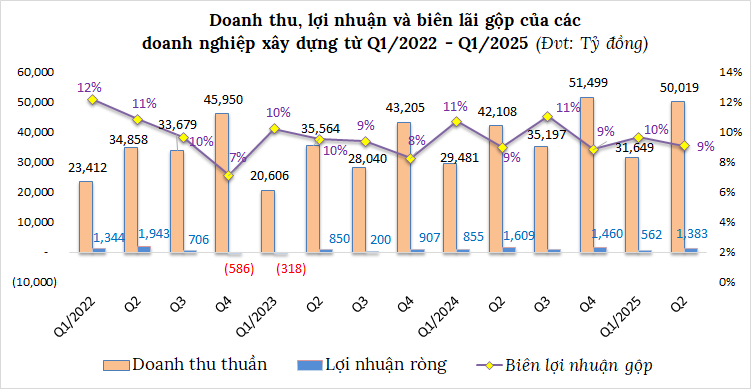

According to VietstockFinance statistics, 99 construction companies listed on the stock exchange (HOSE, HNX, UPCoM) have published their second-quarter financial statements for 2025, with total revenue exceeding 50 trillion VND, a 19% increase year-on-year. Meanwhile, net profit reached nearly 1,400 billion VND, a 14% decrease. The industry’s gross profit margin for the quarter stood at 9%.

Source: VietstockFinance

|

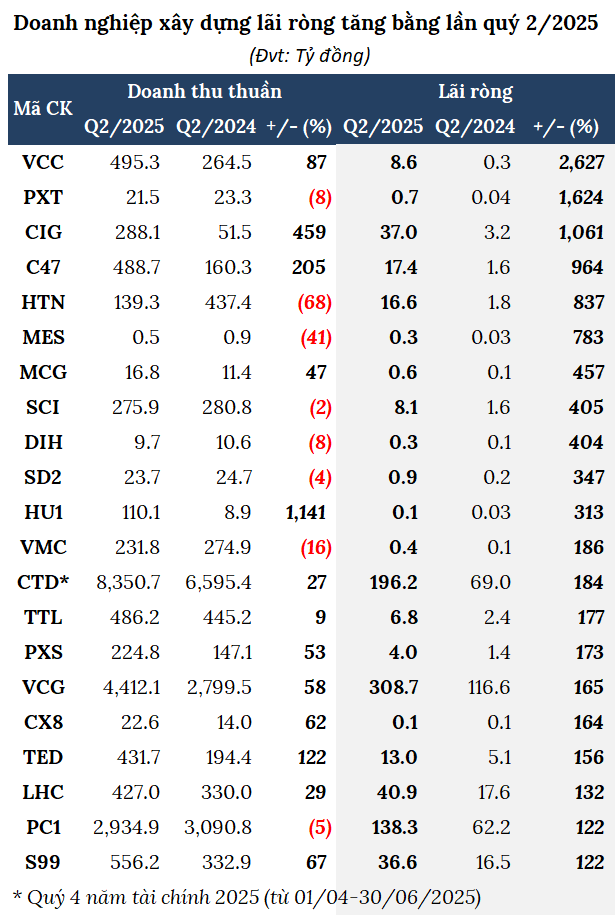

Breakneck growth for some enterprises

Among the companies that have published their results, 21 units reported an increase in profits. Vinaconex 25 (HNX: VCC) led the growth with a net profit of nearly 9 billion VND, 27 times higher than the same period last year, thanks to a construction revenue of over 347 billion VND, double that of the previous year. Cumulatively, for the first six months, the profit exceeded 10 billion VND, ten times higher than last year, achieving 42% of the yearly plan.

COMA 18 Joint Stock Company (HOSE: CIG) earned 37 billion VND in the second quarter, 12 times higher than last year, thanks to a significant increase in its core business activities. Six-month profit exceeded 41 billion VND, 31 times higher, but only achieved nearly 15% of the target.

Favorable construction activities at home and abroad helped Construction Joint Stock Company 47 (HOSE: C47) achieve a net profit of over 17 billion VND in the second quarter, 11 times higher than the same period last year, the highest since the first quarter of 2022. Six-month cumulative profit was nearly 28 billion VND, ten times higher, achieving 70% of the plan.

Coteccons (HOSE: CTD) made an impression with a net profit of over 196 billion VND in the fourth quarter of the 2025 financial year (April 1 – June 30, 2025), nearly three times higher than the same period last year, the highest in 22 quarters, thanks to increased construction revenue and provision reversals. For the entire 2025 financial year, the company brought in nearly 454 billion VND in profit, exceeding its plan by 6%.

