The USD Index (DXY) – a measure of the greenback’s strength against a basket of six major currencies – fell by another 0.11 points to 97.73 on August 22, marking a third consecutive week of declines.

On the same day, Mr. Powell signaled a shift towards a tighter policy stance amid heightened downside risks, dampening the appeal of the USD.

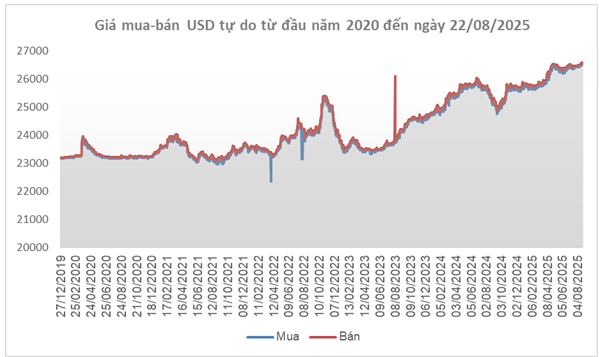

Source: SBV

|

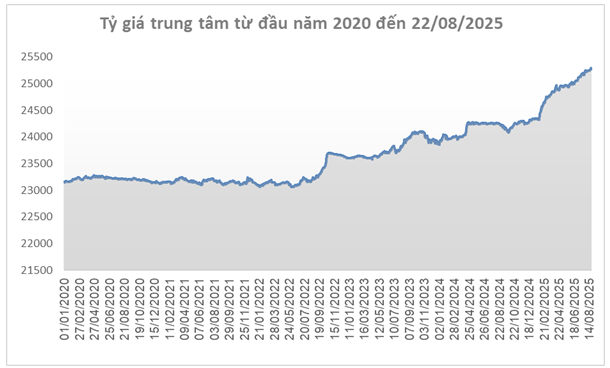

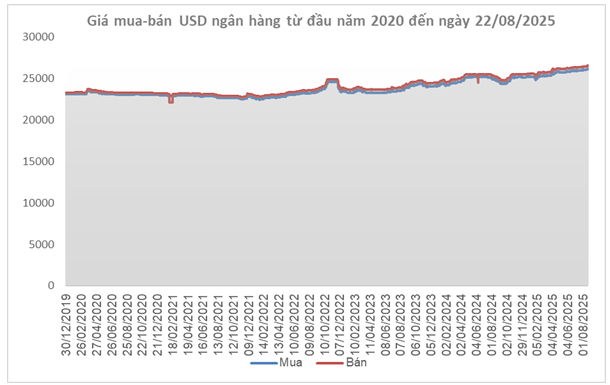

In contrast to the international trend, domestic exchange rates remained elevated. On August 22, the State Bank of Vietnam (SBV) set the daily reference exchange rate at a record high of VND 25,298 per USD, an increase of VND 49 from the previous week. With a +/- 5% fluctuation band, commercial banks are allowed to trade dollars between VND 24,033 and VND 26,563.

The buying and selling rates at the State Treasury’s Foreign Exchange Management Agency rose to VND 24,084 – VND 26,512 per USD, an increase of VND 47 and VND 51, respectively, from the previous week.

Source: VCB

|

At Vietcombank, the listed rates on August 22 were VND 26,130 – VND 26,520 per USD, an increase of VND 70 in both buying and selling rates compared to the previous week.

Source: VietstockFinance

|

In the free market, the USD also strengthened, rising by VND 60 and VND 75, respectively, in buying and selling rates, trading around VND 26,510 – VND 26,580 per USD.

Faced with pressure on the USD/VND exchange rate, the SBV announced a shift to selling term foreign currency with cancellation with a selling price of VND 26,550/USD in the first two sessions of the week (August 25-26), instead of spot sales as before. The buyers are credit institutions with a negative foreign currency position, with a maximum limit equal to the amount needed to balance their foreign currency position.

Selling foreign currency on term is a commitment by the SBV to supply USD to commercial banks at a future date at a predetermined rate, helping banks lock in lower purchase prices even when the exchange rate rises. With the option to cancel, the SBV reserves the right to terminate the contract before maturity if the exchange rate falls.

This tool is often used by the SBV as a policy signal: calming market sentiment, managing exchange rate expectations, and maintaining flexibility in its operations.

– 19:16 24/08/2025

The Ultimate Guide to HFIC’s Successful Equity Offering: Raising Nearly VND 800 Billion

The Ho Chi Minh City Finance Investment State-owned Company (HFIC) is looking to offload its remaining 116.3 million subscription rights of Ho Chi Minh City Securities Corporation (HSC) shares. With a set price of VND 6,875 per subscription right, the state-owned company aims to generate over VND 799 billion from this sale.

The Dark Side of the Greenback: Black Market Dollar Soars to Unprecedented Heights

The US dollar surged on the black market on August 22, reaching a record high of 26,630 – 26,730 VND/USD. This unprecedented spike highlights the significant demand for foreign currency in the underground market, a stark contrast to the official exchange rates.