On July 28 and 29, the “Group of 4 Companies” comprising Hoang Truong Tourism Real Estate Investment Joint Stock Company, Bien Dong Investment and Management Consulting Joint Stock Company, Phu Thinh Phat Investment Joint Stock Company, and Duc Mai Import-Export Joint Stock Company announced resolutions after obtaining the consent of bondholders and related parties. The four companies added 14 land-use rights (LURs) as collateral, sharing the secured assets (SAs) for the secured obligations of four bond lots that they issued, namely HT2020, BIENDONG2020, PTP2020, and DUCMAI2020.

|

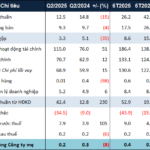

The HTCH2024001 bond issued by Hoang Truong is valued at VND 1,400 billion. РТP2020, issued by Phu Thinh Phat on December 23, 2020, and maturing on June 23, 2026, has an outstanding balance of VND 900 billion. The DUCMAI2020 bond, issued by Duc Mai on December 22, 2020, and maturing in December 2025, has an outstanding balance of nearly VND 1,352 billion. The BIENDONGH2025001 bond, issued by Bien Dong on December 14, 2020, is valued at nearly VND 1,321 billion and matures on June 14, 2025. |

At the same time, the parties also approved the transfer of ownership in the enterprise that is the investor of the project of the high-rise commercial, service, and office housing area in An Khanh Ward, Thu Duc City, Ho Chi Minh City to the transferee.

“The Transferee”, after receiving the capital contribution in the legal entities owned by the above four enterprises, will transfer the money to the bank accounts of these enterprises to settle their bond and loan debts. And the Transferee will continue to use the received capital contribution as collateral for its loan and those of related companies at the bank.

The Group of 4 Companies shares 14 LURs as SAs for their own bond obligations and other secured obligations with equal priority of payment.

The 14 LURs, with a total area of 6,988.5 m2, are owned by Sun City Real Estate Investment Joint Stock Company (Sun City). Sun City is also the investor of the project of the high-rise commercial, service, and office housing area in An Khanh Ward, Thu Duc City, Ho Chi Minh City (referred to as “Sun City’s Project”).

How will the ownership transfer be carried out?

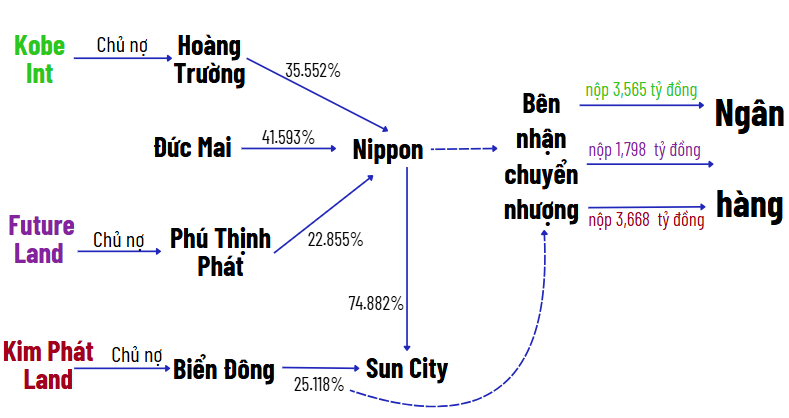

Hoang Truong transfers 35.55% of Nippon Company’s capital to the Transferee. Upon completion of the change of ownership in Nippon, the Transferee will pay a minimum of VND 3,565 billion to the bank and mortgage its capital contribution in Nippon for its loan at the bank.

Subsequently, Hoang Truong will repurchase the HT2020 bond before maturity and settle the debt of Kobe Int Real Estate Investment Company.

Regarding Phu Thinh Phat, this unit will transfer nearly 22.9% of Nippon’s capital to the Transferee, receiving an amount of nearly VND 1,798 billion.

Phu Thinh Phat will also mortgage assets to secure the Transferee’s loan at the bank (the total credit limit is no more than VND 9,500 billion). Nippon is allowed to use SA 2 (74.882% of Sun City’s capital owned by Nippon) to secure obligations at the bank of companies that are capital contributors of Sun City or Nippon.

After completing the procedure, the bank will release the amount of VND 1,798 billion, and Phu Thinh Phat will repurchase the PTP2020 bond before maturity and settle the debt of Future Land Investment Joint Stock Company.

The remaining 41.59% of Nippon’s capital, owned by Duc Mai, will also be transferred. Then, the Transferee will transfer VND 3,668 billion to Duc Mai’s account at the bank. Upon completion of the change of ownership procedure at Nippon, the Transferee will mortgage this Nippon capital for its loan at the bank. In addition, with SA 2 (74.882% of Sun City’s capital owned by Nippon), Nippon is permitted to mortgage to secure obligations at the bank of the Company that is a capital contributor of Sun City or Nippon.

Once the money is released, Duc Mai will repurchase the entire DUCMAI2020 bond before maturity and settle the debt of Kim Phat Land Company.