With a surge in construction activities, Vinaconex (VCG) also made a substantial profit in the second quarter, with nearly 309 billion VND, more than three times higher than the previous year. In the first six months, profit decreased by 29% to nearly 437 billion VND, achieving 42% of the target.

Source: VietstockFinance

|

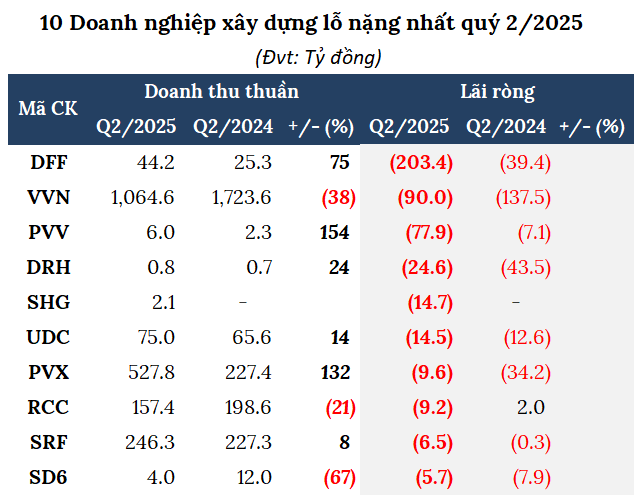

Prolonged losses

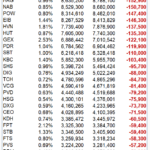

In contrast to the growth group, many businesses continue to sink deeper into a spiral of losses. Dua Fat Group (UPCoM: DFF) extended its losing streak to the eighth consecutive quarter, with a loss of over 203 billion VND, bringing its cumulative loss to over 882 billion VND—a worrying figure considering its charter capital of only 800 billion VND.

The Vietnam Industrial Construction Joint Stock Company (VVN) recorded its eleventh consecutive quarterly loss, with 90 billion VND, and a cumulative loss of over 3,125 billion VND; owner’s equity was negative by more than 2,280 billion VND.

Meanwhile, Vinaconex 39 (UPCoM: PVV) suffered a massive loss of nearly 78 billion VND, marking its 38th consecutive quarterly loss (since the first quarter of 2016), with a cumulative loss of nearly 535 billion VND, dragging owner’s equity down by nearly 213 billion VND. Short-term debt exceeded short-term assets by nearly 439 billion VND. Overdue loans exceeded 234 billion VND, and unpaid interest amounted to nearly 393 billion VND. The auditor opined that these factors raise significant doubts about PVV‘s ability to continue as a going concern in the next 12 months.

Source: VietstockFinance

|

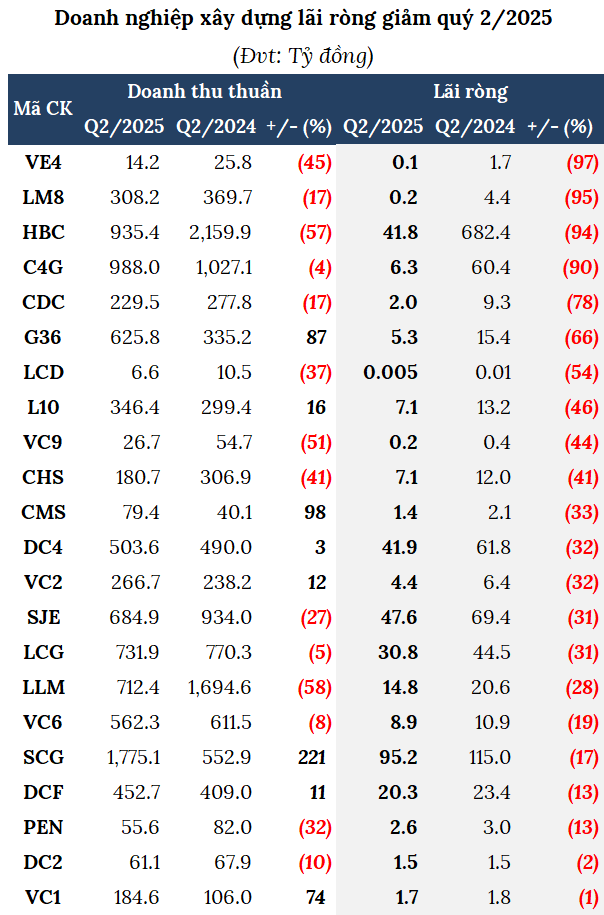

Notably, Hoa Binh Construction Joint Stock Company (UPCoM: HBC) saw its second-quarter net profit drop by 94%, to 42 billion VND. The company attributed this to the challenging market conditions in the construction industry. Furthermore, HBC provisioned over 260 billion VND for doubtful debts, causing a decrease in profit. In the first six months, net profit was over 47 billion VND, a 94% decrease, achieving just over 14% of the yearly target.

