The State Bank of Vietnam (SBV) increased the bidding scale on the collateralized lending channel (OMO) while maintaining the interest rate at 4.0%/year during the trading session on August 22. As a result, VND 8,291 billion was bid at a tenor of 7 days, VND 30,000 billion at 14 days, VND 13,839 billion at 28 days, and VND 1,165 billion at 91 days. In total, the SBV injected nearly VND 53,295 billion of new loans into the banking system through the OMO channel on August 22.

After offsetting VND 32,089 billion of matured OMO, the SBV net injected VND 21,206 billion into the market – the highest level in almost a month. This brought the total outstanding OMO to VND 198,934 billion.

However, it is important to highlight that with OMO bids concentrated in the 14-28 day tenor range, the SBV’s support to the banking system is only short-term in nature.

The SBV has consistently maintained a net liquidity injection stance since the beginning of 2025, with a significant expansion since the end of June.

The SBV’s aggressive implementation of open market operation solutions aims to reduce interbank market rates to timely and fully meet banks’ liquidity needs. This supports banks in accessing low-cost funds from the SBV to further reduce lending rates in line with the government’s orientations and directives.

However, maintaining a supportive policy stance also contributes to upward pressure on the USD/VND exchange rate, especially as the US dollar is showing signs of recovery in the international market.

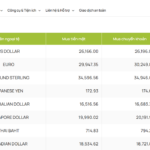

On August 22, the central exchange rate was increased by 25 VND to a record high of 25,298 VND/USD by the SBV. This was the fourth consecutive increase in the central rate this week. The reference buying and selling rates were also adjusted upwards to 24,084 – 26,512 VND/USD by the Banking Exchange Department.

USD rates at commercial banks continued to climb for the fifth consecutive session, with increases ranging from 24 to 76 VND in both buying and selling prices. Currently, the selling price of USD is pegged close to the ceiling rate of 26,562 VND/USD. Since the beginning of the year, USD rates at banks have risen by nearly 4%, despite a nearly 9% drop in the USD in the international market. Faced with an inability to further increase selling prices, many banks have significantly increased buying prices, indicating persistent pressure on the exchange rate.

According to Mr. Pham Chi Quang, Director of the Monetary Policy Department, maintaining a strong currency requires it to be attractive. Part of this attractiveness is derived from interest rates. However, in the past, the SBV has implemented policies to maintain low-interest rates to support economic growth.

“To achieve low-interest rates, there must be certain trade-offs, including exchange rate trade-offs,” said Mr. Quang at a recent press conference.

Additionally, according to the leader of the Monetary Policy Department, in order to support liquidity for credit institutions and help them access low-interest rates, the State Bank has maintained low interbank interest rates. This has led to a negative interest rate differential between VND and USD, stimulating speculative demand and foreign currency hoarding. This is also one of the factors putting pressure on the exchange rate.

At the same time, despite Vietnam’s stable balance of payments and trade surplus, rapid fund conversion due to continuous foreign capital outflows from the stock market since 2024 has exerted significant pressure on the foreign exchange market.

The Abundant Forex Supply: Why Are Exchange Rates Still Rising?

The current exchange rate adjustment can be seen as a calculated move, carefully absorbing immediate pressures while providing room for the economy to breathe in the medium term.

“Central Bank’s Rate Hike: USD Surges Past VND 26,500 at Banks, Flirting with Regulated Ceiling”

The intense competition in the market has forced banks to refrain from increasing selling prices any further. However, their significant surge in buying rates reveals the persistent pressure of exchange rates.