As for Bien Dong, it will transfer more than 25% of Sun City’s capital to the Transferee. Upon completion, the Transferee will mortgage this capital contribution in Sun City for its loan at the bank. The Transferee will deposit a minimum of VND 1,829 billion into the blocked account at the bank, and it will be released upon completion of the legal process. At the same time, Bien Dong will repurchase the entire BIENDONG2020 bond before maturity and settle the debt of Kim Phat Land Investment Joint Stock Company.

|

What are the other SAs? SA 3: Property rights currently owned and arising in the future from and/or related to Sun City’s Project. SA 4: Land-use rights for the land with land use right certificates related to Sun City’s Project. SA 5: Property rights arising from documents/agreements related to compensation and transfer of land-use rights for the land belonging to Sun City’s Project. SA 6: 14 LURs in Sun City’s Project, with a total area of 6,988.5 m2. |

New Owners of the Group of 4 Companies

Before December 2024, Hoang Truong had a charter capital of VND 1,200 billion, of which Mr. Vu Duy Khuong contributed 70% and Mrs. Pham Thi Diem contributed 30%.

In mid-December 2024, the company increased its capital to VND 2,000 billion, in which Silver Field International Trading Joint Stock Company held 30%, Phuoc Long Real Estate Investment and Trading Company Limited held 10%, and Mrs. Nguyen Thi Tram Anh held 60%. Notably, in mid-April this year, Hoang Truong introduced a new owner, Kobe Int Real Estate Company Limited.

Kobe Int was established in 2021 in Hanoi, with its main business being real estate trading. Its initial charter capital was VND 10 billion, and Ms. Vu Thi Hoang Anh (born in 1996) served as Director and legal representative. At the beginning of 2022, the company increased its capital to VND 310 billion.

Bien Dong, at the end of last year, increased its capital from VND 800 billion to VND 880 billion, with Ms. Hoang Thi Kim Thanh (born in 1950) as the enterprise owner and General Director.

In January 2025, Duc Mai had four shareholders, including Kim Phat Land with 13.5%, An Thai Land Business Company Limited with 36%, M Home Real Estate Business Company Limited with 40%, and Mr. Nguyen Thanh Long with 10.5%. In April, the company updated its new owner as Kim Phat Land.

Kim Phat Land was established at the end of 2023 in Hanoi, with its main business being real estate trading. Its initial charter capital was VND 100 billion, and Ms. Hoang Thi Kim Thu, the Director and legal representative, was the owner. In April of this year, the company increased its capital to VND 415 billion.

Phu Thinh Phat has a charter capital of VND 780 billion, and in April, it also changed its owner to Future Land Investment Joint Stock Company. Previously, the company was owned by Mr. Hoang Hong Hoa (Chairman of the Members’ Council) with 61.538% and LC Real Estate Business Company Limited with 38.462%.

Future Land was established at the end of 2023 in Ho Chi Minh City with a capital of VND 3 billion, owned by Ms. Nguyen Thi Dieu Anh. In April of this year, the company was directed by Ms. Nguyen Thi Phuong (born in 1998) as Director and increased its capital to VND 120 billion.

Thus, through these transactions, Hoang Truong, Phu Thinh Phat, and Duc Mai will divest their entire capital from Nippon (the enterprise holding 74.882% of Sun City), while Bien Dong will divest its capital from Sun City.

Matrix diagram of capital rotation for debt repayment of Sun City’s owner group

|

|

Sun City’s project has a scale of 8.96 hectares, a total investment of over VND 10,500 billion, a maximum land use coefficient of 10 times, a maximum height of 35 floors, and 20% of the land area for social housing as prescribed. The project is expected to be implemented from 2024 to 2032, with a duration of 50 years. Sun City Company has a charter capital of VND 3.8 trillion, in which Nippon contributes 74.882% and Bien Dong contributes 25.118%. Nippon has a charter capital of over VND 3.9 trillion, in which Phu Thinh Phat contributes 22.855%, Hoang Truong contributes 35.552%, and Duc Mai contributes 41.593%. |

– 12:00 23/08/2025

“Withdrawn Applications for Residential Land Use, Yet Tax Debts Still Leave People ‘Hanging’: The Tax Department Explains Why”

The hefty land-use conversion tax has burdened many residents, who, after withdrawing their applications, were still faced with outstanding tax liabilities and late payment penalties by the tax department. This has left them wondering, “Why are we still penalized despite the land registry office’s approval of our withdrawal?”

“NBB Successfully Transfers NBB Quang Ngai After a Year-Long Delay”

On August 13th, NBB Joint Stock Company (HOSE: NBB), a prominent investment firm, announced that it had successfully completed the transfer of its capital contribution in its subsidiary, NBB Quang Ngai One Member Co., Ltd., to SDP Investment Joint Stock Company.

How to Prove the Origin of Land Purchased with a Handwritten Agreement for a Red Book?

The 2024 Land Law provides for the issuance of red books for households and individuals who are using land without documents relating to land use rights, provided they are not in violation of land laws and their case does not involve land allocated by an incompetent authority.