CIENCO4 Corporation (UPCoM: C4G) and DICERA Holdings (HOSE: DC4) also reported profits of 6 billion and 42 billion VND, respectively, decreases of 90% and 32%.

Source: VietstockFinance

|

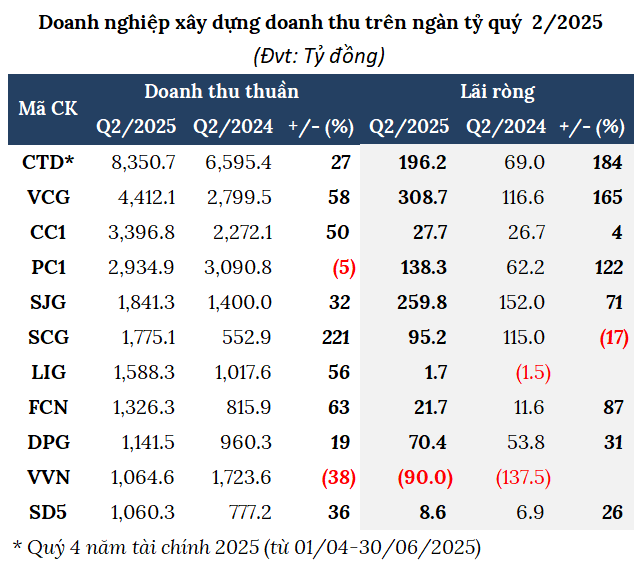

Industry leaders maintain billion-dollar revenues

In the second quarter, 11 construction companies achieved revenues of over 1,000 billion VND. In addition to industry leaders such as CTD, VCG, CC1, and PC1, the quarter saw the participation of the SCG Construction Group (HNX: SCG), with revenues of over 1,775 billion VND, 3.2 times higher than the same period last year, thanks to a threefold increase in construction activities. Net profit reached over 95 billion VND, a 17% decrease.

FECON Corporation (HOSE: FCN) witnessed a revenue increase of over 60%, reaching over 1,600 billion VND, a 63% increase year-on-year, while net profit was nearly 22 billion VND, an 87% increase.

Song Da 5 Joint Stock Company (HNX: SD5) attracted attention as its revenue surpassed 1,000 billion VND for the first time, a 36% increase year-on-year, while net profit was nearly 9 billion VND, a 26% increase.

