|

The emerging trend of Pickleball in Vietnam – Illustrative image from the Vietstock Pickleball 2025 tournament |

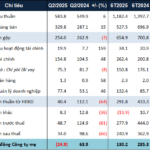

Garmex Saigon JSC (UPCoM: GMC) reported a reviewed net loss of 14.3 billion VND for the first six months of 2025, higher than the 12 billion VND loss in the self-prepared financial statements. This increase was mainly due to additional provisions at Garmex Quang Nam subsidiary of over 292 million VND for overdue advances, and investment provisions at associate company Phu My JSC of nearly 1.6 billion VND. Garmex also incurred an additional 315 million VND in deferred tax expenses from this investment.

| Garmex’s Net Profit in the Last 5 Years |

|

|

The reviewed loss is in stark contrast to the net profit of over 755 million VND in the same period in 2024, when the Company recognized deferred tax assets from the dissolution of Blue Saigon LLC in the US. In the first half of 2025, Garmex no longer had this source of income, and revenue from core operations was negligible.

Average revenue of VND 5 million/day, relying on pickleball court rentals

Net revenue for the first six months reached VND 898.5 million, more than 2.5 times higher than the same period last year, but still averaging only about VND 5 million per day. Pharmaceutical business contributed VND 177 million, and a new revenue stream of over VND 508 million came from Vinaprint JSC – an enterprise chaired by Garmex’s Board member Bui Minh Tuan.

Earlier, in February 2025, Garmex signed a contract with Vinaprint to rent 3,000 square meters of land for developing pickleball and other sports facilities, at a price of nearly VND 1.8 billion per year. This created a new revenue stream, riding on the emerging popularity of pickleball in Vietnam. This was also the reason for the approval of adding sports business to the company’s operations at the 2025 AGM.

|

Vinaprint’s pickleball court rental prices range from 150,000 to 200,000 VND per hour, depending on the time slot and day of the week, with additional equipment rental services – Image: Vinaprint |

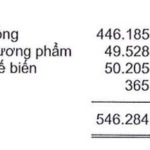

Garmex, which once owned five factories with over 4,000 employees, now has only 29 staff members after ceasing garment operations in May 2023 due to a lack of orders. The burden of inventory related to partner Gilimex, valued at over VND 109 billion, remains unresolved, despite a provision of VND 15 billion.

Accumulated loss exceeds VND 118 billion, resumption of production remains distant

As of the end of June 2025, Garmex recorded accumulated losses of over VND 118 billion. While the Company had planned to resume garment manufacturing at the Quang Nam factory with 1,200 workers from March 2025, this plan does not seem to have materialized.

Aside from awaiting order recovery, Garmex stated that it will monitor Phu My JSC to expedite the housing project and recover its investment. However, the current business operations heavily rely on rental income and sports-related revenue.

On the UPCoM exchange, GMC stock price is currently at VND 4,200 per share, a nearly 50% drop from last year, an over 80% decline from its peak in September 2022, and still subject to trading restrictions.

– 10:53 20/08/2025

The Port of Good Fortune: Unveiling the GenZ Deputy Director’s Vision

Phuoc An Port is proud to announce the appointment of Ms. Tran Thi Hien Luong as its new Deputy General Director, effective August 15th. Ms. Luong, born in 2002, is the daughter of Mr. Tran Nhan Tam, a respected member of the Board of Directors.

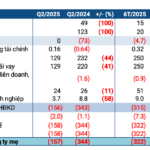

A Challenging Second Quarter: PSH Reports a Loss of Over VND 300 Billion in the First Half of the Year

The repercussions of the forced tax invoice at the end of 2023 continue to plague the Petroleum Trading and Investment Joint Stock Company (UPCoM: PSH). The company reported yet another quarter of significant losses, this time for the second quarter of 2025, amounting to hundreds of billions of dong.

“HDG Posts Net Loss in Q2, Foreign Shareholders Purchase Additional 2 Million Shares”

Pyn Elite Fund (Non-Ucits), a major shareholder of Hanoi Construction Corporation (HOSE: HDG), demonstrated its confidence in the company by purchasing 2 million shares during the trading session on July 24, despite the company’s recent quarterly loss.