

Given the current dynamics, the lunar month of “Ngau” in 2025 is no longer a transaction trough but an opportunity to access quality products and avail of developer promotions. Hanoi’s primary market is ushering in a new phase, presenting opportunities for both end-users and investors alike.

The Rise of Real Estate Projects Along the Billion-Dollar Boulevard: Unveiling the Historical Perspective

While luxury projects along the West Thang Long axis in Hanoi have reached their peak price, Vinhomes Wonder City is a rare metropolitan area that presents a significant upside potential of doubling or tripling in value. Being in the initial phase of its growth cycle, this urban development holds immense untapped potential for investors and homebuyers alike.

The Birth of Jade Square: Captivating Hanoi’s Real Estate Market

On August 14-15, 2025, a strategic partnership signing ceremony, introduction, and in-depth training for the Jade Square project took place at the VICC International Convention Center in Nam An Khanh New Urban Area. The event captured the attention of the entire Hanoi real estate market, especially the Tay Ho Tay area.

Affordable Housing Gets an Upgrade: Are Skyrocketing Prices Justified?

In recent years, the Hanoi condominium market has witnessed an intriguing paradox. Projects that were once considered affordable have now reached, and in some cases, surpassed the price threshold of luxury developments. However, the quality and amenities remain largely unchanged. This anomaly presents a unique challenge for homebuyers, as they navigate a market where price tags no longer align with traditional expectations of value.

Is the Big Wave Coming? A Sneak Peek Into the Da Nang Land Market and Its Future Prospects

As investors with cash reserves ranging from 4 to 10 billion VND start returning to the market, it signals a positive shift in the Danang land market. This resurgence of investment activity post-Tet has increased liquidity and selling prices, indicating that the market is poised to ride a new wave of growth.

Redefining West Hanoi Living: Avenue Garden and the OSI Holdings Advantage

The experts predict that the west of Hanoi will be the next destination for discerning residents seeking a high quality of life and investment potential. Avenue Garden presents itself as the perfect answer to the search for a place that offers both a “superior standard of living” and long-term investment opportunities.