Source: VietstockFinance

|

The “blood clot” named accounts receivable

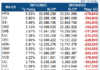

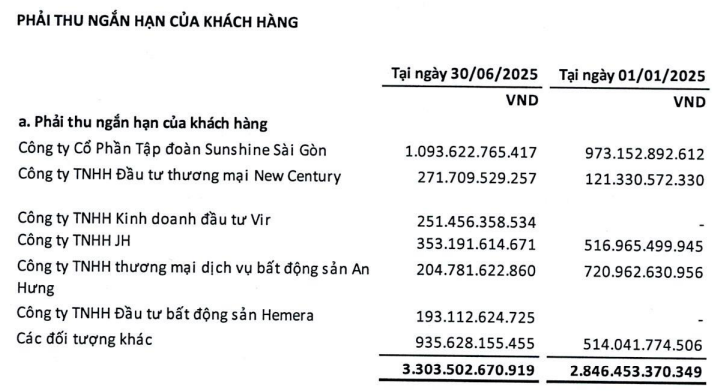

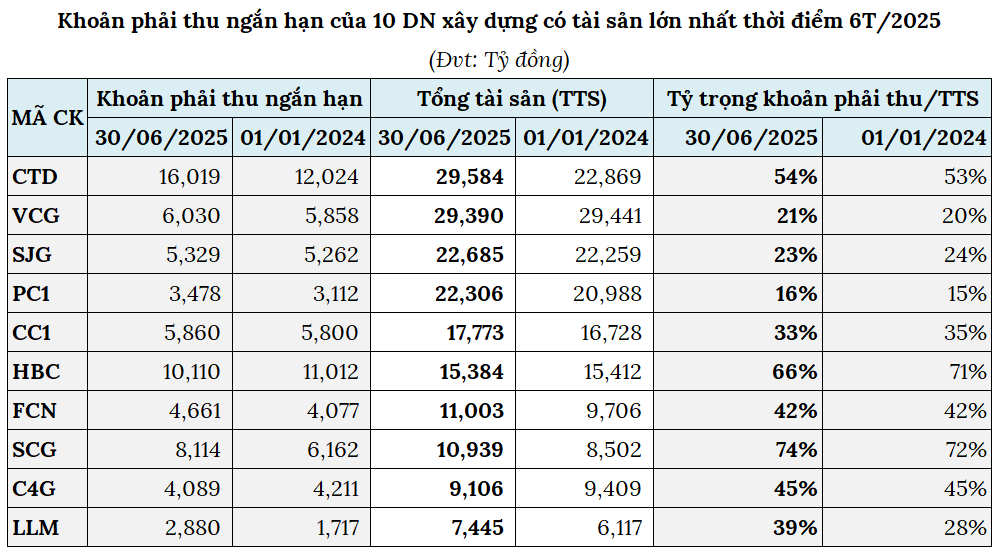

One of the most significant challenges for construction companies is the issue of accounts receivable. Looking at the balance sheets of the ten companies with the largest total assets as of June 30, 2025, short-term receivables, especially short-term receivables from customers, account for an extremely large proportion, up to 50%, and even up to 70% of total assets.

This figure reflects that most of the companies’ assets are not in cash or inventory but in amounts owed by customers for projects that have been delivered or partially completed.

This reality is both a peculiarity and a significant bottleneck for the industry, as cash flow is prolonged and dependent on the payment progress of investors. Construction companies invest capital in advance to purchase materials, pay workers, rent equipment, etc., but they receive payment slowly, sometimes taking several months or years.

The risk of bad debt is always present. If customers encounter difficulties or disputes arise, accounts receivable can turn into bad debts, forcing companies to make provisions. In this case, profits exist only on “paper” because revenue has been recognized, but cash has not been received, causing a discrepancy between accounting profits and actual cash flow.

Typically, CTD has a large amount of short-term receivables exceeding 16 trillion VND, a 33% increase from the beginning of the year and accounting for 54% of total assets. Most of this amount comprises receivables from customers of over 15.3 trillion VND, and the company has provisioned over 1.2 trillion VND for doubtful debts.

HBC also has short-term receivables of over 10.1 trillion VND, accounting for 66% of total assets, with customer receivables of nearly 6.3 trillion VND and a provision of over 1.8 trillion VND for doubtful debts.

At SCG, short-term receivables amounted to over 8.1 trillion VND, a 32% increase, and accounted for 74% of total capital sources. Of this, customer receivables amounted to over 3.3 trillion VND, a 16% increase.

Source: SCG

|

Overall, the extremely high proportion of short-term receivables from customers is a clear warning about the financial health of many construction companies. Profits may appear on the financial statements, and contracts may be plentiful, but actual cash flow is still “stuck” with the customers.

Source: VietstockFinance

|

Benefiting from public investment and a flourishing real estate market

According to MBS, the period of 2025-2026 will be pivotal for the medium-term public investment cycle, with many key projects such as the North-South Expressway (phase 1), Long Thanh International Airport (phase 1), and ring roads 3 and 4 in Hanoi and Ho Chi Minh City being expedited. Simultaneously, the real estate supply is expected to increase by 30% due to the removal of legal obstacles and the maintenance of low-interest rates.

MBS forecasts that the construction industry will grow by about 13% year-on-year in 2025, and the backlog of major companies will increase by 8% thanks to winning bids for many key projects, and the civil construction industry is expected to improve.

In the period of 2025-2030, the gross profit margin for the industry is projected to be 6.5%, a 1% increase from the previous period, as most projects are awarded through bidding with higher contract prices than direct appointment. Moreover, stable prices for some construction materials, such as steel, will help cool down raw material costs.

– 12:00 22/08/2025

Dabaco Takes Over Another Livestock Company in Thanh Hoa

“Dabaco is set to acquire a 98% stake in Lam Son Nhu Xuan CNC Agriculture Joint Stock Company, a Thanh Hoa-based enterprise. This acquisition involves the transfer of 9.8 million shares, representing a significant step for Dabaco as it expands its presence in the dynamic and thriving agricultural sector of Vietnam.”

The Ultimate Guide to HFIC’s Successful Equity Offering: Raising Nearly VND 800 Billion

The Ho Chi Minh City Finance Investment State-owned Company (HFIC) is looking to offload its remaining 116.3 million subscription rights of Ho Chi Minh City Securities Corporation (HSC) shares. With a set price of VND 6,875 per subscription right, the state-owned company aims to generate over VND 799 billion from this sale.

“Highway Investor Reports $156 Million Profit in H1 2025”

The Hanoi Highway, a prominent BOT enterprise within the CII ecosystem, witnessed a slight uptick in profits, surpassing 156 billion VND in the first half of 2025.